The foreign exchange (Forex) market is the world’s largest and most liquid financial market. It’s a decentralized global market where currencies are traded against each other. The Forex market is open 24 hours a day, five days a week, making it a truly global market.

Image: www.notandor.cn

Because of its size and liquidity, the Forex market is an attractive place for traders to make money. However, it’s important to remember that Forex trading is not without risk. In fact, it’s one of the riskiest financial markets in the world. That’s why it’s important to have a solid understanding of the market before you start trading.

Correlation in Forex Trading

One of the most important concepts in Forex trading is correlation. Correlation is a statistical measure that shows how two currencies move in relation to each other. A positive correlation indicates that the two currencies move in the same direction. A negative correlation indicates that the two currencies move in opposite directions.

Correlation is important for Forex traders because it can help them to identify trading opportunities. For example, if a trader sees that the euro and the US dollar are strongly correlated, they may be able to profit from a long position in the euro and a short position in the US dollar.

How to Use Correlation in Forex Trading

There are a number of ways to use correlation in Forex trading. One common strategy is to use correlation to identify trading pairs. A trading pair is simply two currencies that are traded against each other. When choosing a trading pair, it’s important to look for pairs that have a strong correlation.

Another way to use correlation in Forex trading is to use it to identify trading signals. A trading signal is a signal that tells a trader when to buy or sell a currency pair. There are a number of different ways to generate trading signals, but one common method is to use technical analysis. Technical analysis is the study of past price movements in order to identify trading opportunities.

Tips for Successful Forex Trading

Here are a few tips for successful Forex trading:

- Do your research. Before you start trading, it’s important to do your research and understand the Forex market. This includes learning about the different currencies, the economic factors that affect them, and the different trading strategies.

- Start small. When you’re first starting out, it’s important to start small. Don’t risk more money than you can afford to lose.

- Use a stop-loss order. A stop-loss order is an order that tells your broker to sell your currency pair if it reaches a certain price. This can help you to limit your losses.

- Be patient. Forex trading is not a get-rich-quick scheme. It takes time and effort to learn the market and become a successful trader.

Image: forexmt4systems.com

FAQs About Forex Correlation

Q: What is correlation in Forex trading?

A: Correlation is a statistical measure that shows how two currencies move in relation to each other.

Q: How can I use correlation in Forex trading?

A: There are a number of ways to use correlation in Forex trading, including identifying trading pairs and generating trading signals.

Q: What are some tips for successful Forex trading?

A: Some tips for successful Forex trading include doing your research, starting small, using a stop-loss order, and being patient.

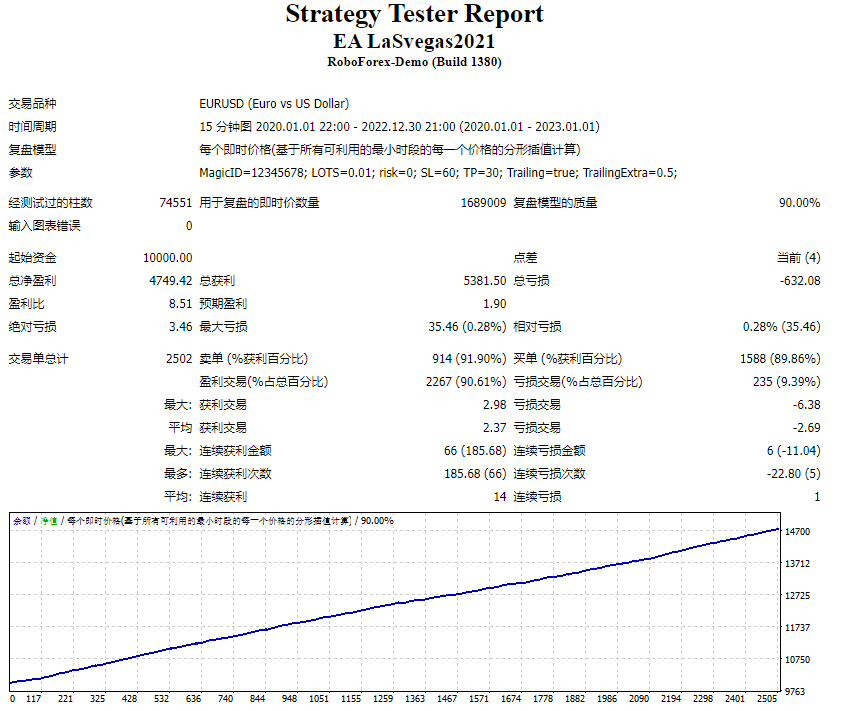

Super Accurate Profitable Strategy Forex Corelation

Conclusion

Correlation is an important concept in Forex trading. By understanding how correlation works, traders can increase their chances of success in the Forex market. Do you find the content related to the topic : super accurate profitable strategy forex corelation? Kindly let us know your valuable feedback in the comment box provided below.