A Path to Global Currency Exchange: Unraveled

The allure of forex trading draws many, but the question of whether credit cards can be harnessed to access this dynamic market remains unanswered for many in India. This article aims to demystify this aspect, providing you with a comprehensive guide to navigating the intersection of forex and credit cards in India. Join us as we unravel the truth and empower you with the knowledge to make informed decisions.

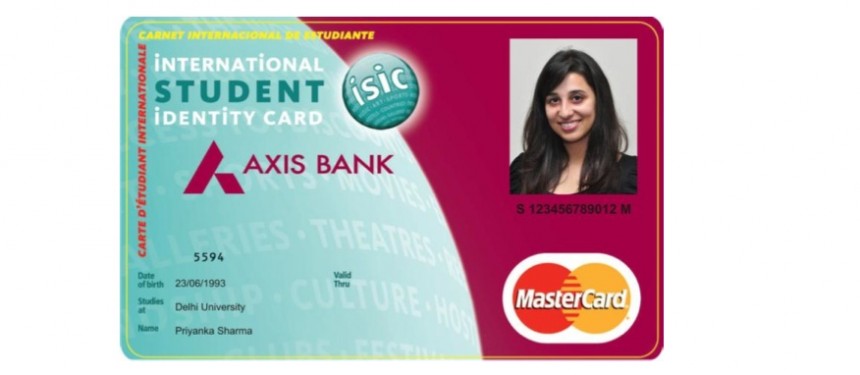

Image: ubawyzo.web.fc2.com

Exploring the Realms of Forex

Foreign exchange, commonly known as forex, is the global marketplace where currencies are traded. It plays a pivotal role in facilitating international trade, tourism, and investments. The forex market witnesses a staggering daily trading volume of over $5 trillion, making it the largest financial market worldwide. For Indian investors seeking to diversify their portfolios or capitalize on global economic trends, forex presents a potential avenue worth considering.

The Indian Landscape: Forex Trading and Credit Cards

While forex trading has gained traction in India, the use of credit cards for this purpose has remained a topic of debate. The Reserve Bank of India (RBI), the country’s central bank, has specific regulations governing the use of credit cards for forex transactions. Let’s delve into these regulations and explore the options available to Indian forex enthusiasts.

RBI’s Stance on Forex Trading with Credit Cards

The RBI has implemented strict measures to curb the potential misuse of credit cards for forex trading. As per RBI’s guidelines, Indian residents are prohibited from using credit cards to directly fund forex trading accounts. This prohibition extends to all forms of credit cards, including those issued by Indian banks or international financial institutions.

Image: www.slideserve.com

Exploring Alternative Options: Debit Cards and Wire Transfers

Given the RBI’s stance on credit cards, Indian investors seeking to engage in forex trading must explore alternative payment methods. Debit cards and wire transfers are two viable options to bridge the gap between Indian bank accounts and international forex brokers.

Debit Cards: A Convenient Gateway

Debit cards offer a convenient and secure way to fund forex trading accounts. Indian residents can use debit cards linked to their Indian bank accounts to make deposits into their forex trading accounts. However, it’s crucial to note that some banks may impose transaction limits or fees for international payments, so it’s advisable to check with your bank beforehand.

Wire Transfers: A Reliable Alternative

Wire transfers remain a trusted method for forex transactions. Indian investors can initiate wire transfers from their Indian bank accounts to the bank account of their forex broker. While wire transfers may involve slightly longer processing times compared to debit cards, they are generally considered more secure and reliable, especially for larger transactions.

Choosing a Reputable Forex Broker: A Crucial Step

When venturing into forex trading, selecting a reputable and regulated broker is paramount. Indian investors should prioritize brokers licensed by recognized regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies ensure that brokers adhere to strict ethical and operational standards, safeguarding the interests of traders.

Navigating Forex Trading Responsibly

Forex trading carries inherent risks, and it’s imperative to approach it with a responsible mindset. Here are some essential tips to keep in mind:

- Educate Yourself: Equip yourself with a thorough understanding of forex trading, its risks, and strategies. Knowledge is the foundation of successful trading.

- Start Small: Begin with smaller investments until you gain confidence and experience. Remember, forex trading should complement your financial goals, not jeopardize your stability.

- Manage Risk: Implement robust risk management strategies, such as setting stop-loss orders, to protect your capital from potential losses.

Can I Buy Forex Using Credit Cardindia

Empowering Indian Forex Traders: Knowledge is Power

Comprehending the regulations and payment options available empowers Indian forex traders to make informed decisions. By embracing due diligence, selecting reputable brokers, and adopting responsible trading practices, you can navigate the forex market with confidence and potentially reap its rewards.