In today’s interconnected global economy, currencies play a pivotal role in facilitating international trade and investments. Among these, two key players stand out: the rupee treasury and the forex treasury, guardians of financial stability and international exchange. Embark on this illuminating journey as we uncover the intricacies of their operations, empowering you to navigate the world of currency management with confidence.

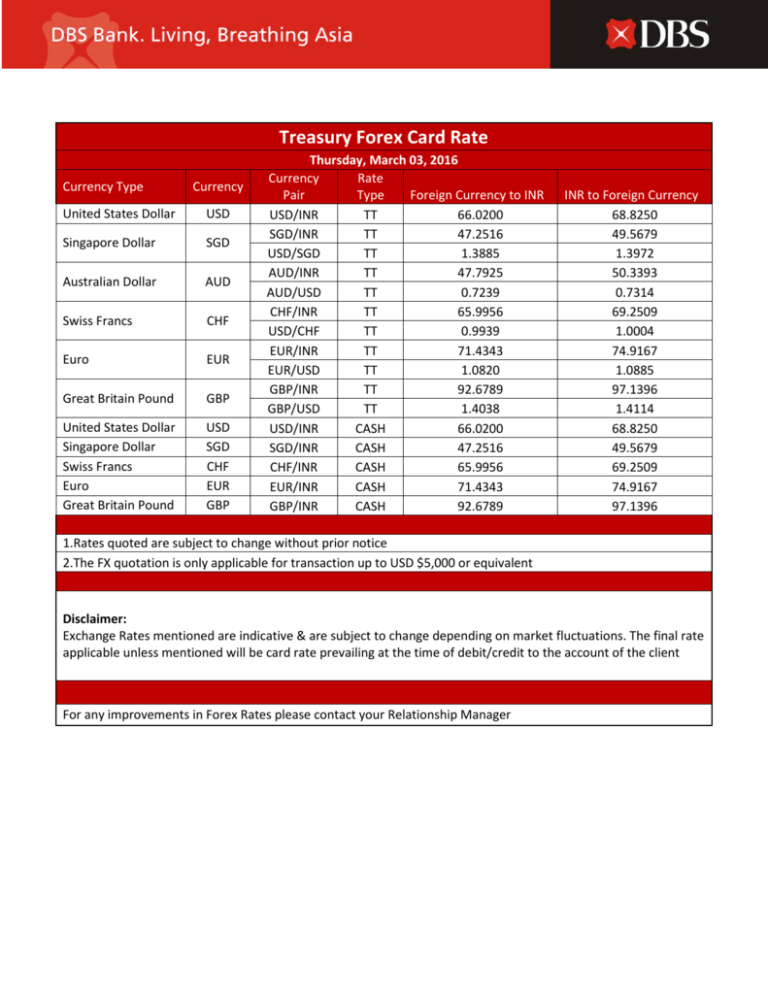

Image: studylib.net

What is the Rupee Treasury?

Imagine the rupee treasury as a central hub, a financial fortress safeguarding the Indian rupee. Its primary mission is to maintain the stability of the rupee against external fluctuations and ensure the smooth functioning of domestic financial markets. The Reserve Bank of India (RBI), the apex monetary authority of the nation, orchestrates the operations of the rupee treasury.

Under the watchful eye of the RBI, the rupee treasury implements monetary policy decisions, intervenes in the foreign exchange market to manage currency volatility, and manages the issuance and redemption of government securities. By harmonizing these actions, the treasury ensures that the rupee remains a stable and trusted medium of exchange, fostering economic growth and stability.

Unveiling the Forex Treasury: A Global Currency Gateway

In contrast to the rupee treasury, which focuses on the domestic currency, the forex treasury ventures into the realm of international exchange. Forex, short for foreign exchange, refers to the trading of currencies between nations. The forex treasury serves as a liaison, facilitating cross-border transactions and managing the inherent risks associated with currency exchange.

Major banking institutions and financial institutions maintain forex treasuries to cater to the currency needs of their clients and participate in the global foreign exchange market. They act as intermediaries, bridging the exchange requirements of importers, exporters, businesses, and individuals, ensuring the seamless flow of funds across borders.

The Art of Treasury Management: Balancing Risks and Opportunities

Treasury management, whether in the realm of rupee or forex, requires a delicate dance between managing risks and seizing opportunities. The managers of rupee treasury closely monitor domestic economic indicators, such as inflation, interest rates, and balance of payments, to preempt any potential disturbances to the rupee’s stability. Forex treasuries, on the other hand, navigate the complexities of global currency markets, hedging against currency fluctuations and optimizing returns for their clients.

In both cases, treasury managers utilize sophisticated risk management tools and hedging strategies to mitigate potential losses and enhance profitability. By skillfully navigating the financial landscape, treasury managers play a pivotal role in ensuring the financial health of individuals, businesses, and nations.

