In the dynamic world of foreign exchange (forex) trading, managing unrealized gains and losses is crucial for accurate financial reporting. Tally, a robust accounting software, empowers traders with the functionality to seamlessly record these complex transactions. This article will guide you through the intricacies of passing unrealized forex gain and loss entries in Tally, ensuring transparency and compliance.

Unrealized gains and losses represent the potential profit or deficit associated with open forex positions that have not yet been closed. These fluctuations in currency values can significantly impact a trader’s financial statement. Tally’s intuitive interface facilitates the seamless recording of these transactions, enabling traders to maintain accurate accounts.

Understanding the Concept of Forex Gain and Loss Entries

Before delving into the mechanics of recording forex gain and loss entries, it’s essential to grasp the fundamental concepts:

- Unrealized Gain: When the value of a currency pair held in an open position increases, the trader realizes an unrealized gain.

- Unrealized Loss: Conversely, if the currency pair’s value depreciates, the trader incurs an unrealized loss.

- Passing Forex Gain and Loss Entries: The process of recording these unrealized gains and losses into Tally’s accounting system.

How to Pass Unrealized Forex Gain and Loss Entries in Tally

Tally offers a straightforward approach to record unrealized forex gain and loss entries:

- Create a separate ledger account specifically for unrealized forex gains and losses.

Go to Gateway of Tally > Accounts Info > Create > Ledger Accounts

Image: kygimafezes.web.fc2.comEnter a unique name, e.g., “Unrealized Forex Gain/Loss”

Set the account type as “Profit/Loss”

Accept to create the ledger account.

- Configure foreign currency accounts for each currency involved in your forex trading.

Go to Gateway of Tally > Accounts Info > Create > Ledger Accounts

Set the account type as “Bank”

Enter the currency symbol, e.g., “USD” for US Dollar

Accept to create the foreign currency account.

- Record the unrealized gain or loss transaction.

Go to Gateway of Tally > Vouchers > Journal Voucher

Select the date of the transaction

Enter the amount of the gain or loss in the debit/credit column

Select the “Unrealized Forex Gain/Loss” ledger account in the respective column

Select the corresponding foreign currency account in the opposite column

Enter a brief description, e.g., “Unrealized gain on USD position”

Accept to save the journal voucher.

Expert Insights: Maximizing Accuracy and Compliance

To ensure optimal accuracy and compliance, consider the following expert recommendations:

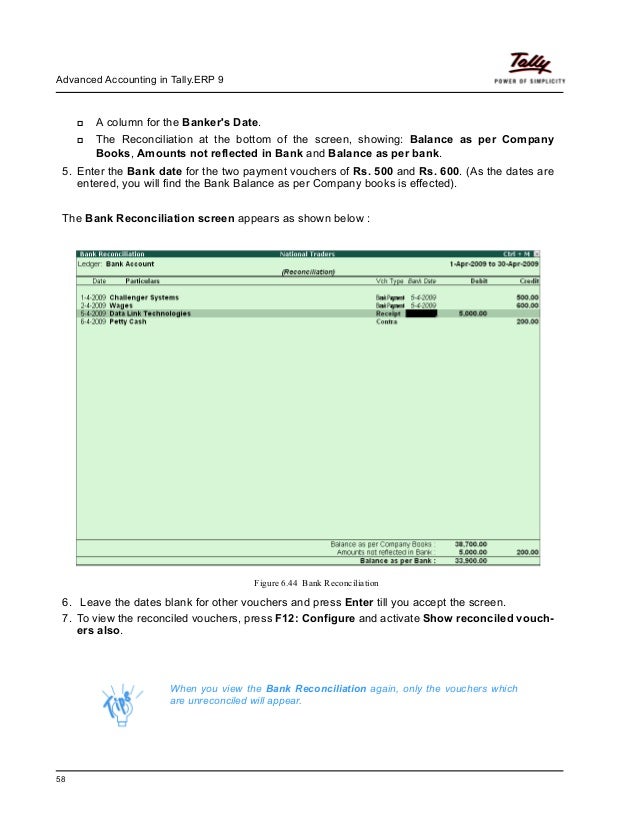

- Regular Reconciliation: Regularly reconcile your forex trading accounts with your Tally records to identify and rectify any discrepancies.

- Documentation Discipline: Maintain meticulous documentation of all forex transactions, including trade confirmations and bank statements.

- Stay Updated: Keep abreast of the latest accounting standards and regulatory requirements related to forex trading.

Conclusion: Empowering Forex Traders with Accurate Accounting

By following the comprehensive guide outlined in this article, forex traders can confidently pass unrealized forex gain and loss entries in Tally, ensuring accurate financial reporting and compliance. Tally’s user-friendly interface and robust functionality empower traders to maintain transparent accounts, enabling informed decision-making and long-term success in the dynamic world of foreign exchange trading.

Remember, accurate accounting is the cornerstone of a successful forex trading operation. Embrace the power of Tally and take control of your forex finances today!

Image: www.chegg.com

How To Pass Unrealized Forex Gain Loss Entries In Tally