Introduction:

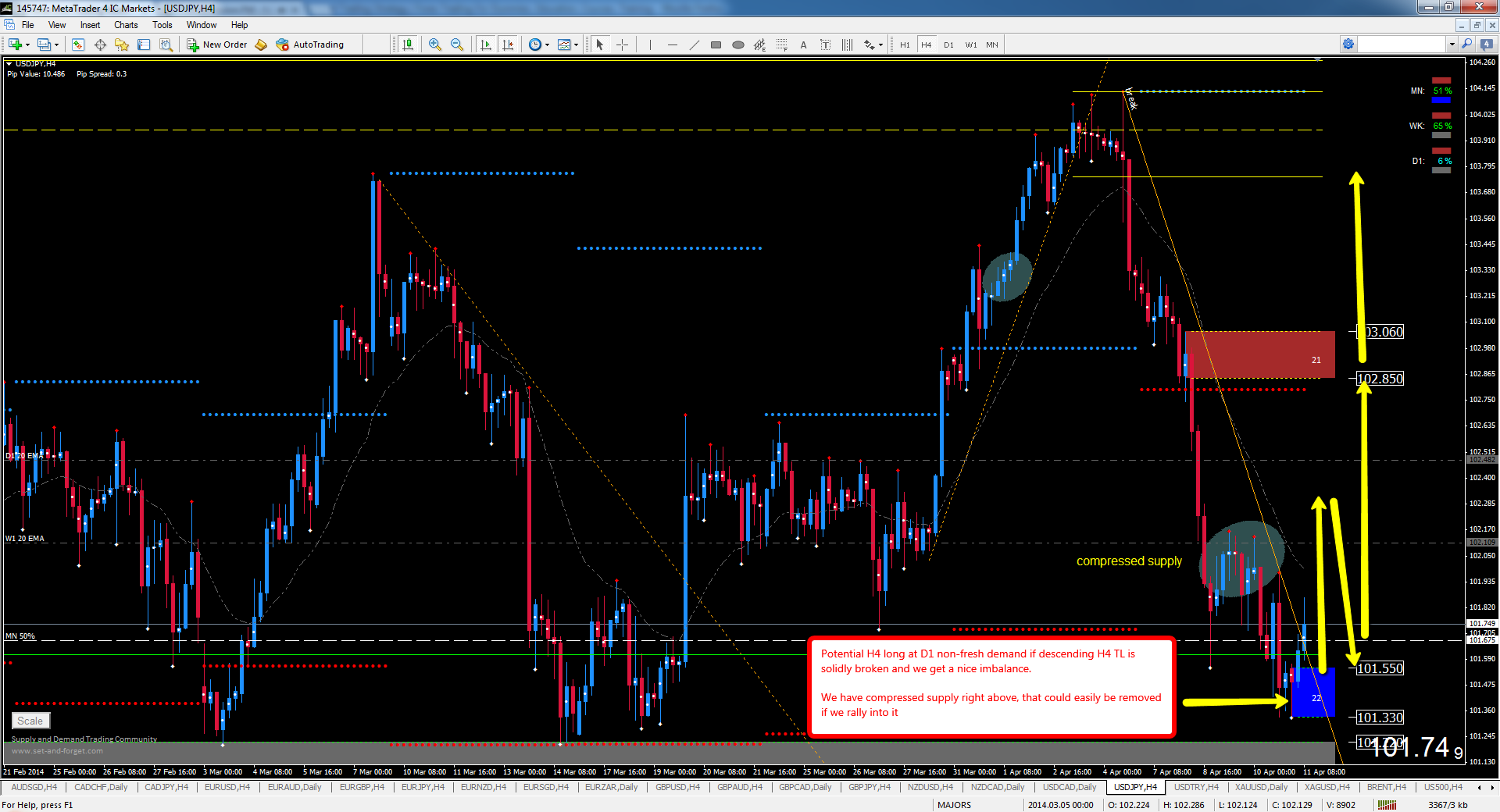

Image: www.set-and-forget.com

In the fast-paced world of forex trading, finding reliable tools that can simplify complex tasks and enhance your decision-making is crucial. Enter the realm of set-and-forget forex indicators – a game-changer for traders who seek an automated and stress-free approach. This comprehensive guide will delve into the intricate details of these powerful indicators, empowering you with the knowledge to harness their full potential and unlock the gateway to successful forex trading. Whether you’re a seasoned veteran or an eager novice, this article will equip you with the necessary insights to elevate your trading strategies.

