Imagine a world where your investments manage themselves, tirelessly analyzing market trends and executing trades based on pre-defined strategies, all while you’re enjoying a cup of coffee or catching up on your favorite show. This isn’t a futuristic fantasy, but the reality offered by automated trading, a revolutionary approach that’s transforming the financial landscape. Whether you’re a seasoned trader or a curious novice, the allure of a system that operates independently, potentially optimizing your returns and minimizing risks, is undeniable.

Image: help.peoplecentral.co

In this comprehensive guide, we’ll delve into the intricate world of automated trading, unraveling its mechanisms, exploring its benefits and drawbacks, and empowering you to make informed decisions about whether it’s the right fit for your investment journey. We’ll demystify the technical jargon, explore the different types of automated trading strategies, and guide you through the process of setting up your own automated trading system. Get ready to unlock a world of possibilities and embrace the power of algorithms!

Understanding the Fundamentals: What is Automated Trading?

Automated trading, often referred to as algorithmic trading, is the process of using computer programs called trading bots or algorithms to execute trades automatically. These algorithms are designed to analyze market data, identify trading opportunities, and execute trades based on pre-defined rules and strategies. The beauty of automated trading lies in its ability to remove emotional biases and execute trades with lightning speed, achieving efficiency that’s often beyond human capabilities.

Think of it as having a personal financial analyst constantly monitoring the market for you, analyzing vast amounts of data in seconds, and making decisions based on your pre-set parameters. This eliminates the need for constant market surveillance and allows you to focus on other aspects of your life.

The Evolution of Automated Trading: From Humble Beginnings to High-Frequency Trading

The roots of automated trading can be traced back to the early days of computerized trading, where simple programs were used to execute basic orders. Over time, advancements in computing power and the availability of real-time data paved the way for more sophisticated algorithms. The development of high-frequency trading, where algorithms execute trades at lightning speed, is a testament to the transformative power of automated trading.

Today, automated trading is widely used by institutional investors, hedge funds, and individual traders alike. The market for algorithmic trading software is booming, with platforms offering a wide range of features and functionalities tailored to different needs and preferences.

Types of Automated Trading Strategies: A Spectrum of Approaches

The world of automated trading is diverse, with a wide variety of strategies catering to different risk profiles and investment goals. Here are some of the most common types:

