Introduction:

Image: www.zeebiz.com

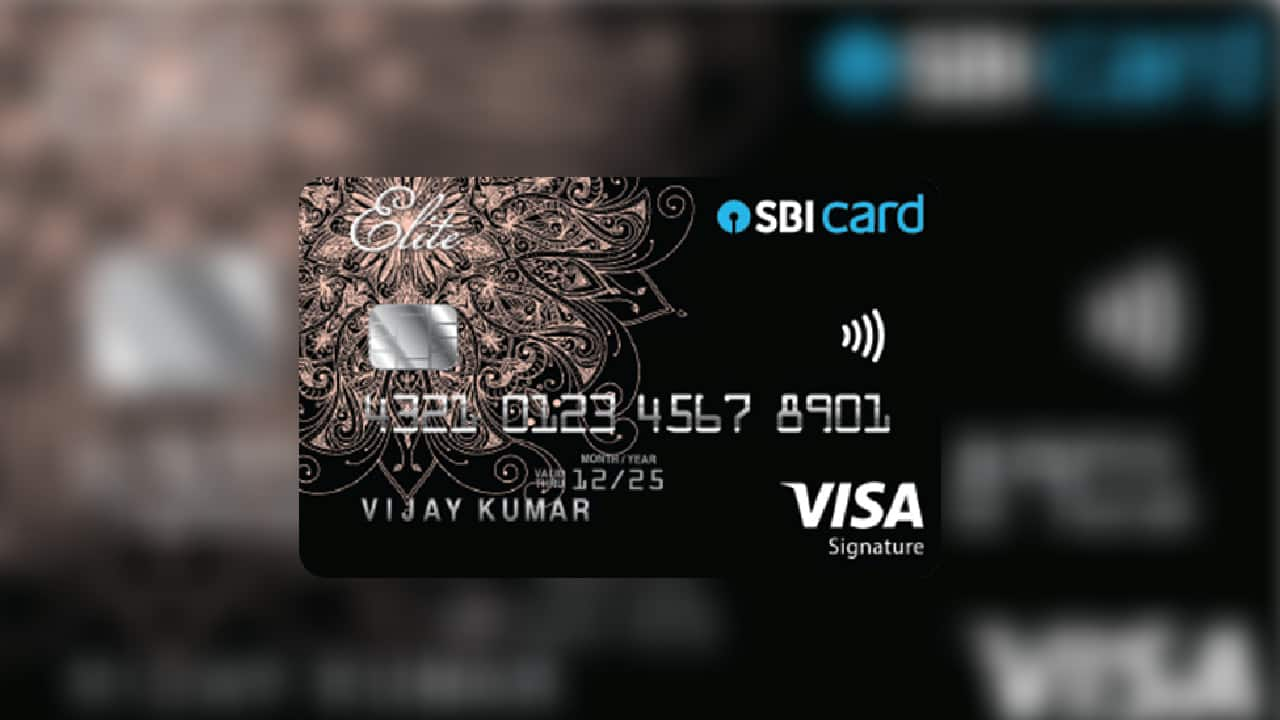

In today’s interconnected world, international travel and global business ventures are an integral part of our lives. Managing finances during overseas escapades, however, can often be a daunting task, filled with hidden fees, unfavorable exchange rates, and cumbersome documentation. Enter the SBI Single Currency Forex Card—a revolutionary solution designed to simplify your financial transactions abroad, granting you financial freedom and peace of mind.

Introducing the SBI Single Currency Forex Card:

The SBI Single Currency Forex Card is a prepaid card linked to the Indian Rupee (INR). It allows you to load a single foreign currency of your choice, such as US Dollars (USD), Euro (EUR), British Pound (GBP), and more. Once loaded, you can use the card at any merchant or ATM that accepts Visa or Mastercard internationally. The card eliminates currency conversion charges incurred with regular debit or credit cards, offering significant savings on your travel expenses.

Benefits and Advantages of the SBI Single Currency Forex Card:

-

No Currency Conversion Fees: Save up to 4-6% on every transaction by avoiding the hidden charges associated with currency conversions.

-

Competitive Exchange Rates: SBI provides highly competitive exchange rates, ensuring you get the most value for your money.

-

Multi-Currency Facility: Load multiple currencies onto the same card, allowing you to travel hassle-free across different countries without carrying multiple cards or cash.

-

Wide Acceptance: The card is accepted at ATMs and POS terminals worldwide, giving you access to your funds wherever you go.

-

Secure and Convenient: The card is equipped with EMV chip technology and a 4-digit PIN, providing enhanced security for your transactions.

How it Works:

Loading the SBI Single Currency Forex Card is a simple and convenient process. You can visit your nearest SBI branch or utilize SBI’s online banking platform. Once loaded, you can activate the card and start using it for all your overseas expenses. The card can be reloaded as and when required, allowing you to manage your finances effectively.

Expert Insights and Actionable Tips:

Mr. Naveen Murali, Financial Advisor at SBI, highlights the importance of planning when using a Forex Card. He recommends loading the card with an amount sufficient for your estimated expenses, avoiding unnecessary currency conversions and ensuring adequate funds for your trip.

Conclusion:

The SBI Single Currency Forex Card is an indispensable tool for frequent travelers, business professionals, and anyone seeking financial ease while venturing abroad. With its exceptional benefits, competitive exchange rates, and enhanced security, the card empowers you to embrace global experiences without financial worries. Embrace the world with confidence and convenience; get your SBI Single Currency Forex Card today and unlock the boundless possibilities of international finance.

Image: www.moneycontrol.com

Sbi Single Currency Forex Card