Introduction

In the ever-evolving world of forex trading, the use of automated systems has become increasingly prevalent. Traders seek ways to optimize their strategies and minimize the emotional and time costs associated with manual trading. While expert advisors (EAs) and forex robots may sound similar, they represent distinct tools with unique advantages and disadvantages. This article delves into the intricacies of EAs and robots, equipping traders with a comprehensive understanding to make informed decisions.

Image: tanakaakiko.f5.si

Expert Advisors (EAs) are automated trading scripts that run within a forex trading platform. They analyze market data, execute trades, and manage positions according to pre-defined rules. Forex robots, on the other hand, are broader in scope. They typically include EAs but also comprise sophisticated algorithms, artificial intelligence, and advanced optimization techniques. Robots automate not only the trading process but also risk management, technical analysis, and other aspects of forex trading.

Understanding Expert Advisors

EAs are designed to execute specific trading strategies within the confines of a predefined set of rules. Traders can customize EAs to suit their individual strategies, risking tolerance, and market conditions. The advantages of using EAs include:

- Automation: EAs eliminate the need for manual trading, allowing traders to automate repetitive tasks and trade around the clock.

- Objectivity: EAs make decisions based on logical rules, removing emotions from the trading process.

- Consistency: EAs consistently follow pre-defined strategies, ensuring adherence to trading plans.

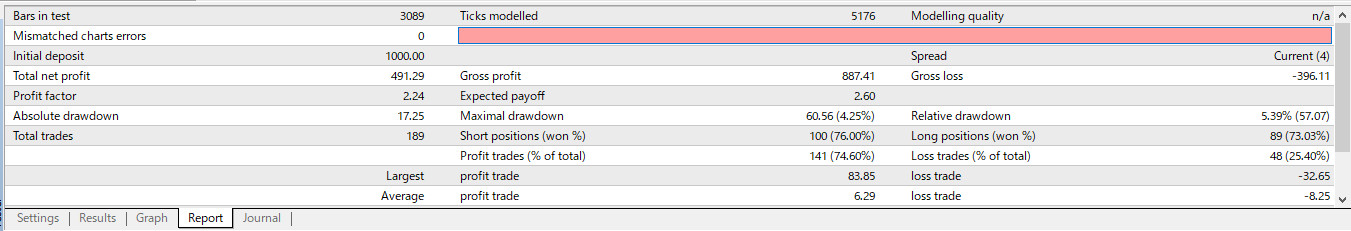

- Backtesting: EAs can be backtested on historical data to evaluate their performance and optimize their parameters.

However, EAs also have limitations:

- Limited flexibility: EAs are constrained by the rules they are programmed with, making them less effective in adapting to changing market conditions.

- Risk management: EAs may struggle with complex risk management techniques, such as position sizing and stop-loss placement.

- Technical skills: Developing and customizing EAs requires technical programming skills, which may not be accessible to all traders.

Exploring Forex Robots

Forex robots represent the next level of automation, offering a broader range of capabilities beyond EAs. They often integrate multiple trading strategies, advanced risk management models, and technical analysis tools. Robots aim to provide comprehensive solutions for traders, covering aspects such as:

- Optimized trading: Robots leverage sophisticated algorithms and artificial intelligence to analyze market data and identify trading opportunities with greater efficiency and precision.

- Risk management: Robots employ advanced risk management techniques to protect traders from excessive losses, ensuring a balanced approach to trading.

- Virtual private servers (VPS): Robots can run on VPS, allowing traders to access their trading accounts and execute trades from anywhere, uninterrupted by downtime or technical issues.

While robots offer numerous benefits, they also have some drawbacks:

- Complexity: Robots are more intricate than EAs, requiring a deeper understanding of forex trading principles and risk management techniques.

- Cost: Robots are often more expensive than EAs, and some providers charge recurring subscription fees.

- Black box approach: The inner workings of some robots may be opaque, making it difficult for traders to fully comprehend their decision-making process.

Which Option is Right for You?

Choosing between an EA and a forex robot depends on individual trading needs, experience, and risk tolerance. EAs are suitable for traders who seek automation but prefer customization and direct control over their trading strategies. Robots, on the other hand, are more appropriate for traders who want a comprehensive solution that automates multiple aspects of trading and integrates advanced risk management techniques.

Image: www.provitstraining.com

Tips for Successful Automated Trading

Whether using an EA or a forex robot, following these tips can enhance your chances of success:

- Research: Thoroughly research EAs and robots before making a selection, considering their track record, strategy, and compatibility with your trading approach.

- Backtest: Backtest EAs and robots on historical data to evaluate their performance under varying market conditions.

- Monitor: Regularly monitor your EA or robot’s performance and make adjustments as needed to optimize their effectiveness.

- Emotional control: Remember that automated systems can still produce losses. Maintain emotional control and avoid overtrading or chasing losses.

- Seek professional advice: Consider consulting with an experienced forex trader or broker for guidance on selecting and using automated trading systems.

Soehoe.Id Expert-Advisor-Atau-Robot-Forex.F30

Conclusion

Expert advisors (EAs) and forex robots offer powerful ways to automate forex trading, providing traders with advantages such as objectivity, consistency, and around-the-clock trading. However, it is crucial for traders to understand their distinct characteristics and limitations. By carefully considering their trading needs and preferences, traders can make informed decisions about which option best aligns with their trading goals. With meticulous research, disciplined monitoring, and a controlled emotional approach, traders can harness the benefits of automated trading and enhance their forex trading endeavors.