Understanding Set-and-Forget Forex Indicators:

Set-and-forget forex indicators are technical analysis tools designed to provide traders with automated signals. These indicators monitor price movements and market data, generating alerts or recommendations based on predefined parameters. Instead of the trader constantly monitoring charts and analyzing complex patterns, the indicator does the heavy lifting, freeing up valuable time and reducing cognitive load. By adhering to the signals generated by these indicators, traders can make informed decisions and execute trades with greater confidence.

Types of Set-and-Forget Forex Indicators:

The forex market offers a vast array of set-and-forget indicators, each tailored to specific trading styles and strategies. Common types include:

-

Trend-Following Indicators: These indicators identify the prevailing trend and provide entry and exit signals accordingly. They are based on the assumption that trends tend to persist, and traders can benefit by aligning their trades with the trend’s direction.

-

Momentum Indicators: Momentum indicators measure the speed and strength of price movements, helping traders identify potential turning points or reversals. By assessing the rate of change, these indicators can provide valuable insights into market momentum and potential trading opportunities.

-

Volume Indicators: Volume indicators gauge the volume of trades or transactions, providing insights into market sentiment and liquidity. High volume can indicate increased volatility and opportunities for profitable trades.

-

Volatility Indicators: Volatility indicators measure the extent of price fluctuations, helping traders assess market conditions and identify periods of high or low volatility. By understanding volatility, traders can adjust their risk management strategies and trading approaches accordingly.

Advantages of Using Set-and-Forget Forex Indicators:

-

Automation and Efficiency: Set-and-forget indicators automate the signal generation process, freeing traders from the need for constant chart monitoring and analysis. This efficiency allows traders to focus on other aspects of their trading, such as risk management and strategy development.

-

Reduced Cognitive Load: By eliminating the need for extensive manual analysis, set-and-forget indicators reduce cognitive load and help traders make faster and more informed decisions. This reduced mental burden can lead to improved focus and enhanced decision-making capabilities.

-

Time Savings: As these indicators work in the background, traders can save a significant amount of time that would otherwise be spent on manual chart analysis. This time savings can be dedicated to other aspects of trading or personal endeavors, enhancing overall productivity.

-

Emotional Detachment: Set-and-forget indicators provide objective signals based on predefined parameters, reducing the influence of emotions on trading decisions. This emotional detachment can prevent impulsive trades and promote a more disciplined and rational approach to trading.

How to Use Set-and-Forget Forex Indicators:

-

Select the Right Indicator: Choose set-and-forget indicators that align with your trading strategy and risk tolerance. Consider the types of indicators described above and select those that complement your approach.

-

Set Up the Parameters: Configure the indicator settings according to your preferences. This involves adjusting parameters such as moving averages, oscillator levels, or volatility thresholds to suit your desired sensitivity and signal frequency.

-

Interpret the Signals: When the indicator generates a signal, interpret it based on the underlying trading strategy and market context. Understand the meaning behind each signal and how it aligns with your trading rules.

-

Test and Refine: Before using set-and-forget indicators in live trading, test them rigorously on historical data or a demo account. This testing phase allows you to refine settings and optimize the indicator’s performance based on actual market conditions.

Conclusion:

Set-and-forget forex indicators empower traders with automated signal generation and simplified decision-making. By understanding the types, advantages, and proper usage of these indicators, you can harness their potential to enhance your trading performance and achieve greater success in the forex market. Remember, the most effective use of set-and-forget indicators lies in the combination of automated signals with fundamental analysis and risk management strategies. By embracing this comprehensive approach, you can unlock the full potential of these powerful tools and elevate your forex trading journey to new heights.

Image: indicatorspot.com

Set And Forget Forex Indicator