In the dynamic and ever-changing landscape of forex trading, understanding correlation periods is a cornerstone of successful decision-making. Identifying the time frames during which currencies exhibit similar or contrasting price movements can empower traders with the insights needed to capitalize on market fluctuations. In this comprehensive exploration, we will delve into the intricacies of correlation periods, arming you with the knowledge to navigate this complex terrain.

Image: www.octafxtr.site

The Significance of Correlation Periods in Forex

Correlation periods play a crucial role in forex trading for several reasons. Firstly, they provide invaluable information about the behavior of currency pairs relative to each other. During periods of positive correlation, currency pairs tend to move in the same direction, making it easier for traders to identify potential trading opportunities. Conversely, in times of negative correlation, currency pairs move in opposite directions, offering distinct opportunities for profit. Identifying these patterns allows traders to make informed decisions about entry and exit points, maximizing their chances of success.

Secondly, correlation periods assist traders in minimizing risk. By diversifying their portfolios with currency pairs that exhibit low or negative correlation, traders can reduce the overall impact of market fluctuations on their capital. This strategic diversification helps to mitigate losses and safeguard profits, ensuring a sturdier foundation for long-term performance.

Thirdly, correlation periods can provide valuable insights into economic conditions and market sentiment. By analyzing the correlation between currencies, traders can gain a deeper understanding of the underlying factors driving price movements. This knowledge empowers them to make sound judgments about the direction of the market.

Identifying Correlation Periods

Identifying correlation periods is a matter of employing both technical and fundamental analysis. Technical indicators, such as moving averages and Bollinger Bands, can help traders visualize and identify periods of positive and negative correlation. Fundamental analysis, on the other hand, involves studying economic data and news events to understand the factors influencing currency movements.

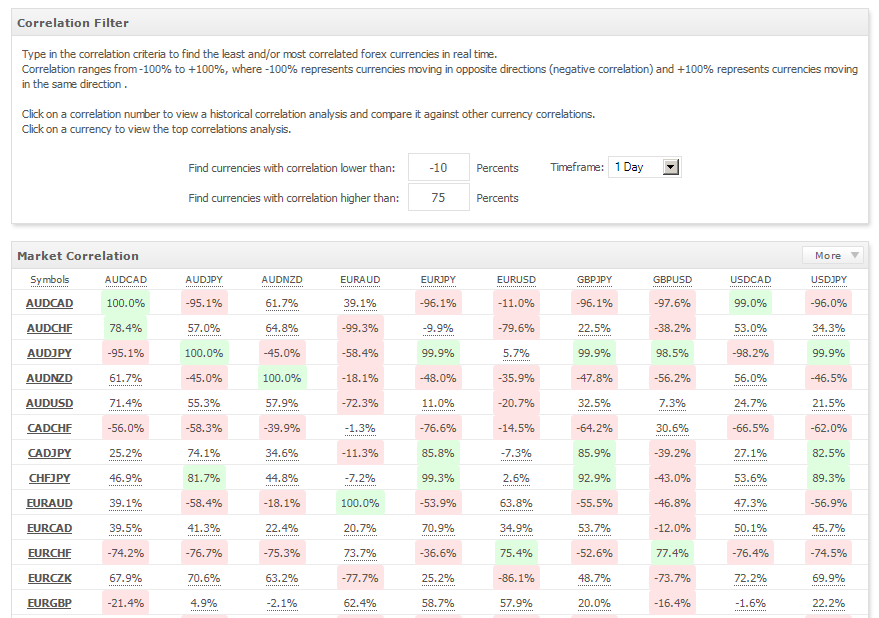

Additionally, traders can utilize correlation matrices to gain a comprehensive view of the correlation between multiple currency pairs. These tables provide real-time data on the correlation coefficient, a statistical measure indicating the degree of correlation between two assets. A positive correlation coefficient near 1 indicates strong positive correlation, while a negative coefficient close to -1 signifies strong negative correlation.

Trading Strategies Based on Correlation Periods

Once correlation periods have been identified, traders can employ various strategies to capitalize on these market patterns. One common approach is the “Pairs Trading Strategy,” which involves simultaneously buying a currency with a high positive correlation and selling a currency with a high negative correlation with a fixed risk ratio. This strategy allows traders to generate profits from price differentials between the two currencies.

Another strategy known as “Divergence Trading” involves seeking opportunities when the price movement of a currency pair diverges from the correlation relationship. Traders can identify such situations by analyzing historical data and monitoring the spread between the two currencies.

Understanding correlation periods and incorporating them into trading strategies is a valuable tool that can significantly enhance profitability. By harnessing the insights, provided by correlation analysis, traders can become more discerning in their trade execution.

Image: blog.myfxbook.com

Expert Advice and Best Practices

Expert advice and adherence to best practices are essential for successful correlation period trading. Here are several key recommendations:

- Start with a solid understanding of forex fundamentals and market analysis techniques.

- Conduct thorough research to identify currency pairs with consistent correlation patterns.

- Use technical indicators, fundamental analysis, and correlation matrices in conjunction for comprehensive analysis.

- Employ a risk management strategy to mitigate potential losses.

- Monitor correlation patterns regularly as they can shift over time.

FAQ: Unraveling the Nuances of Correlation Periods

The best trading strategy depends on individual risk tolerance and market conditions, , “Pairs Trading” and “Divergence Trading” are common strategies employed by traders.

Q: How can I identify potential trading opportunities based on correlation periods?

Potential trading opportunities can be identified by analyzing technical indicators and market news.

Q: What is the role of risk management in correlation period trading?

Risk management is crucial in correlation period trading as it sets limits to potential risks.

Best Correlation Period Trade Forex

Conclusion

Having mastered the fundamentals of correlation periods, traders are now equipped with a potent tool to navigate the markets with greater confidence and precision. By harnessing the insights provided by correlation analysis, traders can make informed decisions, identify trading opportunities, and enhance their overall profitability in the ever-evolving world of forex trading. Are you ready to embark on the journey towards mastering correlation periods? Embrace this knowledge and propel your trading endeavors to new heights.