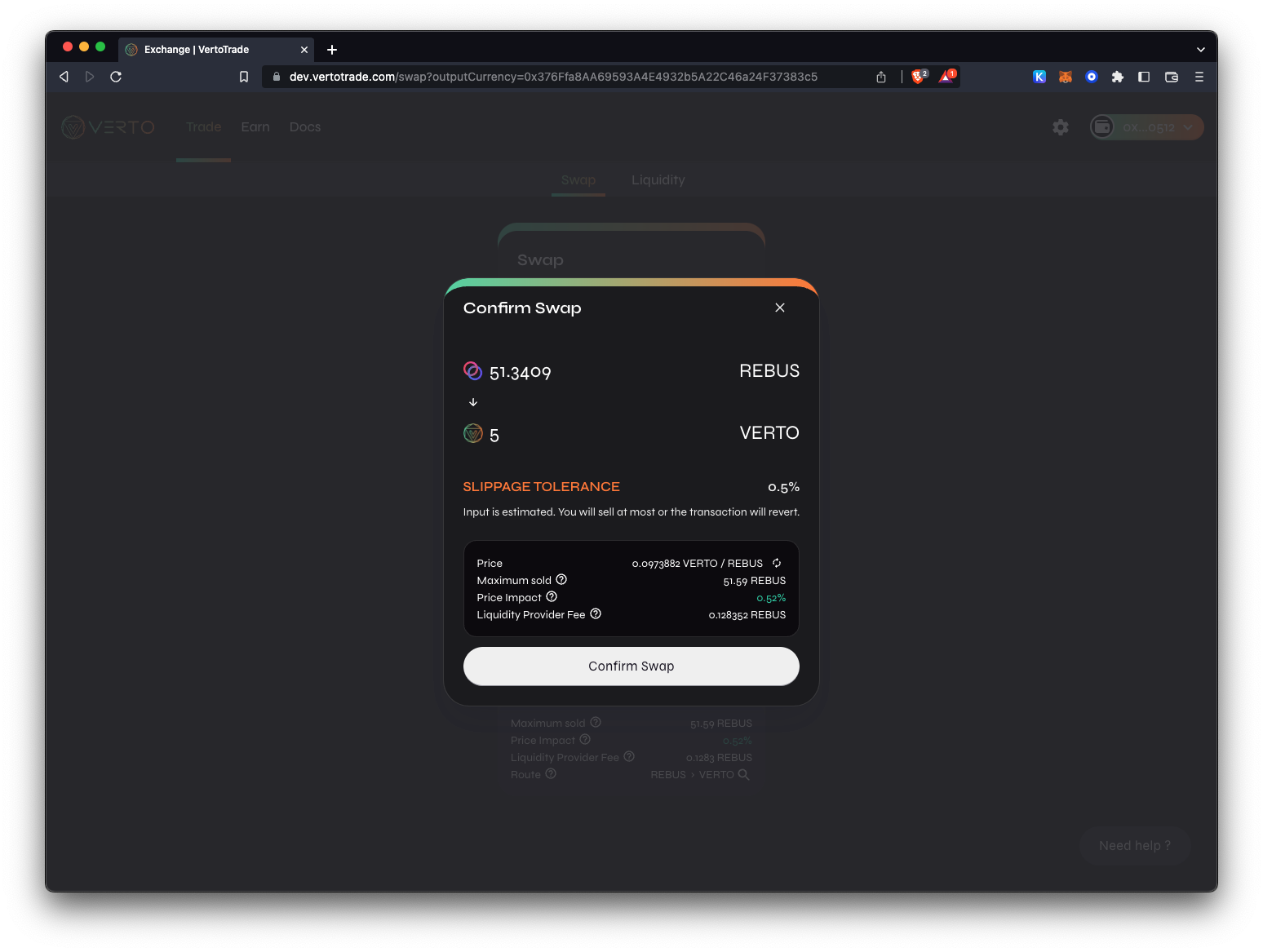

Image: docs.vertotrade.com

Trend-Following

These strategies aim to capitalize on established trends in the market. Algorithms identify and follow these trends, placing trades in the direction of the trend. Trend-following strategies are often used in volatile markets, where price fluctuations offer ample opportunities for profit.

Mean Reversion

Mean reversion strategies are based on the belief that prices tend to revert to their historical average. Algorithms identify assets that have deviated from their mean and place trades to capitalize on their expected return to the average. This strategy is often employed in markets with relatively low volatility.

Arbitrage

Arbitrage strategies exploit price discrepancies between different markets or assets. Algorithms identify these discrepancies and execute trades to profit from the price differences. Arbitrage strategies are often very short-term and require significant computing power and speed to execute effectively.

Scalping

Scalping strategies aim to profit from small price fluctuations within short timeframes. Algorithms enter and exit trades rapidly, capturing small profits from quick price movements. Scalping strategies are often used in highly liquid markets, such as forex, where rapid price fluctuations are common.

The Advantages of Automated Trading: A Paradigm Shift in Investing

Automated trading offers a multitude of benefits that can significantly enhance your investment experience. Here are some of the key advantages:

Objectivity and Discipline

One of the most significant advantages of automated trading is its ability to eliminate emotional biases. Humans, by their nature, tend to make impulsive decisions or succumb to fear and greed when trading. Algorithms, on the other hand, are programmed to execute trades based on pre-defined parameters, unaffected by emotions or psychological pressures. This results in objective and disciplined trading, potentially reducing impulsive decisions and costly mistakes.

Efficiency and Speed

Automated trading systems can analyze vast amounts of data in real time, identifying trading opportunities and executing trades with lightning speed. This allows you to capitalize on fleeting market moments, often faster than humans can react. The efficiency and speed of automated trading can be particularly crucial in volatile markets, where prices can change rapidly.

Customization and Flexibility

Automated trading systems are highly customizable, allowing you to design and implement your own strategies based on your preferences and risk tolerance. You can set parameters for entry and exit signals, define risk management rules, and tailor your strategy to your specific investment goals. This flexibility empowers you to control your trading process and adapt to changing market conditions.

Scalability and 24/7 Operation

Automated trading systems are capable of managing multiple accounts and executing trades across different markets and asset classes. This scalability allows you to manage your investments more effectively without manual intervention. Furthermore, unlike human traders, automated systems can operate 24/7, ensuring that you don’t miss out on trading opportunities due to time constraints or unavailable markets.

The Challenges of Automated Trading: Navigating the Risks and Caveats

While automated trading offers numerous advantages, it’s crucial to acknowledge that it also presents its own set of challenges that require careful consideration.

Technical Complexity

Setting up and managing an automated trading system requires a certain level of technical expertise. You need to understand how algorithms work, the intricacies of programming languages, and the complexities of trading platforms. If you lack the technical knowledge, you may need to engage the services of a skilled programmer or consultant to assist with the process.

