In the vast and ever-evolving realm of finance, forex and currency play an integral role, shaping the global economic landscape. Forex, short for foreign exchange, represents the intricate network of trading currencies between nations, while currency signifies the medium of exchange used within a country. Together, they form a symbiotic relationship that both influences and is influenced by numerous factors.

Image: www.forex.academy

As a testament to their interconnection, the value of a nation’s currency directly impacts its forex market. A currency that is deemed strong or stable attracts international investors seeking secure investments, leading to an increased demand for that currency and, consequently, a rise in its value in the forex market. Conversely, a weak or volatile currency can discourage investors, resulting in a decreased demand and a depreciation in value.

The History and Meaning of Forex and Currency

The history of forex traces back centuries, with the earliest recorded instances of currency exchange occurring in ancient Mesopotamia and China. As trade and travel expanded across borders, the need for a standardized exchange system became apparent, leading to the development of fixed exchange rates and the gold standard. The modern concept of forex emerged in the early 20th century with the establishment of international financial centers such as London and New York.

Currency, on the other hand, holds a profound significance as a symbol of national identity, economic strength, and monetary sovereignty. It facilitates domestic transactions, allows for price comparison and market regulation, and serves as a physical representation of a country’s financial system.

The Mechanics of Forex Trading

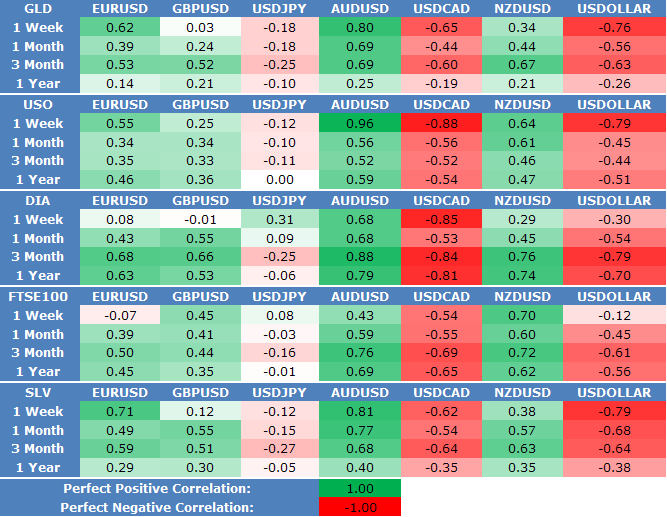

Forex trading involves the buying and selling of currencies in pairs, such as the euro against the US dollar (EUR/USD). Traders speculate on the fluctuation of exchange rates, buying a currency that is expected to appreciate in value against another currency. The profit or loss in a forex transaction is determined by the difference between the buying and selling prices, minus any trading fees.

Forex markets are the most liquid in the world, characterized by high trading volumes and low transaction costs. This liquidity attracts a wide range of participants, including banks, hedge funds, investment companies, and individual retail traders.

The Interplay of Forex and Currency in the Global Economy

The interplay of forex and currency affects various aspects of the global economy. It influences trade balances between countries, determines the cost of imported goods, and can impact inflation rates. Forex fluctuations can also create opportunities for currency speculation, leading to both profits and losses for investors.

Central banks play a significant role in managing the forex market and influencing currency values. They use monetary policy tools such as interest rate adjustments and open market operations to stabilize exchange rates and mitigate the effects of volatile markets.

Image: www.mql5.com

Tips for Understanding the Forex and Currency Market

Understanding the forex and currency market requires a combination of knowledge, experience, and strategic thinking. Here are some expert tips to help you navigate this complex landscape:

Educate yourself: Delve into the fundamentals of forex, technical analysis, and economic factors that influence currency movements. Read industry publications, attend webinars, and consult reliable sources of information.

Monitor the market: Stay informed of global news events, economic data releases, and central bank announcements that can impact the forex market. Use technical analysis tools to identify trends and support and resistance levels.

Frequently Asked Questions on Forex and Currency

Q: What is the difference between the forex market and the stock market?

A: While both markets involve buying and selling financial instruments, the forex market specifically deals with currencies, whereas the stock market involves the trading of company shares.

Q: Is forex trading risky?

A: Like any investment, forex trading carries a level of risk. However, by managing risk through proper money management, using leverage prudently, and educating yourself on market dynamics, you can mitigate potential losses.

Q: How can I learn more about forex trading?

A: Several resources are available to help you learn about forex trading, including books, online courses, seminars, and demo trading platforms that simulate real-time trading conditions.

Relation Between Forex And Currency

Conclusion

The relationship between forex and currency is an intricate and fascinating one, shaping global trade, investment, and monetary policy. By understanding the mechanics of forex trading, economic factors, and the latest trends, individuals can navigate the forex market and gain insights into the interconnected world of finance.

Are you interested in delving deeper into the world of forex and currency? Share your thoughts and questions, and let’s explore this captivating topic further.