Delving into the Indian Forex Market: A Crucible of Global Currency Exchange

The Indian forex market, a vibrant hub of currency trading, serves as a nexus for individuals, corporations, and financial institutions to exchange currencies and manage foreign exchange risk.

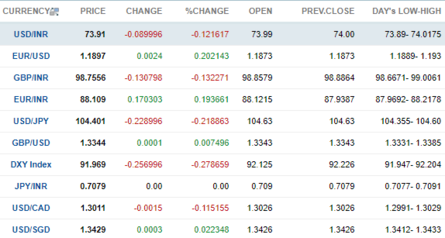

Image: economictimes.indiatimes.com

Navigating the Indian forex market requires an understanding of the major currencies that drive its activity. In this comprehensive exploration, we unveil the key currencies that shape the Indian forex landscape and analyze their significance in international trade and investment.

Currencies Center Stage: A Glimpse into the Indian Forex Market

The Indian rupee (INR) stands tall as the bedrock of the Indian forex market. Not only does it facilitate domestic transactions, but it also plays a vital role in international trade and investment.

The US dollar (USD), an undisputed global powerhouse, maintains a strong presence in the Indian forex market. Its dominance stems from its status as the world’s reserve currency, facilitating international trade and serving as a benchmark for currency valuations.

Other currencies, such as the British pound sterling (GBP), the Euro (EUR), the Japanese yen (JPY), and the Swiss franc (CHF), also make their mark on the Indian forex market. These currencies serve as significant conduits for international trade and investment.

Dynamics Shaping the Forex Market: Unraveling the Interplay of Forces

The dynamics of the Indian forex market are shaped by a multitude of factors, including economic indicators, global economic events, political developments, and central bank policies. These factors influence the demand and supply of currencies, causing fluctuations in their exchange rates.

Economic indicators, such as gross domestic product (GDP) growth, inflation, interest rates, and trade balance, provide insights into the health of the Indian economy and impact the demand for INR. Global economic events, such as changes in global interest rates or geopolitical tensions, can also trigger currency fluctuations.

Political developments can impact the forex market by altering investor sentiment and affecting the perceived risk associated with certain currencies. Central bank policies, particularly those related to interest rates and monetary policy, can influence currency exchange rates by altering the attractiveness of a particular currency for investors.

Riding the Waves: Harnessing Forex Market Trends for Advantage

Keeping abreast of the latest trends and developments in the Indian forex market is crucial for investors and traders seeking to navigate its complexities. Industry experts and analysts provide valuable insights through updates, news sources, forums, and social media platforms.

Monitoring market trends can enable investors to identify opportunities and mitigate risks. By understanding the factors influencing currency exchange rates, investors can make informed decisions about buying, selling, or holding currencies.

Image: sambadenglish.com

Tips and Expert Advice: Empowering Informed Decisions in the Forex Market

Embarking on an educational journey in the Indian forex market empowers investors with the knowledge and skills to make informed decisions. Here are some tips and expert advice to guide your foray into the realm of currency trading:

1. Conduct thorough research: Delve into the fundamentals of forex trading, including currency exchange rates, market dynamics, and risk management strategies.

2. Choose a reliable broker: Partner with a reputable forex broker that offers competitive spreads, low commissions, and a user-friendly platform.

3. Master risk management: Implement robust risk management strategies to protect your capital, including setting stop-loss orders and managing your leverage.

4. Stay adaptable: The forex market is ever-evolving. Be prepared to adjust your strategies and adapt to changing market conditions.

FAQs: Demystifying Common Questions about the Indian Forex Market

Q: What is the minimum investment required for forex trading?

A: The minimum investment varies depending on the broker you choose. Generally, a small amount of capital can suffice to get started.

Q: Can I make profits by trading forex?

A: Yes, potential profits can be made through forex trading, but it’s essential to acknowledge the risks involved and approach trading with a well-informed strategy.

Q: What is the best time to trade forex?

A: The optimal time to trade forex depends on your trading strategy and the currency pairs you wish to trade. Researching the trading hours of different markets can help you make informed decisions.

Major Currencies In Indian Forex Market

https://youtube.com/watch?v=m6PFSKV2Kw0

Conclusion: Unveiling the Gates to Forex Market Success

The Indian forex market presents a vast and dynamic landscape for investors and traders seeking to engage in currency exchange. Understanding the major currencies, market dynamics, and expert advice can empower you to navigate the complexities of the forex market effectively.

Embark on this educational journey, stay informed about industry trends, and implement robust risk management strategies. The Indian forex market beckons, offering the potential for both learning and financial success. Are you ready to explore the world of currency trading?