Introduction

In the ever-evolving and often daunting world of forex trading, understanding the various concepts and terms is crucial for achieving success. Among these fundamental concepts is “position,” which plays a pivotal role in determining your trading strategy and managing risk effectively. This comprehensive guide will delve into the intricacies of position meaning, empowering you with the knowledge to navigate the forex market with confidence.

Image: forexleaderboard.com

Understanding Position in Forex

A position in forex trading refers to an open trade where you have bought or sold a currency pair. Essentially, it represents your obligations and exposures in the market. When you buy a currency pair, you are going long, while selling a currency pair signifies going short. Each position carries its own unique set of risks and potential rewards.

Long Positions

When you go long on a currency pair, you are speculating that the value of the base currency will appreciate against the quote currency. For instance, if you buy EUR/USD, you are essentially expressing a bullish sentiment towards the euro and expecting it to strengthen relative to the US dollar.

Short Positions

Conversely, going short on a currency pair indicates that you anticipate the base currency to depreciate in value against the quote currency. If you sell GBP/JPY, you are betting on the British pound to weaken against the Japanese yen.

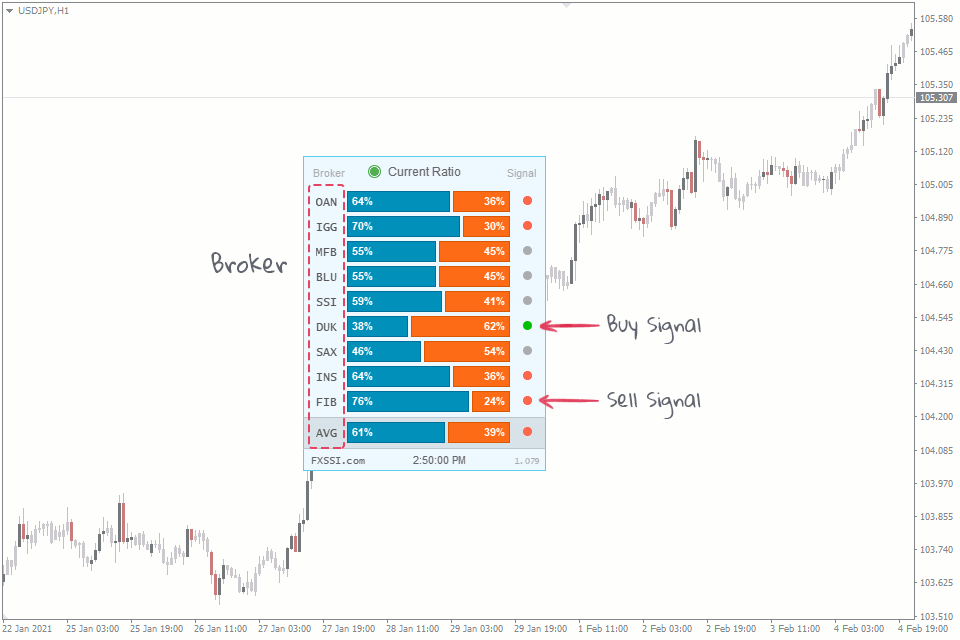

Image: fxssi.com

Hedging with Opposing Positions

Traders often use hedging strategies to manage risk by taking opposing positions on the same currency pair. For example, you could buy a small amount of EUR/USD while simultaneously selling a larger amount of EUR/USD. This technique aims to reduce the potential losses from either position by offsetting their exposure.

Closing Positions

To close a position, you need to execute an opposite trade. If you bought EUR/USD, you would close the position by selling an equal amount of EUR/USD. The difference between your opening price and closing price determines your profit or loss on that trade.

Importance of Position Sizing

Position sizing is an essential aspect of forex trading, as it dictates how much risk you are willing to accept on each trade. The appropriate position size for you will depend on your trading strategy, risk tolerance, and account balance. It is crucial to strike a balance between potential rewards and calculated risks.

Expert Insights

“Position management is the key to successful forex trading,” says renowned trader George Soros. “Controlling your exposure and risk is paramount, as even small fluctuations in currency prices can have significant impacts on your account.”

“Understanding the meaning of position and its implications is fundamental for navigating the forex market,” adds seasoned analyst Carlo Alberto De Casa. “Traders must be well-versed in concepts like going long, going short, and hedging to make informed trading decisions.”

Meaning Of Position In Forex

Call to Action

Empower yourself with the knowledge of position meaning in forex trading. Delve into the resources available, consult with experienced traders, and practice diligently. By mastering this essential concept, you can enhance your trading skills, manage risk effectively, and improve your chances of achieving success in the forex market.