Introduction: Navigating the Forex Labyrinth with Precision

In the dynamic and ever-evolving realm of foreign exchange (forex), impeccable internal audit practices stand as the bedrock of trust, transparency, and sustainable growth. As a forex company, meticulously scrutinizing your operations and finances through regular internal audits is not merely an option; it’s a necessity. To empower you in this vital endeavor, we present the definitive checklist, a roadmap to enhance your audit effectiveness and elevate your forex enterprise.

Image: tomorrowdisaster33.gitlab.io

Sections of the Internal Audit Checklist

1. Governance and Risk Management

– Assess the adequacy and effectiveness of the company’s governance structure and risk management framework.

– Review compliance with regulatory requirements and industry best practices.

– Evaluate the management of conflicts of interest and insider trading.

2. Financial Reporting

– Ensure the accuracy and completeness of financial statements.

– Test the effectiveness of internal controls over financial reporting.

– Verify the adherence to accounting principles and regulations.

Image: www.pinterest.co.kr

3. Trading Operations

– Review trading activities, including order execution, settlement, and risk management.

– Assess the adequacy of trading strategies and risk appetite.

– Evaluate the performance and effectiveness of trading platforms.

4. Operations and Compliance

– Examine business processes for efficiency and adherence to internal policies.

– Ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

– Evaluate the adequacy of IT systems and cybersecurity measures.

5. Legal and Regulatory Compliance

– Review compliance with applicable laws and regulations in all jurisdictions of operation.

– Assess the effectiveness of legal and compliance training programs.

– Evaluate the management of potential legal liabilities and disputes.

Expert Insights: Enhancing Audit Effectiveness

“Internal audits are a crucial tool for identifying areas of improvement and strengthening financial controls,” emphasizes Dr. Emily Carter, a leading expert in corporate governance. “By proactively addressing weaknesses and vulnerabilities, forex companies can mitigate risks and foster a culture of ethical behavior.”

To enhance audit effectiveness, consider these actionable tips:

- Engage a reputable internal audit firm with specialized experience in the forex industry.

- Establish a clear audit plan and scope to guide the audit process.

- Provide auditors with timely access to relevant documentation and data.

- Foster a collaborative and open communication channel with the audit team.

- Regularly review and update the internal audit checklist to ensure alignment with industry standards and regulatory requirements.

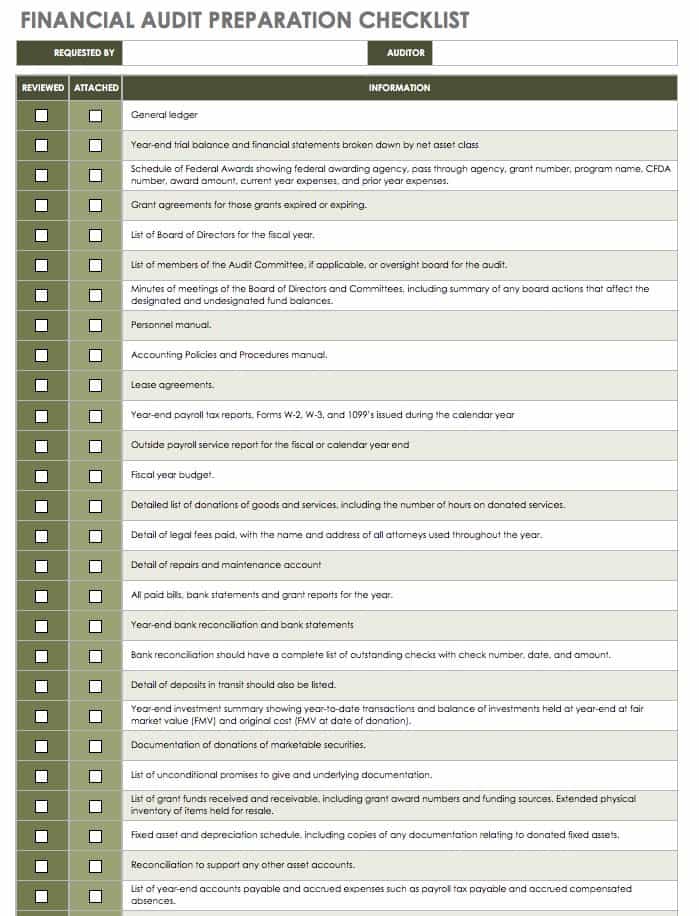

Internal Audit Checklist For Forex Company

Conclusion: The Path to Forex Excellence through Auditing

By adhering to this comprehensive internal audit checklist, forex companies can gain invaluable insights into their operations, identify potential red flags, and proactively manage risks. Embracing the unwavering spirit of transparency, accountability, and continuous improvement, forex enterprises can ascend to new heights of success in this dynamic market. Remember, the path to forex excellence hinges upon the meticulous implementation of sound internal audit practices.