Introduction

Embark on a captivating journey into the realm of forex trading, where the global currency market beckons you to navigate its ever-changing tides. In this comprehensive guide, we unveil the exclusive tips and strategies honed by seasoned forex traders in the United Kingdom, empowering you to conquer the financial frontiers with confidence.

Image: www.liveinternet.ru

Delving into the Fundamentals

Forex trading, a colossal arena where currencies are exchanged, offers boundless opportunities for profit. As a beginner, it’s imperative to grasp the basics: currencies are traded in pairs (e.g., EUR/USD), and their values fluctuate based on a myriad of economic, political, and social factors.

The Art of Technical Analysis

Technical analysis, the cornerstone of successful forex trading, deciphers patterns and trends in price movements. Traders use a plethora of technical indicators, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI), to forecast potential market outcomes and identify trading opportunities.

Chart Patterns

Chart patterns, visual representations of price movements, serve as valuable indicators of market sentiment. Some common patterns include:

- Head and shoulders (reversal pattern): A signal of a trend reversal, characterized by a peak followed by two lower peaks.

- Inverse head and shoulders (reversal pattern): A bullish pattern indicating a trend reversal from bearish to bullish, with a low followed by two higher lows.

- Triangle pattern (continuation pattern): A pattern that indicates a continuation of the prevailing trend, with prices moving within a narrowing range and breaking out in the direction of the prior trend.

Image: www.cmcmarkets.com

Technical Indicators

Technical indicators complement chart patterns and provide additional insights into price movements:

- Moving averages (MA): These smooth out price data, revealing underlying trends and support/resistance levels.

- Bollinger Bands (BB): They plot a moving average and two bands that indicate potential areas of overbought and oversold conditions.

- Relative Strength Index (RSI): This indicator measures the magnitude of recent price movements, helping traders gauge whether a currency is overbought or oversold.

Fundamental Analysis: Unveiling the Narrative

Complementing technical analysis, fundamental analysis considers economic, political, and social events that influence currency value. These include:

- Economic data releases (Gross Domestic Product, inflation, unemployment rates): Market-moving events that reflect the health of an economy and provide guidance on potential currency trends.

- Interest rate decisions by central banks (e.g., Federal Reserve, Bank of England): These announcements significantly impact currency values as they influence borrowing costs and investment flows.

- Geopolitical events and political stability: Global events, such as conflicts, elections, and trade disputes, can cause volatility in the forex market.

