Introduction

I vividly recall the intoxicating surge of excitement as I witnessed the market unfold before me, each candle and bar painting a vivid narrative of opportunity. The intricate dance of price action captivated me, unlocking the secrets to unlocking market movements. As I delved deeper into the intricate world of forex trading, I stumbled upon the hidden treasure of price action reversal patterns, gems that could unveil potential turning points in the market’s trajectory.

Image: forexpops.com

These patterns serve as invaluable tools for traders, enabling them to anticipate potential trend reversals and position themselves accordingly. It’s a thrilling journey into the market’s heartbeat, where precision and patience reign supreme.

Understanding Price Action Reversal Patterns

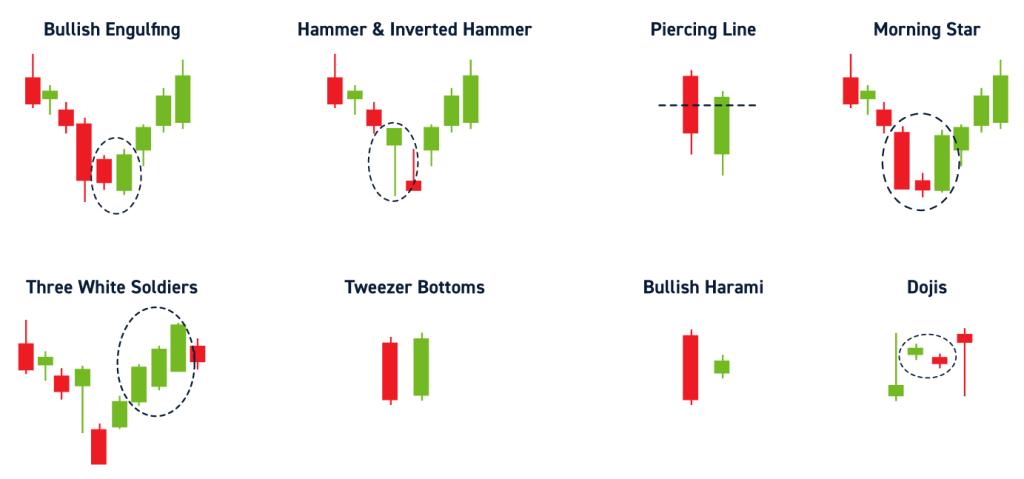

Price action reversal patterns are candlestick or bar formations that indicate a potential shift in the prevailing market trend. These patterns emerge at critical junctures, signaling a showdown between buyers and sellers. By identifying these patterns, traders can gain a strategic edge, anticipating potential reversals and maximizing their trading potential.

Reversal patterns are classified into two main categories: bullish reversal patterns, which suggest a potential upward reversal, and bearish reversal patterns, which hint at a possible downward reversal. Traders vigilantly monitor price action, seeking these patterns to make informed trading decisions.

Top 5 Price Action Reversal Patterns

1. Double Bottom

The double bottom pattern resembles the letter “W” on a price chart. It forms when the price falls to a support level, rebounds, falls back to the same support level or slightly below it, and then rallies again. This pattern signals a potential end to a downtrend and the start of an uptrend.

2. Double Top

The double top pattern mirrors the “M” shape on a price chart. It emerges when the price rises to a resistance level, pulls back, rallies to the same resistance level or slightly above it, and then falls again. This formation suggests a potential reversal from an uptrend to a downtrend.

3. Head and Shoulders

The head and shoulders pattern is a classic reversal pattern that consists of a “head” (a high point) with two lower “shoulders” (smaller highs) on either side. A neckline is drawn connecting the lows of the two shoulders. A breakout above the neckline signals a potential trend reversal.

4. Inverse Head and Shoulders

The inverse head and shoulders pattern is a bullish reversal pattern. It forms when the price falls to a trough (the “head”), rises, falls again to a lower trough (the “left shoulder”), rises once more to a higher trough (the “right shoulder”), and then breaks out above the neckline (a line drawn connecting the highs of the two shoulders).

5. Bullish/Bearish Engulfing Patterns

Engulfing patterns occur when a large candle or bar completely “engulfs” (or contains) the previous candle or bar. A bullish engulfing pattern, formed when a green candle engulfs a red candle, indicates a potential upward reversal. Conversely, a bearish engulfing pattern, formed when a red candle engulfs a green candle, suggests a potential downward reversal.

Tips and Expert Advice

Utilizing price action reversal patterns in forex trading demands patience and discipline. Here are some tips from seasoned traders:

- Look for patterns in the context of the broader market trend.

- Confirm the pattern with technical indicators.

- Set stop-loss orders to manage risk.

- Consider psychological levels, such as round numbers or previously significant support/resistance levels.

- Trade with realistic profit targets.

Image: centerpointsecurities.com

Conclusion

Price action reversal patterns are a powerful tool in a forex trader’s arsenal. By recognizing and interpreting these patterns, traders can gain valuable insights into potential market reversals. However, it’s essential to remember that trading the Forex market involves inherent risk. Arm yourself with thorough research, a sound trading strategy, and an unwavering commitment to continuous learning to navigate market complexities successfully.

Are you eager to put your newfound knowledge into practice? Dive into the thrilling world of price action reversal patterns and unlock the secrets to enhanced trading success!

Top 5 Price Action Reversal Patterns For Forex Trading

https://youtube.com/watch?v=7OiY5MMCHp4

FAQ

Q: What are the key elements of a price action reversal pattern?

A: Reversal patterns consist of multiple candles or bars arranged in specific formations. They may include distinctive features like support/resistance levels, breakouts, and engulfing patterns.

Q: How can I confirm a price action reversal pattern?

A: Confirm the pattern by looking for additional signals, such as technical indicators, trendlines, or other chart formations that support the trend reversal.

Q: What are some of the most common price action reversal patterns?

A: Double bottom, double top, head and shoulders, inverse head and shoulders, and engulfing patterns are widely recognized price action reversal patterns.

Q: Are price action reversal patterns always reliable?

A: While price action reversal patterns provide valuable insights into potential trend changes, they are not foolproof. Market conditions can be unpredictable, and other factors can influence price movements.

Q: How can I improve my accuracy in identifying price action reversal patterns?

A: Practice and experience play a significant role in improving pattern recognition. Continuously study historical charts, analyze market trends, and refine your trading strategies through ongoing research.