Understanding Lot Sizes and Their Importance

Have you ever wondered how much risk you’re taking on with each trade you place? Or how many pips you need to profit from a trade? Understanding lot sizes is crucial for any forex trader, as it directly impacts your potential profit and loss. The right lot size allows you to manage your risk effectively and maximize your trading potential. But navigating the complexity of lot sizes can be daunting, especially for beginners.

Image: www.atfx.com

This is where an MT4 lot size calculator comes in handy. It’s a powerful tool that simplifies the process of determining the appropriate lot size for your trades. By inputting your account balance, risk tolerance, and other relevant details, you can quickly calculate the optimal lot size for your trading style and desired risk level.

What is an MT4 Lot Size Calculator?

Definition and Function of the Calculator

An MT4 lot size calculator is a software tool specifically designed for MetaTrader 4 (MT4) platform users. It helps traders determine the optimal lot size for their trades based on factors like their account balance, risk appetite, and entry/exit points. This tool is essential for managing risk and controlling potential losses while maximizing profit opportunities.

Benefits of Using a Lot Size Calculator

Using an MT4 lot size calculator offers several significant benefits:

- Precise Lot Size Calculation: The calculator ensures accuracy in determining the lot size, eliminating guesswork and manual calculations.

- Risk Management: Calculators help manage risk by allowing traders to set their desired risk percentage per trade, preventing excessive losses due to wrong lot size selection.

- Profit Optimization: By determining the optimal lot size, traders can maximize their profits while staying within their acceptable risk tolerance.

- Time Efficiency: Calculators expedite the process of calculating the lot size, saving time for traders to focus on other aspects of their trading strategy.

- Increased Confidence: Using a lot size calculator boosts confidence by providing traders with a concrete basis for their trade sizing decisions.

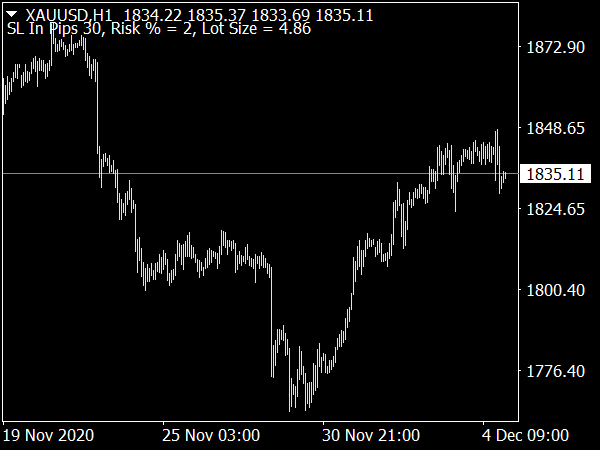

Image: www.best-metatrader-indicators.com

How to Use an MT4 Lot Size Calculator

Steps Involved in Calculating Lot Size

Most MT4 lot size calculators work on a similar principle, requiring you to input certain details:

- Account Balance: Enter your current account balance in the calculator.

- Risk Percentage: Specify your desired risk percentage per trade, typically between 1% and 5%.

- Stop-Loss Distance: Input the distance in pips between your entry point and your stop-loss order.

- Currency Pair: Select the currency pair you are trading.

Once you enter these details, the calculator will automatically calculate the optimal lot size based on your input. It will also show you the potential profit and loss for that trade using the calculated lot size. The calculator provides a clear picture of the potential financial implications of your trading decisions before you even place the order.

Types of MT4 Lot Size Calculators

Standalone Calculators

Standalone calculators are websites or downloadable software applications specifically designed to calculate lot sizes. They often offer advanced features like the ability to save your preferred settings, perform historical calculations, and even integrate with your MT4 platform.

Calculator Plugins

Some MT4 lot size calculators are available as plugins that can be directly integrated into your MT4 platform. These plugins offer the convenience of having the calculations performed directly within your trading environment. They often provide real-time updates based on current market conditions and your open trades.

Tips and Expert Advice on Using the Calculator

Start with a Small Risk Percentage

It’s always advisable to start with a smaller risk percentage, such as 1% or 2%, especially when you’re new to forex trading. This allows you to gradually build your experience and confidence in trading with different lot sizes.

Adjust the Calculator Settings Regularly

Market conditions are constantly changing, so it’s essential to adjust the calculator settings regularly based on your current account balance, risk appetite, and trading strategy. Don’t rely on a fixed lot size regardless of these factors.

Consider Your Trading Style

Different trading styles require different lot sizes. Scalpers tend to use smaller lot sizes due to their frequent trading, while swing traders might opt for larger lot sizes for holding positions over longer periods.

FAQ

Q: What is the difference between a standard lot and a mini lot?

A: A standard lot is 100,000 units of the base currency, while a mini lot is 10,000 units. The lot size affects the trade’s value and potential profit or loss.

Q: Does the lot size affect my trading commissions?

A: Yes, trading commissions are often calculated based on the lot size. Larger lot sizes usually attract higher commissions.

Q: How can I improve my risk management when using a lot size calculator?

A: Start with a small risk percentage, implement a stop-loss order for each trade, and adjust your lot size based on market conditions and your risk tolerance.

Mt4 Lot Size Calculator

Conclusion

An MT4 lot size calculator is an invaluable tool for any forex trader, helping them manage risk effectively and optimize their profit potential. By understanding the importance of lot sizes and using a calculator to determine the optimal trade size, you can embark on a more confident and successful trading journey. Have you found this article helpful? If so, share this with your fellow traders and let’s continue the conversation on risk management in forex trading!