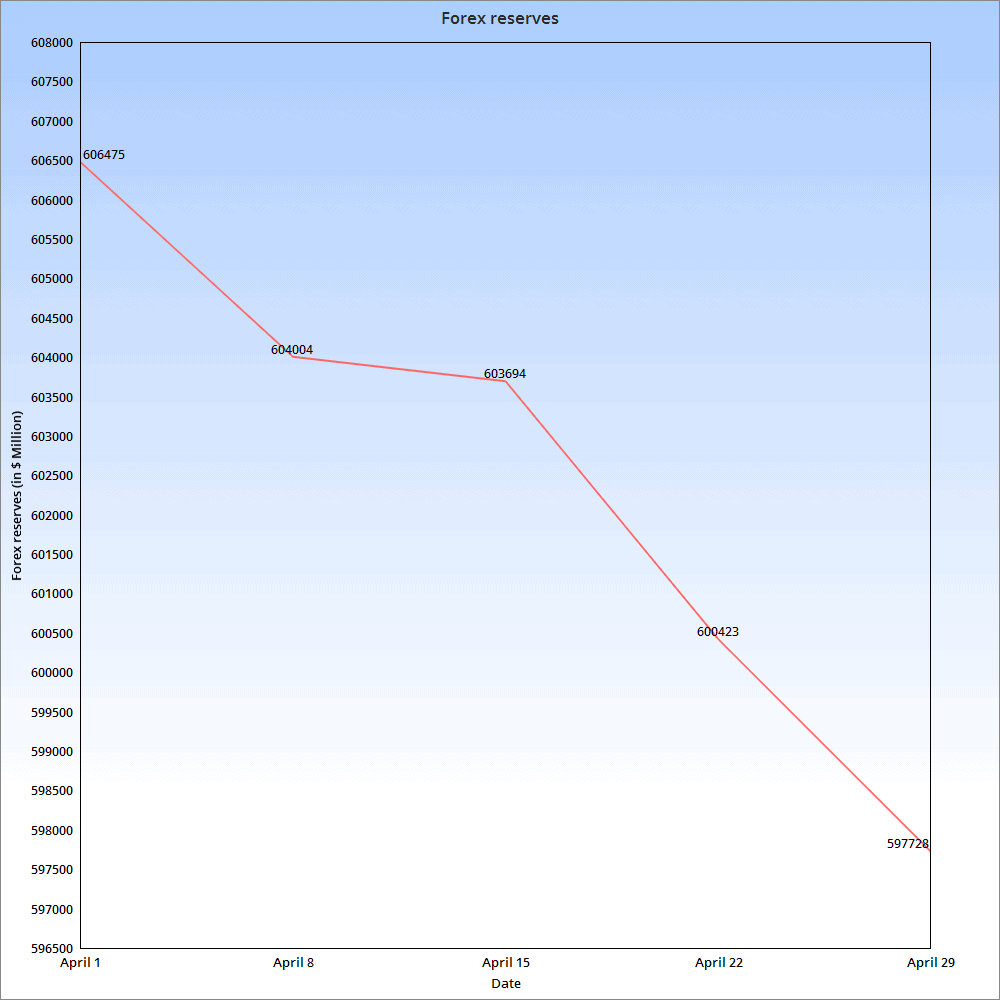

Image: www.siasat.com

A Symbiotic Relationship: Rupee Treasury and Forex Treasury

Despite their distinct domains, the rupee treasury and forex treasury maintain a symbiotic relationship, fostering a stable and efficient financial environment. The forex treasury serves as a conduit through which rupees enter and leave the country, while the rupee treasury stabilizes the domestic value of these inflows and outflows.

Forex trading influences the demand and supply dynamics of the rupee, which, in turn, affects its exchange rate. Thus, the actions of one treasury have ripple effects on the other, highlighting their interconnectedness and shared responsibility in maintaining financial harmony.

Harnessing the Power of Treasury: Expert Insights

“The rupee treasury acts as a monetary shock absorber, cushioning the impact of external economic disturbances on the domestic economy,” notes Dr. Arvind Virmani, a renowned economist and former Chief Economic Advisor to the Government of India.

Elaborating on the role of the forex treasury, Patricia Hewitt, a seasoned forex trader at a leading financial institution, emphasizes, “Forex treasuries bridge the currency divide, enabling cross-border trade and promoting economic integration.”

Their insights underscore the critical role treasury operations play in fostering a robust and dynamic financial ecosystem.

Empowering Individuals: Practical Financial Strategies

Understanding the nuances of rupee treasury and forex treasury can empower individuals to make informed financial decisions. By keeping abreast of currency fluctuations, individuals can optimize their savings, investments, and international transactions.

To navigate the currency markets effectively, it is advisable to seek guidance from a reputable financial advisor who can provide personalized recommendations and risk management strategies tailored to your specific needs.

What Is Rupee Treasury And Forex Treasury

Conclusion

The world of currency management is a tapestry woven with intricate threads of rupee treasuries and forex treasuries. These financial sentinels stand guard, ensuring the stability and liquidity of our financial systems. Their operations, though complex, are essential to the smooth functioning of international trade, investments, and personal finances. By unraveling their mysteries, you now possess a deeper understanding of these financial guardians, empowering you to confidently navigate the ever-changing landscape of global currency exchange.