In the dynamic world of forex trading, where currencies ebb and flow like the tide, a deep understanding of market movements is the key to success. Among the many technical indicators that traders utilize, knowing the mean moment of various forex pairs can provide a valuable advantage. Join us as we delve into the world of all forex pairs average moment, exploring its significance and unlocking its potential for profitable trades.

Image: www.pinterest.com

What is Mean Moment?

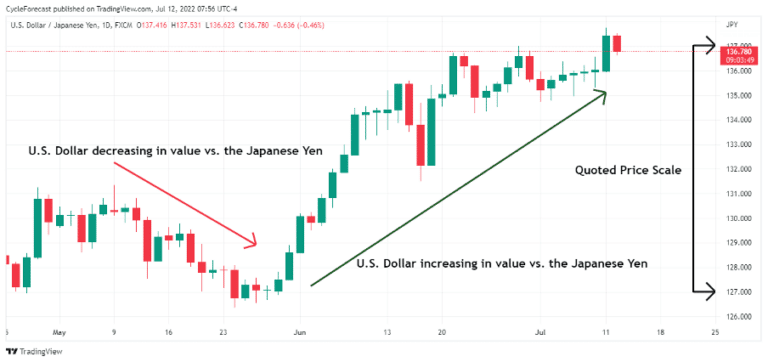

Mean moment, also known as average true range, is a technical indicator that measures the average range of price fluctuations over a specified period. It quantifies the volatility of a currency pair, indicating the amount of price movement traders can expect. A high mean moment suggests a volatile pair, while a low mean moment indicates relative stability.

Understanding Mean Moment in Forex Pairs

Knowing the mean moment of forex pairs is crucial for several reasons. Firstly, it helps traders determine the appropriate stop-loss levels. A higher mean moment necessitates a wider stop-loss to accommodate potential price swings, while a lower mean moment allows for tighter stop-losses, reducing risk.

Secondly, mean moment assists in risk management. Traders can adjust their position size based on the volatility of the pair they’re trading. A volatile pair calls for smaller position sizes to mitigate risk, while a less volatile pair allows for larger positions. This ensures that traders don’t overextend themselves and minimize potential losses.

Latest Trends and Developments

The forex market is constantly evolving, and the mean moment of currency pairs is no exception. Recent trends have shown a shift towards increased volatility across major pairs. This is attributed to factors such as geopolitical uncertainties, economic data releases, and central bank actions.

To stay abreast of these changing conditions, traders should monitor economic calendars, news sources, and social media platforms to identify potential catalysts for market volatility. By keeping up-to-date with the latest developments, traders can make informed decisions and adjust their strategies accordingly.

Image: www.forextraders.com

Tips for Using Mean Moment in Trading

Incorporating mean moment into your trading strategy can enhance your profitability. Here are some expert tips:

- Consider mean moment when setting stop-loss and take-profit levels.

- Adjust position size based on the volatility of the pair being traded.

- Monitor mean moment over time to identify changes in volatility patterns.

By applying these tips, traders can gain a deeper understanding of market conditions and make more informed trading decisions.

FAQs

Q: What is the mean moment of a forex pair?

A: Mean moment measures the average range of price fluctuations over a specified period, indicating the volatility of a currency pair.

Q: Why is mean moment important in forex trading?

A: Mean moment guides traders in setting appropriate stop-loss levels, managing risk, and determining position size.

Q: How do I calculate the mean moment?

A: Calculating mean moment requires technical software or online platforms that provide historical data. Formula: Mean Moment = (n-1)^-1 * Σ(TRi/n), where TRi is the True Range for period i and n is the number of periods.

All Forex Pairs Average Moment

https://youtube.com/watch?v=dBxhXVZC7oE

Conclusion

Mastering the mean moment of all forex pairs empowers traders with a valuable tool for navigating the dynamic forex market. By understanding its significance, monitoring trends, and applying expert tips, traders can enhance their strategies, mitigate risk, and maximize their potential for profitable trades. Are you ready to unlock the secrets of forex pair mean moments and elevate your trading game?