The Intriguing World of Forex: A Journey Through Time

In the bustling metropolis of global finance, foreign exchange, or Forex, reigns supreme. It’s a dynamic realm where currencies dance in a synchronized ballet, exchanging hands across time zones. But what time is it, exactly, in this financial wonderland? Enter the fascinating world of Forex time zones.

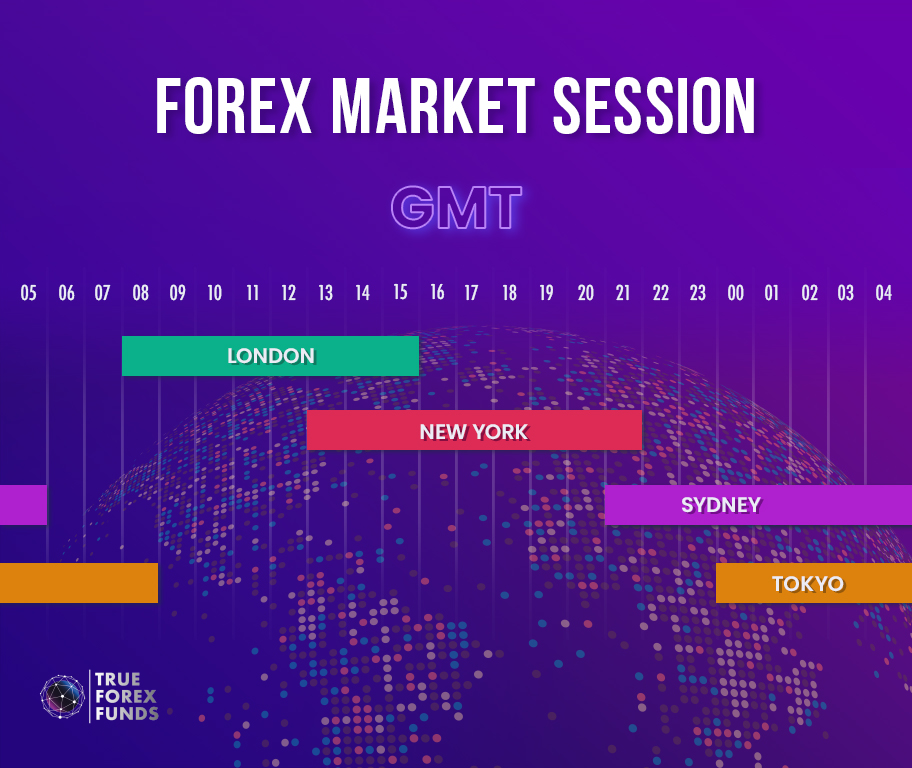

Image: trueforexfunds.com

Imagine yourself as a global trader, your desk overlooking the skyline of multiple cities. Each city pulsates with its own vibrant rhythm, dictated by the local time zone. From the bustling streets of Tokyo to the iconic skyline of London, and the vibrant financial hub of New York, the Forex market operates 24 hours a day, traversing time zones like a financial odyssey.

Navigating the Temporal Currents

The Forex market is a sea of currencies in constant flux. Traders navigate this ever-shifting landscape by adhering to a standardized set of time zones, ensuring seamless transactions and timely responses to market movements. The king of Forex time zones, and the reference point for all global trading activities, is the Coordinated Universal Time (UTC).

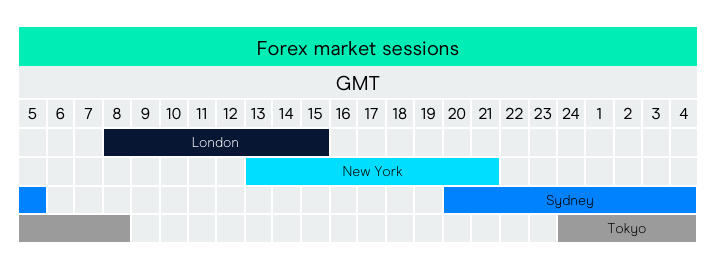

UTC, often referred to as Greenwich Mean Time (GMT), is the foundation upon which Forex operates. It serves as the benchmark against which all other time zones are measured. When it’s midnight in London under GMT, for example, it’s 7 pm in New York (GMT-5), and 1 pm in Sydney (GMT+11).

Global Forex Hubs and Their Time Zones:

- London: GMT (UTC)

- New York: GMT-5

- Tokyo: GMT+9

- Sydney: GMT+11

- Frankfurt: GMT+1

- Paris: GMT+1

Trading with the Sun: The Overlap Advantage

As the sun rises and sets across the globe, the Forex market follows a captivating dance, with each time zone playing its part. When the trading day begins in Tokyo, the market in London is winding down, creating an overlap period where liquidity surges. This overlap offers traders ample opportunities to capitalize on market movements spanning different regions.

For instance, a trader in New York can monitor market sentiment in Tokyo during the overlap hours and make informed decisions based on both Eastern and Western market dynamics. The global Forex network ensures that there is always a vibrant hub of activity, regardless of the time of day.

The Time-Sensitive Nature of Forex

Understanding time zones is crucial in Forex trading. Currency pairs fluctuate in value throughout the day, influenced by economic data releases, geopolitical events, and market sentiment. Timing is everything, and traders must be aware of the impact that time zones can have on their strategies.

For example, if a major economic report is released in the United States at 8:30 am EST (GMT-5), the market will likely react swiftly. Traders in London, who are 5 hours ahead (GMT), would experience the market impact at 1:30 pm. By understanding the time zone differences, traders can anticipate market movements and position themselves accordingly.

Image: howtotradeonforex.github.io

Mastering the Temporal Landscape: Tips for Traders

Harnessing the power of Forex time zones requires a strategic approach:

- Plan your trading schedule: Determine the optimal trading hours based on your time zone and target markets.

- Monitor multiple time zones: Keep abreast of market movements across key trading hubs.

- Utilize trading platforms with time zone capabilities: Choose platforms that display time zones and allow for real-time monitoring.

- Stay informed about economic events: Track economic data releases and geopolitical events that can impact currency values.

- Consider time zone shifts: Be aware of daylight saving time changes and adjust your trading schedule accordingly.

By mastering the intricacies of Forex time zones, traders gain a significant advantage in navigating the global financial landscape. They can identify trading opportunities, manage risk, and optimize their strategies to achieve their financial goals.

What Time Zone Is It Trading Forex

Conclusion: Embracing the Time-Bending World of Forex

The Forex market is a symphony of time zones, where currency flows dance to the rhythm of global events. By understanding this temporal tapestry, traders can time their trades with precision, seize opportunities as they arise, and conquer the complexities of the financial market. In the ever-fluid world of Forex, time is not merely a measure; it’s a strategic tool, a key to unlocking the realm of financial possibilities.