In the ever-changing world of foreign exchange trading, choosing the right currency pair can be the difference between success and failure. With countless pairs to select from, navigating the forex market can be daunting. This comprehensive guide will unravel the secrets of the best currency pairs to trade, empowering you with the knowledge to maximize your returns.

Image: www.researchgate.net

Navigating the Forex Maze: Why Currency Pairs Matter

Forex trading, also known as currency trading, involves buying and selling currencies in pairs. The relative value of one currency to another fluctuates constantly due to a myriad of economic, political, and social factors. Understanding these factors and identifying the currency pairs most responsive to them is crucial for profitable trading. By choosing the right currency pair, you can increase your chances of predicting price movements and generating substantial profits.

Deciphering the Market: Factors Influencing Currency Pair Selection

Selecting the optimal currency pair for trading requires a thorough understanding of the factors that influence the forex market. These factors include:

- Economic Data: The release of economic data, such as GDP growth, inflation rates, and unemployment figures, can significantly impact currency values. Traders monitor these data points closely to anticipate market reactions.

- Political Events: Political turmoil, changes in government, and economic sanctions can affect currency values. Understanding the political climate and forecasting potential events can provide profitable trading opportunities.

- Interest Rates: Central banks’ decisions on interest rates influence currency values. Higher interest rates tend to strengthen currencies, while lower rates weaken them.

- Market Sentiment: The overall sentiment of market participants influences currency values. Traders analyze news, statistics, and technical indicators to gauge market sentiment and predict future price movements.

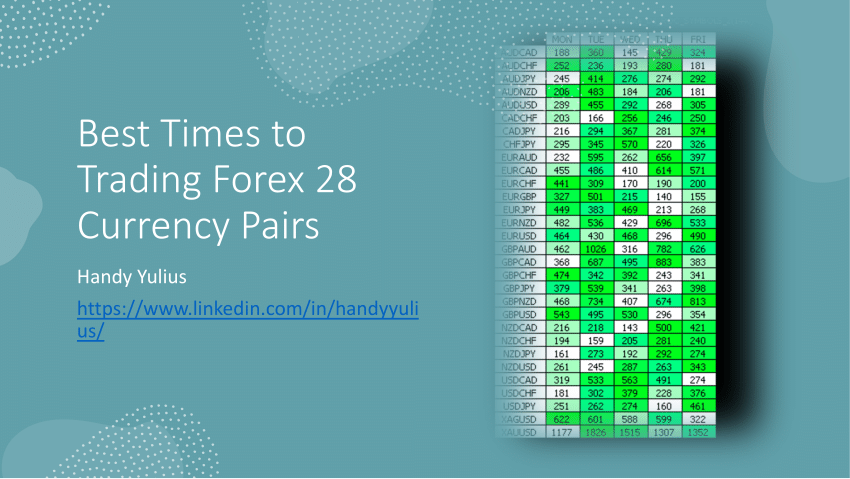

Unveiling the Most Lucrative Currency Pairs: A Comparative Analysis

Based on the factors mentioned above, certain currency pairs have emerged as the most profitable for trading. These pairs exhibit high volatility, liquidity, and predictable price patterns, making them ideal for both short-term and long-term traders. Here’s a comparative analysis of the top three currency pairs:

Image: homecare24.id

EUR/USD: The Global Powerhouses

- Euro (EUR): The official currency of 19 countries, including Germany, France, and Italy, the euro is the second-largest reserve currency globally.

- US Dollar (USD): The world’s reserve currency and the most traded currency in the forex market, the US dollar is a safe haven during economic uncertainties.

The EUR/USD pair is the most heavily traded currency pair due to its high liquidity, volatility, and predictable trends. It offers numerous trading opportunities throughout the day, making it suitable for various trading styles.

USD/JPY: The Yen’s Influence

- Japanese Yen (JPY): The official currency of Japan, the yen is a safe-haven currency due to the country’s economic stability and low inflation.

- US Dollar (USD): The world’s reserve currency, the US dollar, is the primary driver of the USD/JPY pair.

The USD/JPY pair is known for its volatile swings and is highly influenced by the Japanese government’s monetary policy and economic data. It provides ample opportunities for both scalpers and swing traders.

GBP/USD: The Brexit and UK’s Influence

- British Pound (GBP): The official currency of the United Kingdom, the pound is a major reserve currency and heavily influenced by the UK’s economic performance.

- US Dollar (USD): The world’s reserve currency, the US dollar, dominates the GBP/USD pair.

The GBP/USD pair is highly volatile due to political events, such as Brexit negotiations, and is heavily influenced by economic data from both the UK and the US. It offers short-term trading opportunities for scalpers and intraday traders.

Choosing the Right Pair for Your Trading Style

Selecting the best currency pair for trading depends on your individual trading style, risk tolerance, and time availability:

- Scalpers prefer highly liquid pairs like EUR/USD or USD/JPY, which offer quick, small-profit opportunities.

- Day traders focus on pairs with moderate volatility and predictable patterns, such as GBP/USD or EUR/USD.

- Swing traders seek currency pairs with strong long-term trends and steady momentum, such as USD/JPY or GBP/USD.

- Position traders hold positions for extended periods, targeting major price movements and overall market direction.

Embracing the Dynamic Nature of Forex Trading: Adapting to Market Changes

The forex market is constantly evolving, and successful traders must adapt to changing conditions to stay profitable:

- Monitor Market News and Data: Stay informed about economic events, political developments, and central bank announcements that can impact currency values.

- Technical Analysis: Use charts and indicators to identify trends, support and resistance levels, and potential trading opportunities.

- Risk Management: Implement proper risk management strategies, such as stop-loss orders and money management techniques, to protect against losses.

Which Is The Best Currency Pair To Trade In Forex

https://youtube.com/watch?v=QmmLBmtw5Zw

Conclusion

Choosing the right currency pair is an essential aspect of successful forex trading. By understanding the factors that influence currency values, analyzing market trends, and adapting to changing conditions, you can select the optimal pair that aligns with your trading style and maximizes your profit potential. Remember, the forex market is dynamic and volatile, and the best currency pair to trade can change over time. Stay vigilant, stay informed, and continue to learn to reap the rewards of this ever-evolving financial landscape.