Are you ready to overcome the complexity of currency markets? Understanding the intricate dance between different currencies is crucial for successful forex trading. In this blog, we’ll unravel the mysteries of Forex currency correlation tables, empowering you with the knowledge to predict market movements with precision.

Image: www.cmcmarkets.com

Forex currency correlation refers to the relationship between the performance of two different валюты. By analyzing how they move in relation to each other, traders can make informed decisions about their trading strategy.

Interpreting Currency Correlation Tables: A Step-by-Step Guide

1. Understanding the Table Format

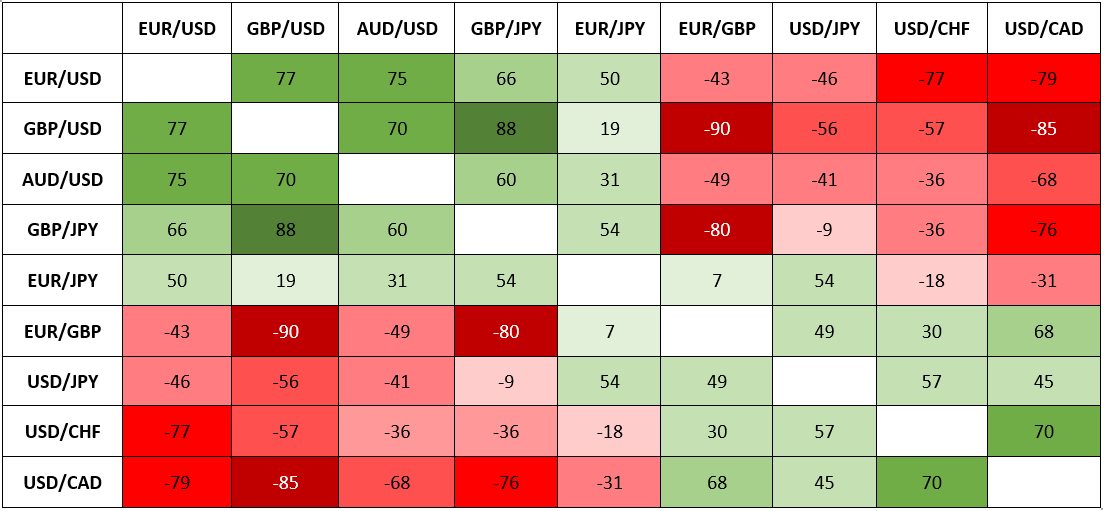

Forex currency correlation tables are typically presented as a matrix, with each валюты representing a row and column. The value at the intersection of each row and column indicates the correlation coefficient between the two currencies. Values can range from -1 (perfect negative correlation) to +1 (perfect positive correlation).

2. Identifying Currency Pairs with High Correlation

Pairs with a strong positive correlation (above 0.8) tend to move in the same direction. For instance, a correlation of 0.95 between EUR/USD and GBP/USD implies that both pairs will likely move up or down together.

Conversely, negative correlation (below -0.8) indicates that the currencies move in opposite directions. An example would be a correlation of -0.9 between EUR/USD and USD/JPY, suggesting that EUR/USD is likely to rise when USD/JPY falls.

Image: forexe75system1.blogspot.com

3. Utilizing Correlation to Forecast Market Behavior

By leveraging currency correlation tables, you can predict the potential movement of one currency pair based on the performance of another. For instance, if EUR/USD shows a strong positive correlation with GBP/USD, a rise in EUR/USD may indicate a likely rise in GBP/USD.

4. Managing Risk with Correlation

Diversification is key in risk management. By trading correlated currency pairs, you can spread your risk across different assets. If one pair faces a downturn, the other positively correlated pair may offset the losses.

5. Staying Informed about Market Trends

Forex currency correlation tables are not static but constantly evolve with market conditions. Stay updated with the latest tables by referring to reputable sources and industry-leading platforms.

Tips from Expert Traders

1. Use Correlation as a Guide, Not a Rule

While correlation tables provide valuable insights, they are not a guarantee of future market behavior. Consider other factors such as economic data, geopolitical events, and market sentiment when making trading decisions.

2. Combine Correlation with Technical Analysis

For a more comprehensive approach, combine currency correlation analysis with technical indicators like moving averages, support and resistance levels, and candlestick patterns to pinpoint trading opportunities.

Frequently Asked Questions

- Q: Why is it important to use a currency correlation table?

A: Currency correlation tables enhance your understanding of market dynamics and facilitate informed trading decisions.

- Q: How can I find a reliable currency correlation table?

A: Reputable financial websites, currency analytics platforms, and brokerage firms provide updated currency correlation tables.

- Q: Is currency correlation a constant measure?

A: No, currency correlation can change over time based on economic, geopolitical, and market changes. Monitoring these changes is crucial for effective trading.

Forex Currency Correlation Table Pdf

Conclusion

By mastering the art of interpreting Forex currency correlation tables, you unlock a powerful tool for precise market prediction. Remember, knowledge is power in the world of forex trading. Are you ready to venture into the exciting world of Forex?