In the ever-evolving world of forex, pips – the smallest price increment in a currency pair – hold immense significance. For traders, accurately calculating pips is crucial to determining their profits or losses. This comprehensive guide will delve into the intricacies of the forex pips calculator, empowering you with the knowledge and skills to maximize your trading potential.

Image: www.getknowtrading.com

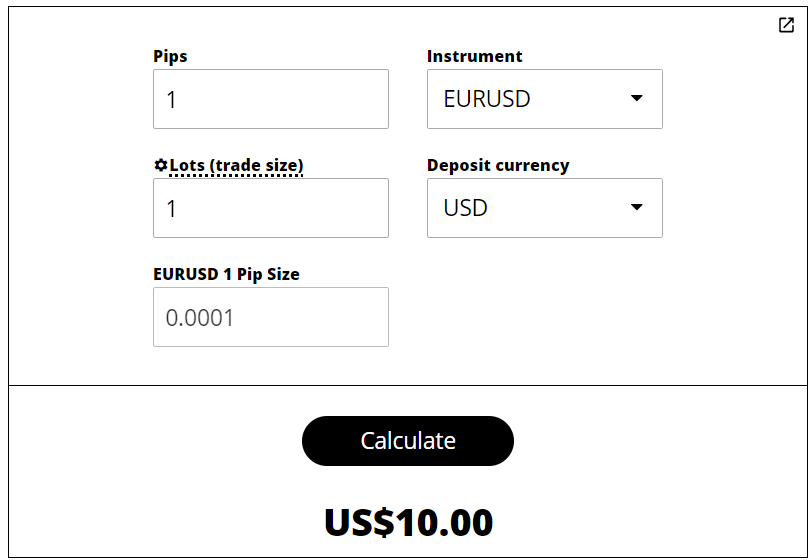

The Pips Calculator: A Forex Trader’s Essential Tool

Imagine a surgical scalpel in the hands of a skilled surgeon. The pips calculator serves a similar purpose for forex traders, enabling them to dissect minute price changes with unparalleled precision. At its core, the pips calculator measures the difference between two currency prices, eliminating the need for complex manual calculations. By using real-time data, this indispensable tool provides traders with instant information on potential profits or losses associated with each trade.

Navigating the Pips Calculator: A Step-by-Step Guide

Stepping into the realm of pips calculations can seem daunting, but our step-by-step guide will equip you with the confidence to master this vital skill:

-

Identify the Currency Pair: The pips calculator requires you to specify the currency pair you’re trading. This determines the number of pips per point of movement.

-

Input the Contract Size: Represent the amount of currency you’re trading in the lot size or contract size field. This number directly impacts the pips value.

-

Calculate the Pips: Using the formula (Current Price – Entry Price) x Pip Value, you can determine the number of pips gained or lost on your trade.

Decoding the Pips Calculator Results

The pips calculator offers more than just a numerical value; it provides valuable insights into your potential profitability. A positive pips value indicates a gain, while a negative value signifies a loss. By understanding these results, you can make informed decisions and adjust your trading strategies accordingly.

Image: forexscalpingforum.blogspot.com

Example: Making Pips Calculations a Reality

Let’s put the pips calculator to the test with a real-life example. Suppose you’re trading the EUR/USD currency pair with a contract size of 100,000 units. The current price is 1.12500, and your entry price was 1.12450. Using the pips calculator, you can determine your potential profit or loss:

(1.12500 – 1.12450) x 10 = 5 pips

In this case, you’ve gained 5 pips on your trade. By multiplying this value by the contract size (100,000), you ascertain the total profit:

5 pips x $100,000 = $500

Optimizing Pips Calculations for Profitability

Maximize the accuracy and utility of your pips calculations with these expert tips:

-

Choose a Reputable Calculator: Utilize a reliable and reputable pips calculator that offers accurate results and up-to-date currency data.

-

Consider Spread Costs: The bid-ask spread is an additional cost to consider when calculating pips. Subtract the spread from your pips calculation to arrive at a more precise profit/loss estimate.

-

Monitor Currency Movements: Stay informed about market conditions and track currency fluctuations to make informed trading decisions. Live currency charts and news updates are valuable tools for this purpose.

-

Manage Leverage: Leverage can amplify your potential profits, but it also carries increased risk. Use leverage prudently and in accordance with your trading strategy.

Forex Pips Calculator

Conclusion: Pips Calculations – The Key to Forex Success

Mastering pips calculations is an essential component of successful forex trading. The pips calculator provides indispensable real-time data and insights, enabling traders to optimize their trading strategies, minimize risk, and maximize profits. By adhering to our comprehensive guide and utilizing the tips provided, you can leverage the power of pips calculations to unlock your full potential as a forex trader. Embrace the precision and accuracy of the pips calculator, and open the door to greater trading success.