The thrill of forex trading is undeniable. The potential for substantial profits, the rapid pace of the market, and the feeling of being in control of your financial destiny are just some of the factors that draw people in. But beneath this exciting surface lies a harsh reality: forex trading is inherently risky. Without a robust strategy and disciplined money management, even the most skilled traders can find themselves on a precarious path. This is where the forex money management calculator steps in as your unwavering companion, providing the tools to navigate the treacherous waters of forex trading with confidence.

Image: allaboutforexs.blogspot.com

Imagine yourself staring at your computer screen, heart thrumming as the forex market fluctuates wildly. You’re tempted to jump in, to chase those fleeting profits, but a voice within whispers a word of caution: “What if I lose everything?” This is the dilemma that every forex trader faces. The allure of quick riches can easily overshadow the importance of careful planning, but the difference between realizing your trading dreams and losing everything can hinge on just one factor: money management. This is where a forex money management calculator becomes your silent guardian, your ally in securing a sustainable and profitable trading future.

Understanding Your Forex Money Management Calculator: The Foundation of Success

A forex money management calculator is more than just a simple tool; it’s a vital component of your trading arsenal. At its core, it helps you determine your optimal risk exposure and allocate your trading capital strategically. Think of it as a roadmap for navigating the forex market, ensuring you don’t lose your way and end up stranded on the wrong side of a trade.

The Power of Risk Management: Why Your Money Management Calculator Matters

The forex market is constantly in motion, fueled by a myriad of economic, political, and social factors. This volatility, while exciting for some, can be a recipe for disaster for those who lack a solid money management framework. A forex money management calculator helps you define and control your risk by:

- Calculating Your Optimal Position Size: It takes into account your trading capital, your desired risk percentage, and the volatility of the currency pair you’re trading to determine the appropriate lot size for your trade. This ensures you don’t risk more than you can afford to lose.

- Defining Stop-Loss Levels: These are crucial safety nets in your trading strategy. Your money management calculator can help you determine where to place your stop-loss orders based on your risk tolerance and the current market conditions.

- Managing Drawdowns: Drawdowns are inevitable in trading, but they can be mitigated with a disciplined approach. Your money management calculator helps you calculate the maximum potential drawdown you can withstand, ensuring you don’t get swept away by market turbulence.

Beyond Risk Management: The Multifaceted Benefits of a Money Management Calculator

While risk management is the cornerstone of a money management calculator, its benefits extend beyond just mitigating losses. By using a forex money management calculator, you can:

- Optimize Profit Potential: Efficiently allocating your capital and managing risk allows you to maximize your profit potential by trading the right size positions in the right markets.

- Gain Clarity and Discipline: The calculator brings structure and discipline to your trading approach, helping you avoid impulsive decisions and stick to your predefined trading plan.

- Measure Your Progress: By tracking your trading activity and performance within your money management calculator, you gain valuable insights into your strengths and weaknesses, allowing you to refine your strategy and improve your trading efficiency over time.

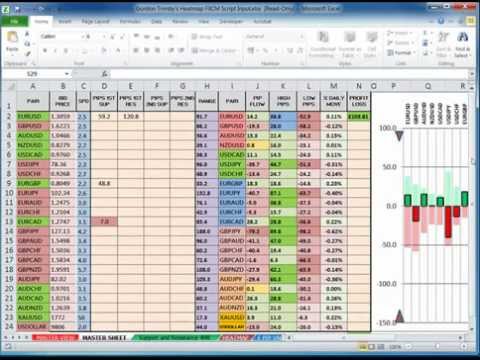

Image: www.forexracer.com

Unlocking the Power of Different Money Management Strategies: A Versatile Tool

The beauty of a forex money management calculator lies in its flexibility. It can be tailored to accommodate various money management strategies, each with its own unique advantages:

- Fixed Fractional Risk: This strategy involves allocating a fixed percentage of your capital to each trade, regardless of market volatility. It provides consistent risk exposure and is suitable for traders seeking stability.

- Fixed Lot Size: This approach involves trading a predetermined lot size for all your trades. It offers a simple and structured approach, particularly beneficial for beginners.

- Martingale System: While this strategy is controversial due to its potential for significant losses, it’s worth noting that some forex money management calculators can incorporate it, allowing you to experiment with different trading methodologies.

Beyond the Calculator: Implementing Your Strategy for Success

Armed with your forex money management calculator, you now have the tools to navigate the forex market, but the true power lies in implementing your strategy with discipline and consistency. Here are some expert tips to maximize your success:

- Know Your Risk Tolerance: Honestly assess your risk tolerance and ensure it aligns with your financial goals and capacity for loss.

- Develop a Trading Plan: A well-defined trading plan, outlining your entry and exit points, risk management rules, and trading strategy, is essential for consistency and discipline.

- Backtest Your Strategy: Before deploying your strategy live, backtest it using historical market data to assess its performance and identify potential weaknesses.

Forex Money Management Calculator

https://youtube.com/watch?v=Al4vzcbblhc

Conclusion: Mastering the Art of Forex Money Management

A forex money management calculator is your indispensable companion on your trading journey. It empowers you to make informed decisions, control risk, and maximize your profit potential. By embracing its power and implementing it with discipline, you pave the way for a successful and sustainable trading future. So, take the first step today – explore the diverse range of forex money management calculators available and find the one that aligns perfectly with your unique trading style. Remember, with the right tools and a steadfast commitment to disciplined trading, you can unlock the true potential of the forex market and emerge as a confident and successful trader.