Backtesting Limitations

Backtesting, the process of evaluating a trading strategy on historical data, is crucial for assessing its potential profitability. However, keep in mind that backtesting results can be misleading, as they don’t account for the constantly evolving market dynamics and the unpredictable nature of future events. It’s important to understand the limitations of backtesting and to use it as a tool for evaluating strategies, not as a guarantee of future performance.

Market Risk and Unexpected Volatility

Automated trading systems are not immune to market risk. Unforeseen events, such as economic crises or geopolitical instability, can significantly impact market behavior and disrupt even the most well-designed strategies. It’s essential to have robust risk management measures in place to mitigate losses and protect your capital.

Over-Optimization and Data Snooping

Over-optimization occurs when a trading strategy is overly tailored to historical data, leading to unrealistic expectations of future performance. Data snooping refers to the practice of testing a strategy on a data set that includes future data, artificially inflating its performance. It’s important to avoid these pitfalls and to adopt a rigorous approach to strategy development and backtesting.

Getting Started with Automated Trading: A Step-by-Step Guide

If you’re intrigued by the possibilities of automated trading and want to take the plunge, here’s a step-by-step guide to get you started:

1. Define Your Investment Goals and Risk Tolerance

Before diving into the world of algorithms, it’s important to define your investment goals and risk tolerance. What are you trying to achieve with your trading? Are you looking for long-term growth, short-term profits, or income generation? How much risk are you willing to take? Clearly defining your goals and risk tolerance will help you select the right strategies and systems for your needs.

2. Choose a Trading Platform

The next step is to choose a trading platform that supports automated trading. Many platforms offer features like algorithmic trading tools, real-time data, and backtesting capabilities. It’s important to select a platform that’s reliable, user-friendly, and meets your specific technical needs.

3. Learn the Basics of Programming

While some platforms offer drag-and-drop interfaces to create simple trading strategies, a deeper understanding of programming languages like Python is highly recommended. Python is widely used in financial applications, and it provides the flexibility to design and implement advanced strategies.

4. Develop and Test Your Trading Strategy

Once you’ve chosen a platform, it’s time to develop your trading strategy. This involves defining entry and exit signals, setting risk parameters, and carefully reviewing historical data. Backtesting your strategy on historical data is essential to assess its potential profitability and identify any weaknesses.

5. Start with Small Trades and Monitor Performance

Once you’re satisfied with your strategy, start with small trades to assess its performance in real-world conditions. Monitor your results carefully, and make adjustments as needed. Remember, no strategy is perfect, and there will be losing trades along the way. The key is to learn from your mistakes and to continually refine your approach.

The Future of Automated Trading: Emerging Trends and Innovations

Automated trading continues to evolve at a rapid pace, driven by technological advancements and a growing appetite for efficiency and innovation. Here are some of the key trends shaping the future of this exciting field:

Artificial Intelligence (AI) and Machine Learning

AI and machine learning are revolutionizing the way trading strategies are developed and executed. Algorithms are becoming increasingly sophisticated, capable of analyzing vast datasets, identifying complex patterns, and making predictions with unprecedented accuracy. AI-powered trading systems can adapt to changing market conditions and learn from their experience, potentially gaining an edge over traditional strategies.

Cloud-Based Platforms

Cloud-based platforms are gaining popularity in the automated trading space, offering greater scalability, accessibility, and cost-effectiveness. These platforms allow traders to access powerful computing resources and real-time data from anywhere with an internet connection. Cloud computing also offers greater flexibility and scalability, making it easier to manage multiple accounts and strategies.

Blockchain Technology

Blockchain technology, the underlying technology behind cryptocurrencies, is also making inroads into the automated trading world. Blockchain-based platforms offer enhanced security, transparency, and efficiency, potentially revolutionizing the way trades are executed and settled.

How To Trade Automatically

Conclusion: Embrace the Potential of Automated Trading with Informed Decisions

Automated trading is a powerful tool that can transform the way you approach investing. By leveraging the power of algorithms and technology, you can potentially optimize returns, minimize risks, and free yourself from the constraints of manual trading. However, it’s crucial to approach automated trading with a clear understanding of its benefits and challenges. Understand the technical complexities, learn the basics of programming, and develop a solid strategy through thorough research and backtesting.

As you embark on your automated trading journey, remember that this is an ongoing process. Continuously monitor your strategies, adapt to changing market conditions, and embrace the learning experience. The future of trading is undeniably intertwined with automation, and with the right knowledge and approach, you can harness its potential to make your financial goals a reality.