Prologue:

In the ever-evolving landscape of global finance, bondholders are encountering a novel challenge: soaring hedging costs. Amidst these escalating expenses, a growing number of bondholders are undertaking a strategic shift, opting to assume foreign exchange (forex) risk as a means of managing their investments. Is this a prudent adaptation to market dynamics, or a risky gamble that could potentially jeopardize their portfolios? This article delves into the intricacies of this decision, exploring its potential benefits, risks, and the wider implications for the bond market.

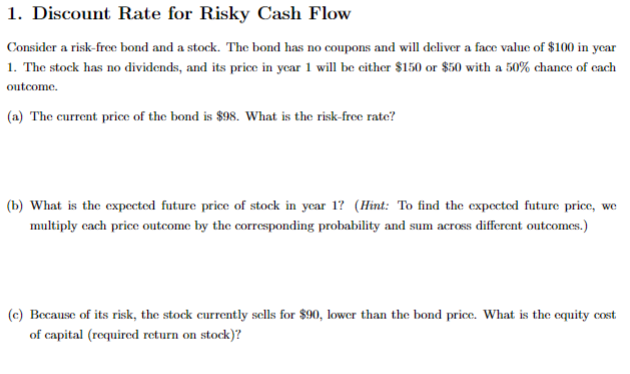

Image: www.chegg.com

Understanding Hedging and Forex Risk:

Hedging is a financial strategy employed to mitigate risk by offsetting potential losses with corresponding gains in another market or asset class. In the context of bonds, investors often hedge against interest rate or currency fluctuations. Forex risk, on the other hand, arises when the value of a bond denominated in one currency is affected by changes in exchange rates between that currency and the investor’s home currency.

Costly Conundrum: Soaring Hedging Expenses

Traditionally, bondholders employed various hedging instruments, such as forward contracts or currency swaps, to manage forex risk. However, in recent times, the costs associated with these hedging strategies have skyrocketed. This surge is attributed to factors such as increased market volatility, geopolitical uncertainties, and the tightening of monetary policies by central banks worldwide.

Embracing Forex Risk: A Calculated Gamble

Faced with escalating hedging costs, many bondholders are reassessing their risk management strategies. A growing contingent is opting to shoulder forex risk directly, believing that the potential returns outweigh the risks. This approach involves investing in bonds denominated in currencies that are expected to appreciate against their own.

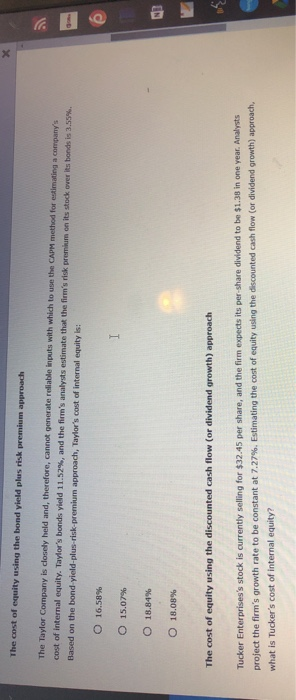

Image: www.chegg.com

Potential Benefits: Currency Appreciation and Diversification

Assuming forex risk offers several potential benefits. First, it allows bondholders to capitalize on currency appreciation, boosting their returns if the foreign currency strengthens. Additionally, it provides diversification benefits, as the performance of foreign bonds is typically not perfectly correlated with that of domestic bonds.

Risks: Currency Depreciation and Market Volatility

However, embracing forex risk also carries inherent risks. Currency depreciation can erode the value of the underlying bonds, potentially leading to losses. Moreover, market volatility can exacerbate these risks, making it difficult to predict currency fluctuations accurately.

Expert Insights and Actionable Tips:

Renowned financial analyst Mark Hamilton advises bondholders to carefully consider their risk tolerance and investment goals before assuming forex risk. “Investors need to assess their ability to withstand potential losses and determine if the potential upside justifies the risks,” he cautions.

Another expert, portfolio manager Sarah Jones, recommends diversifying forex exposure across multiple currencies. “By investing in bonds denominated in different currencies, investors can mitigate the impact of any single currency depreciating,” she explains.

Bondholders Take On Forex Risk As Hedging Costs Soar

Conclusion:

The decision of whether or not to assume forex risk is a complex one that requires careful consideration of potential benefits, risks, and individual circumstances. While this strategy can provide opportunities for enhanced returns and diversification, it also exposes investors to potential losses due to currency fluctuations. Bondholders should consult with financial professionals, thoroughly research the risks involved, and make informed decisions that align with their risk tolerance and investment objectives. As the bond market continues to navigate the challenges of rising hedging costs, the choice of whether to embrace forex risk will remain a pivotal decision for investors seeking to protect and enhance their portfolios.