In the fast-paced world of foreign exchange (forex) trading, prompt payment is paramount. However, occasionally, situations arise where payments become overdue, posing significant challenges for businesses.

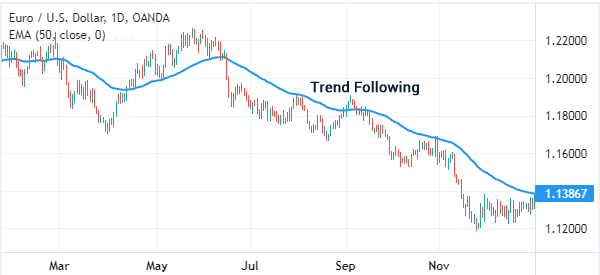

Image: www.daytradetheworld.com

Overdue forex payments can strain relationships with clients, expose businesses to financial losses, and disrupt cash flow. In this comprehensive guide, we will delve into the topic of overdue analysis in forex business, providing practical strategies and expert advice to minimize the impact and improve payment efficiency.

Identifying Overdue Payments in Forex

Early identification of overdue payments is crucial for prompt follow-up. Forex businesses typically monitor payments through automated systems and regular invoicing reconciliation. If a payment is not received within the agreed-upon timeframe, it may be considered overdue.

It is important to establish clear payment terms and consequences for late payments to prevent delays and potential disputes. Timely reminders and proactive outreach to clients can also reduce the likelihood of overdue payments.

Causes of Overdue Payments

Overdue payments in forex business can stem from various factors, including:

- Client financial difficulties: Customers may encounter temporary financial setbacks that hinder their ability to make timely payments.

- Administrative errors: Mistakes in invoice processing, payment instructions, or bank transfers can result in delays.

- Currency fluctuations: Unexpected exchange rate changes may impact the availability of funds for client payments.

- Payment fraud: Malicious actors may attempt to disrupt payment processes or divert funds intended for forex businesses.

Understanding the potential causes of overdue payments can help businesses develop appropriate mitigation strategies.

Expert Advice for Overdue Analysis and Resolution

Experienced forex professionals recommend implementing the following steps for effective overdue analysis and resolution:

- Establish Clear Policies and Procedures: Formalize payment terms, including consequences for late payments, to manage client expectations.

- Monitor Payments Regularly: Utilize automated systems to track payments and identify potential delays promptly.

- Communicate Effectively: Maintain open communication with clients, sending timely reminders and following up on overdue payments professionally.

- Investigate Root Causes: Determine the underlying reasons for overdue payments and address any underlying issues to prevent recurrence.

By adhering to these expert recommendations, forex businesses can streamline payment processes and minimize the risk of overdue payments.

Image: forexpops.com

FAQs on Overdue Payments in Forex

Q: What are the consequences of overdue payments for forex businesses?

A: Overdue payments can lead to financial losses, strained business relationships, and disrupted cash flow.

Q: How can I prevent overdue payments from clients?

A: Establish clear payment terms, communicate effectively, and monitor payments regularly. Prompt and professional follow-up can also reduce the likelihood of delays.

Q: I have an overdue payment from a client. What steps should I take?

A: Contact the client promptly and professionally, investigate the root cause, and negotiate a payment plan if necessary. Legal action may be a last resort to recover overdue payments.

Overdue Analysis In Forex Business

Conclusion

Overdue analysis in forex business is an essential aspect of maintaining financial stability and client relationships. By proactively identifying potential delays, understanding the underlying causes, and implementing robust payment processes, forex businesses can mitigate the impact of overdue payments and enhance their overall operational efficiency.

Are you ready to revolutionize your forex payment management and minimize the impact of overdue payments? Share your thoughts and experiences in the comments below to engage in a productive discussion on this critical topic.