Introduction

Picture this: You’ve been trading for months, but the profits just aren’t coming. You’re starting to feel frustrated and discouraged, questioning your abilities. Then, one day, you stumble upon the reversal candle trading strategy. Intrigued, you dive into the concept, and suddenly, everything changes. You start seeing the market with newfound clarity, identifying patterns and making informed trades. Within weeks, you’re turning consistent profits, leaving your previous struggles behind.

Image: www.trade-like-pro.com

If this scenario resonates with you, then you’re in the right place. In this comprehensive guide, we’ll delve into the intricacies of the reversal candle trading strategy, providing you with the knowledge and tools to master this game-changing technique. So, buckle up and get ready to unlock the secrets of profitable trading.

Understanding Reversal Candles

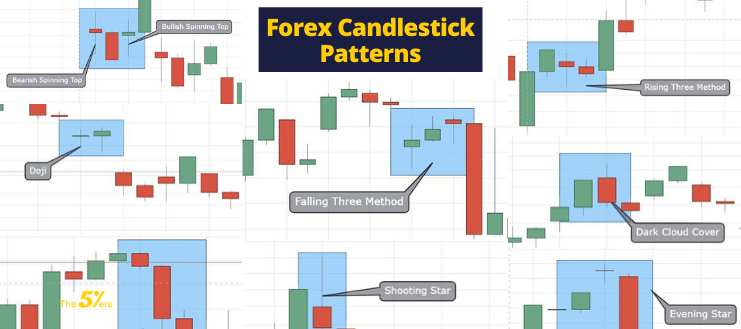

Reversal candles are powerful technical indicators that signal a potential change in market direction. They are formed when the price action takes a sudden and significant turn, indicating a shift in momentum. There are various types of reversal candles, but the most common include the bullish hammer, the bearish shooting star, the doji, and the engulfing pattern.

These candles have unique characteristics that distinguish them from other candlesticks. For instance, a bullish hammer has a small body and a long lower shadow, indicating that buyers have stepped in to support the price after a downtrend. Conversely, a bearish shooting star has a small body and a long upper shadow, suggesting that sellers have taken control after an uptrend.

How to Identify and Trade Reversal Candles

Identifying reversal candles requires careful observation of the market and attention to detail. Look for candles with large bodies and small shadows, or vice versa. Note the position of the candle in relation to previous price action and the presence of any support or resistance levels.

Once you’ve identified a potential reversal candle, it’s time to decide whether to trade it. Ideally, you want to enter a trade in the direction of the reversal. For example, if you spot a bullish hammer, you should consider buying the asset. However, it’s crucial to wait for confirmation before entering the trade. This can come in the form of a breakout above or below a key level, or a subsequent candle that further strengthens the reversal signal.

The Power of Multiple Time Frames

One of the most effective ways to increase the accuracy of your reversal candle trading is to analyze multiple time frames. This provides a broader perspective of the market, allowing you to spot potential reversals at different levels of support and resistance.

For example, you might identify a bullish hammer on the daily chart. However, by examining the hourly chart, you notice that the hammer has formed after a prolonged downtrend and is supported by a key support level. This gives you added confidence in the potential reversal and increases the likelihood of a successful trade.

Image: www.learningonlinecourse.com

Tips for Successful Reversal Candle Trading

To maximize your profits with the reversal candle trading strategy, follow these expert tips:

- Use a reliable charting platform that provides accurate candle formations.

- Study different types of reversal candles and their characteristics.

- Practice identifying reversal candles on historical data before trading live.

- Never enter trades based on one candle alone. Look for confirmation from other technical indicators or price action patterns.

- Manage your risk effectively by setting stop-loss orders and limiting your position size.

Reversal Candle Trading Strategy-Forex Trading Stock Trading Udemy Free Download

Conclusion

The reversal candle trading strategy is a powerful tool that can help you identify potential market reversals and make profitable trades. By understanding the characteristics of reversal candles, analyzing multiple time frames, and adhering to tried-and-tested trading principles, you can significantly improve your trading results.

Now that you have this newfound knowledge, the ball is in your court. Are you ready to embark on the path to trading success? If so, start practicing the reversal candle trading strategy today and unlock the potential for consistent profits.