Navigating the Forex Broker Landscape: Understanding Dealing Desk Brokers

When venturing into the foreign exchange (forex) market, choosing the right broker is paramount for success. Among the various types of brokers available, dealing desk forex brokers stand out for their unique offering, making them a preferred choice for a substantial segment of traders. This comprehensive guide delves into the world of dealing desk forex brokers, providing an in-depth exploration of their characteristics, advantages, and limitations, culminating in a comprehensive list of reputable brokers to empower your trading journey.

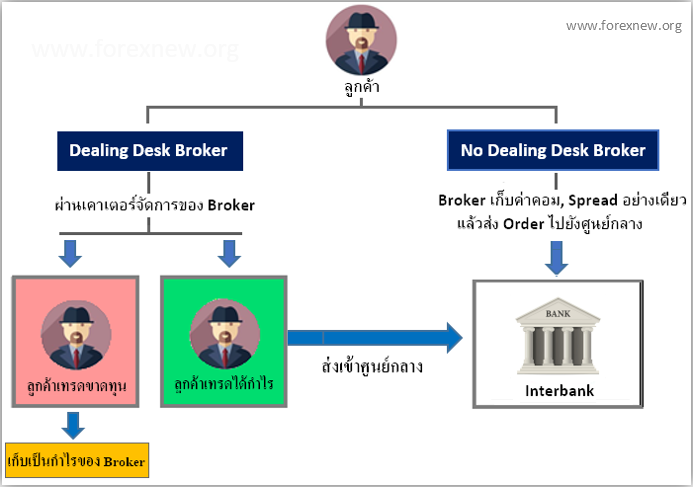

Image: forexnew.org

Defining Dealing Desk Forex Brokers

Dealing desk forex brokers, also known as market makers, assume the role of both counterparty and intermediary in forex transactions. Unlike their non-dealing desk counterparts, which connect traders directly to the interbank market, dealing desk brokers maintain their own in-house liquidity pools, enabling them to quote bid and ask prices to traders. This approach presents certain benefits, such as increased trade execution speed, guaranteed liquidity, and potentially tighter spreads, especially during high market volatility. However, it also introduces potential conflicts of interest, as dealing desk brokers profit from the spread between the bid and ask prices.

Unveiling the Pros and Cons of Dealing Desk Forex Brokers

Advantages:

- Guaranteed liquidity: Dealing desk brokers eliminate the risk of slippage, ensuring that traders can execute orders at the quoted prices, even during periods of high market volatility.

- Tighter spreads: By maintaining in-house liquidity pools, dealing desk brokers often offer more competitive spreads compared to non-dealing desk brokers, particularly during quieter market conditions.

- Fast trade execution: The direct connection between dealing desk brokers and their liquidity providers minimizes the time required for order execution, resulting in swift and efficient trade processing.

- Personalized support: Dealing desk brokers typically assign dedicated account managers to provide personalized support and guidance, catering to the individual needs of traders.

- Educational resources: Many dealing desk forex brokers offer educational materials, webinars, and market analysis tools to support traders’ knowledge and understanding of the forex market.

Disadvantages:

- Potential conflicts of interest: As dealing desk brokers act as counterparties to trades, there is a potential for conflicts of interest. They may have an incentive to quote prices that are less favorable to traders or delay executions to profit from market movements.

- Limited market access: Dealing desk forex brokers do not provide direct access to the interbank market, potentially restricting traders’ ability to access the most favorable prices available.

- Requotes: In highly volatile market conditions, dealing desk brokers may request requotes or widen spreads, leading to potential losses for traders.

Identifying Reputable Dealing Desk Forex Brokers: A Comprehensive List

Navigating the forex broker landscape can be daunting, especially for novice traders. To assist in making informed decisions, we have compiled a comprehensive list of reputable dealing desk forex brokers that meet stringent criteria, including regulatory compliance, industry experience, and customer satisfaction:

- IC Markets

- FP Markets

- Pepperstone

- XM

- AxiTrader

- OANDA

- IG

- FXCM

- 4XC

- AvaTrade

Each of these brokers has established a track record of reliability, offering competitive trading conditions, robust trading platforms, and exceptional customer support.

Image: www.forex.academy

Empowering Your Forex Trading Journey: Matching Your Needs with the Right Broker

Choosing the right dealing desk forex broker is a crucial step in maximizing your trading potential. Consider your individual needs, trading style, and risk tolerance when evaluating different brokers. If you prioritize guaranteed liquidity, competitive spreads, and personalized support, a dealing desk forex broker may align well with your objectives.

Conversely, if you seek greater market access, a non-dealing desk forex broker may be a more suitable option. Thoroughly research and compare multiple brokers before making a decision.

Dealing Desk Forex Broker List

Conclusion: Navigating the Forex Market with Confidence and Savvy

Understanding the intricacies of dealing desk forex brokers is essential for successful forex trading. By leveraging their advantages and mitigating potential risks, traders can harness the benefits of guaranteed liquidity, competitive spreads, and personalized support.

The comprehensive list of reputable dealings desk forex brokers provided in this guide empowers traders with the knowledge necessary to make informed decisions. By choosing the right broker that aligns with their individual needs, traders can embark on their forex trading journey with confidence and a strategic foundation for success.