In the intricate web of global finance, interbank rates stand as a cornerstone that shapes currency exchange and financial stability. As an industry insider for over a decade, I’ve witnessed firsthand the profound impact these rates have on the foreign exchange market and beyond.

Image: bunsis.blogspot.com

Imagine you need to send money to a business partner in Europe. The amount you’ll receive in euros depends not only on the prevailing market rate but also on the interbank rate – the rate at which banks lend to each other. This rate often differs from the published market rate, acting as a hidden force that can sway your transaction’s outcome.

Understanding the Essence of Interbank Rates

Interbank rates form the backbone of the global foreign exchange market, acting as the benchmark for transactions between banks. When a bank needs liquidity in another currency, it turns to its peers for a short-term loan. The interest rate charged on this loan becomes the interbank rate.

These rates fluctuate constantly, driven by a myriad of factors, including supply and demand for currencies, interest rates, and economic outlook. Understanding these dynamics is crucial for traders, investors, and anyone who deals with cross-border payments.

A Deeper Exploration: The Significance of Interbank Rates

- Cross-Border Transactions: Interbank rates directly impact the costs and profits of cross-border payments. Higher interbank rates lead to higher spreads between the buying and selling prices of currencies.

- Currency Speculation: Traders often speculate on changes in interbank rates to make profitable bets on currency movements.

- Economic Indicators: Interbank rates provide valuable insights into the health of an economy’s financial system and the confidence of banks in lending to each other.

Unveiling the Trends: Latest Developments in Interbank Rates

The foreign exchange market is perpetually evolving, and so too are interbank rates. Recent trends reveal the following insights:

- Rise of Electronic Platforms: Electronic trading platforms have increased transparency and efficiency, narrowing spreads and reducing discrepancies between interbank rates and market rates.

- Increased Volatility: Geopolitical events, economic shocks, and technological advancements have fueled volatility in interbank rates, creating both opportunities and risks for traders.

- Central Bank Intervention: Central banks actively intervene in foreign exchange markets to influence interbank rates and stabilize currencies during times of stress.

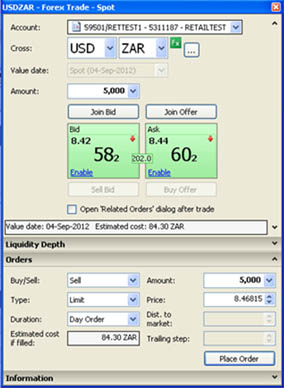

Image: webtrading.standardbank.com

Expert Tips and Advice for Navigating Interbank Rates

As an experienced blogger, I’ve encountered invaluable advice from experts in the field. Here are some tips to help you make informed decisions:

- Research interbank rates: Stay up-to-date with the latest rates and factors influencing them.

- Consider using a forex broker: Brokers often offer competitive interbank rates and can assist with complex transactions.

- Protect against fluctuations: Hedge your currency exposure using forwards or options to mitigate risks.

By adhering to these tips, you can optimize your foreign exchange transactions, mitigate risks, and gain a competitive edge in global financial markets.

Frequently Asked Questions on Interbank Rates

- What is the difference between interbank rates and market rates?

Interbank rates are the rates at which banks lend to each other, while market rates are the rates at which currencies are bought and sold on the forex market. Interbank rates are often slightly lower than market rates.

- How do interest rates affect interbank rates?

Interest rates play a significant role in determining interbank rates. Higher interest rates lead to higher interbank rates, as banks are more inclined to lend to each other at higher rates.

- What are the factors that influence interbank rates?

Supply and demand for currencies, interest rates, economic outlook, political events, and central bank intervention are among the factors that shape interbank rates.

Inter Bank Rate In Forex

Conclusion

Interbank rates are a vital component of global finance, influencing everything from cross-border payments to international trade. By understanding their dynamics, you can effectively navigate foreign exchange transactions, make informed investment decisions, and gain a deeper appreciation of the complexities of global economic interconnections.

Are you ready to delve further into the fascinating world of interbank rates? Embrace the opportunity to enhance your knowledge and explore how these rates impact your financial endeavors. The journey of discovery awaits – embark upon it today!