Navigating the Forex Market with Confidence

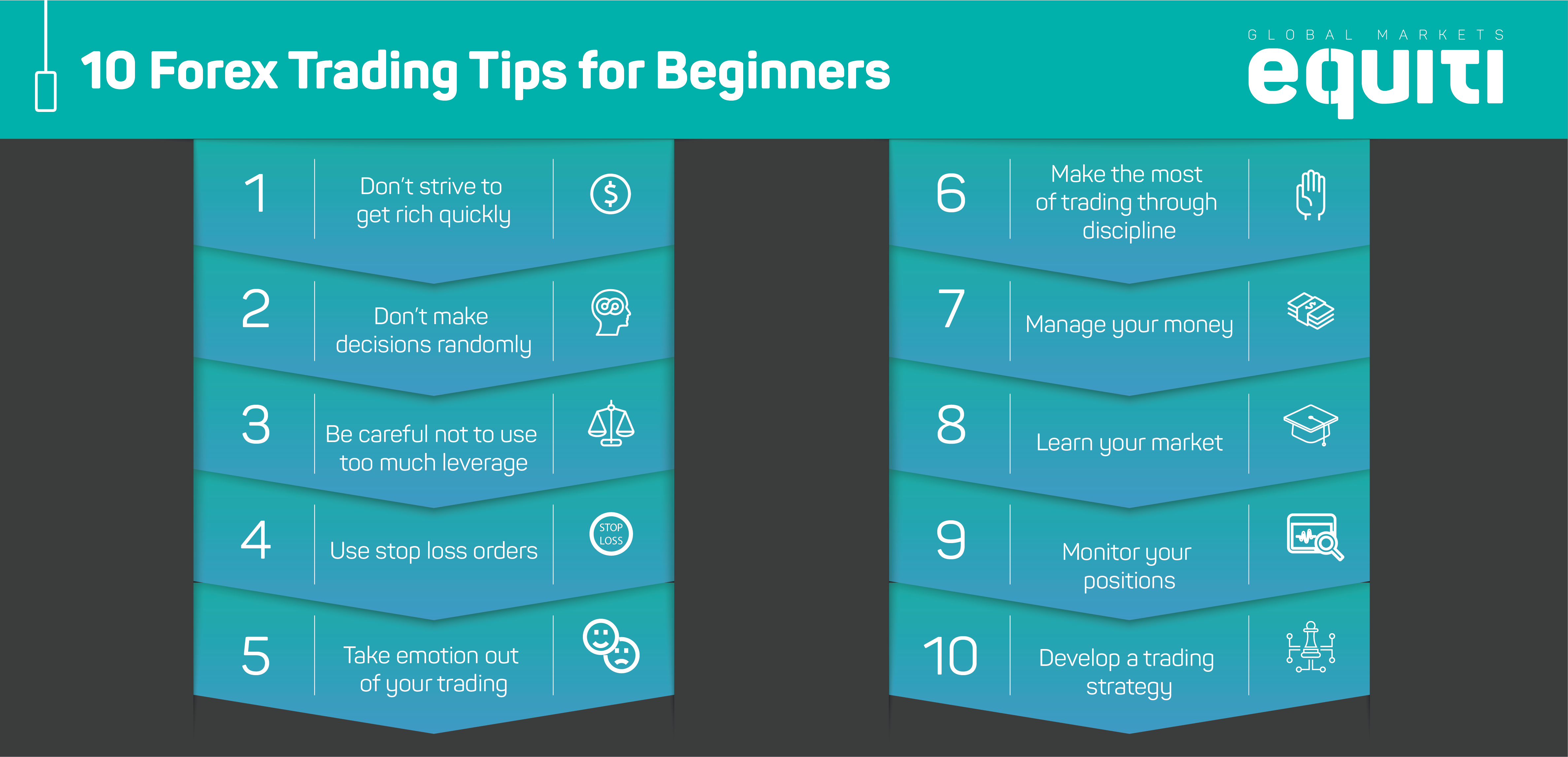

To succeed in forex trading, traders must adhere to a stringent set of principles:

- Embrace Risk Management: Establish a comprehensive risk management strategy that includes setting stop-loss orders and position sizing to mitigate potential losses.

- Control Emotions: Emotional trading, influenced by fear and greed, often leads to rash decisions. Cultivate discipline and avoid letting emotions cloud judgment.

- Continuously Educate Yourself: The forex market is dynamic; traders must continuously upgrade their knowledge and stay abreast of the latest advancements.

Expert Insights and Practical Tips from UK’s Forex Mavericks

- “Master the Art of Patience”: Stephen Walker, a seasoned trader, emphasizes the importance of patience in waiting for the right trading opportunities.

- “Embrace Diversification”: James Carter, a renowned analyst, advises spreading investments across multiple currencies to mitigate risk and capture broader market movements.

- “Harness the Power of Technology”: Emily Jones, a technical expert, highlights the role of trading software and automated tools to enhance efficiency and optimize decision-making.

The Best Forex Tips From U K

Conclusion

The global forex market offers boundless opportunities for financial success. By embracing the exclusive tips and strategies shared by UK’s top traders, you can unlock the potential of this dynamic arena. Remember, success in forex trading requires patience, discipline, and continuous learning. Step into this captivating realm with confidence, armed with the knowledge and skills to conquer the financial frontier.