Understanding Foreign Exchange Rates

The world of foreign exchange rates can be daunting, especially when dealing with a currency as widely used as the Indian rupee. This article aims to demystify SBI’s forex rates for Indian rupees, empowering you with the knowledge to make informed financial decisions. Let’s dive into the intricacies of currency exchange and how SBI’s rates can help you navigate the complexities of international transactions.

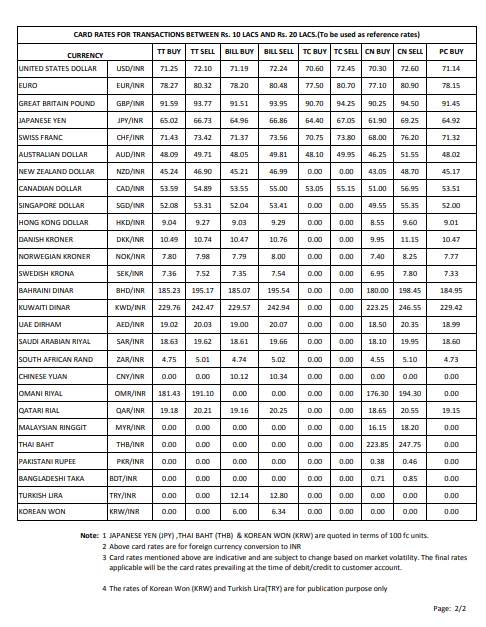

Image: management.ind.in

SBI’s Role in Currency Exchange

The State Bank of India (SBI) plays a pivotal role in facilitating currency exchange in India. As the country’s largest commercial bank, SBI offers competitive forex rates for a wide range of currencies, including the US dollar, Euro, British pound, and Japanese yen. With extensive experience in international banking, SBI ensures secure and seamless foreign exchange transactions for individuals and businesses alike.

Understanding Forex Rates

Foreign exchange rates, also known as currency exchange rates, represent the value of one currency relative to another. These rates fluctuate constantly, influenced by various economic and political factors. When converting Indian rupees to another currency, for example the US dollar, the exchange rate determines how many rupees you need to exchange for one dollar. SBI’s forex rates are meticulously updated in real time, ensuring you get the most accurate and up-to-date rates for your transactions.

Benefits of SBI Forex Rates

- Competitive Rates: SBI offers some of the most competitive forex rates in the market, providing you with the best value for your money.

- Convenience: With a vast network of branches and partnerships across India, SBI makes foreign exchange transactions accessible and convenient.

- Reliability: SBI’s long-standing presence in the banking industry ensures trust and reliability for your international financial transactions.

- Variety of Currencies: SBI supports a wide range of currencies, catering to the diverse needs of travelers, immigrants, and businesses conducting international transactions.

- Expert Guidance: SBI’s experienced staff is always ready to assist you with any questions or concerns you may have regarding forex rates and currency exchange.

Image: forexgannsystem.blogspot.com

Factors Influencing SBI Forex Rates

Various factors influence the daily fluctuations of SBI’s forex rates. These include:

- Economic Indicators: Economic data such as GDP growth rates, inflation, and unemployment rates impact currency values.

- Central Bank Policies: Monetary policies like interest rate changes can significantly affect forex rates.

- Political Stability and Events: Political events and changes in government policies can cause market volatility and influence currency exchange.

- Supply and Demand: The supply and demand for particular currencies in the global market can drive forex rate movements.

- World Events: Major global events like wars, pandemics, and natural disasters can lead to fluctuations in forex rates.

Tips for Getting the Best Forex Rates

- Monitor Exchange Rates: Stay informed about the latest forex rates by regularly checking SBI’s website or mobile app.

- Compare Rates: Don’t settle for the first rate you find. Compare quotes from multiple banks and exchange companies to ensure you’re getting the best deal.

- Negotiate Large Transactions: When exchanging large amounts of currency, contact SBI directly to negotiate a favorable exchange rate.

- Use Market Orders: Place market orders with SBI to secure the current market rate for your currency exchange transaction.

- Consider Buy-Back Guarantees: SBI offers buy-back guarantees for certain currencies, allowing you to exchange currency back at the same rate within a specified time frame.

Expert Advice on Managing Forex Risk

- Hedge Currency Risk: If you anticipate potential fluctuations in forex rates, consider hedging your exposure through instruments like forward contracts or currency options.

- Use a Trading Strategy: Develop a trading strategy that aligns with your risk tolerance and financial objectives.

- Stay Informed: Keep up-to-date on economic and political events that could impact currency exchange rates.

- Work with a Trusted Financial Advisor: Consult a financial advisor to guide you through complex currency exchange transactions and risk management strategies.

Frequently Asked Questions (FAQs)

Q: How do I check SBI’s current forex rates?

A: You can access real-time forex rates on SBI’s website, mobile app, or by contacting your local SBI branch.

Q: What documents are required for foreign exchange transactions?

A: Typically, you will need your passport, visa (if applicable), and proof of purpose for the transaction.

Q: Are there any restrictions on foreign exchange transactions?

A: Yes, there are certain limits and regulations imposed by the Reserve Bank of India on foreign exchange transactions. Visit SBI’s website or consult with your branch for details.

Q: How can I avoid hidden fees in currency exchange?

A: Choose a reputable bank or exchange company like SBI that provides transparent fees and exchange rates. Read the terms and conditions carefully before finalizing your transaction.

Sbi Forex Rates Indian Rupees

Conclusion

Understanding SBI’s forex rates for Indian rupees empowers you to make informed financial decisions and navigate the world of currency exchange with confidence. Whether you’re planning an international vacation, sending money abroad, or engaging in international business, SBI’s reliable rates and expert guidance will ensure a secure and cost-effective experience. Stay informed, subscribe to SBI’s updates, and engage with trusted financial advisors to stay ahead of the curve in foreign exchange transactions. Are you interested in exploring more about SBI’s forex rates for Indian rupees? Let us know your queries or share your experiences in the comment section below!