As the forex market continues to expand rapidly, internal audit plays a pivotal role in safeguarding the financial integrity, reputation, and sustainability of forex brokerage firms. A comprehensive internal audit process enables companies to identify operational inefficiencies, assess risk exposure, and ensure compliance with regulatory standards and best practices. To facilitate this critical function, we have compiled an exhaustive checklist to guide internal auditors through the complexities of a forex company’s operations. By adhering to these comprehensive guidelines, auditors can effectively evaluate internal controls, identify vulnerabilities, and formulate actionable recommendations for operational and financial improvement.

Image: tomorrowdisaster33.gitlab.io

1. Scoping and Planning the Audit:

- Define the audit objectives, scope, and timeframe.

- Develop an audit plan outlining the specific areas and processes to be reviewed.

- Communicate the audit plan to relevant stakeholders, including management and staff.

2. Risk Assessment:

- Conduct a thorough risk assessment to identify potential vulnerabilities and areas of non-compliance.

- Consider key risk factors such as market volatility, liquidity, counterparty risk, and regulatory uncertainty.

- Prioritize audit focus areas based on the identified risk profile.

3. Control Evaluation:

- Review internal controls over key business processes, including order execution, settlement, risk management, and compliance.

- Assess the adequacy and effectiveness of controls in mitigating identified risks.

- Document and evaluate the control environment, including policies, procedures, and ethical standards.

Image: fadukuvo.web.fc2.com

4. Execution and Monitoring:

- Conduct fieldwork, including:

- Examining financial records and documentation.

- Interviewing key personnel.

- Performing walkthroughs and testing controls.

- Continuously monitor the effectiveness of internal controls through regular testing and review.

5. Reporting and Follow-Up:

- Prepare a comprehensive audit report summarizing findings, conclusions, and recommendations.

- Communicate audit results to management and relevant stakeholders.

- Monitor and follow up on the implementation of audit recommendations.

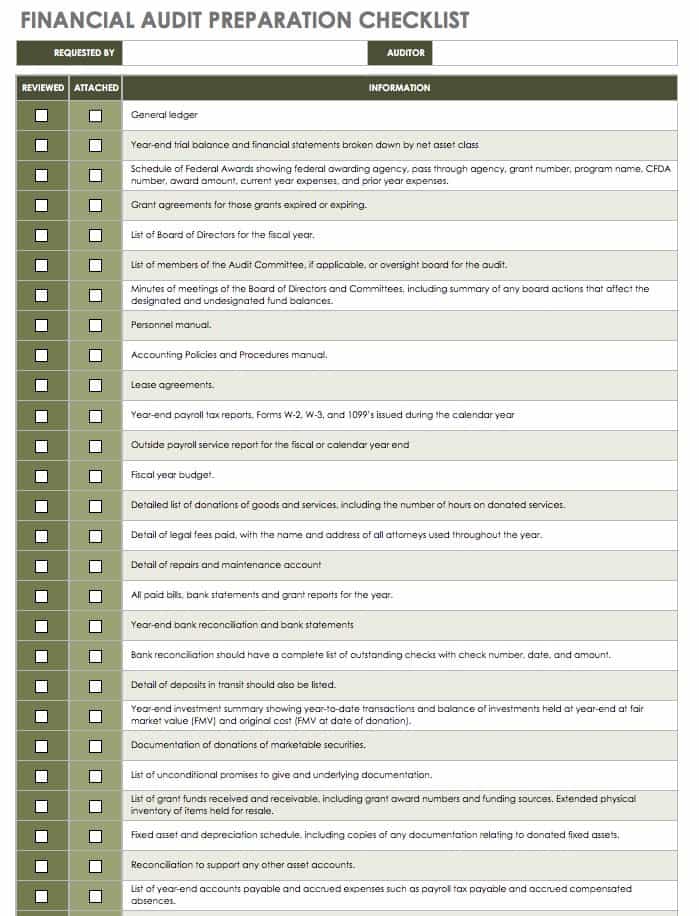

Checklist For Internal Audit Of Forex Comapnies

Conclusion:

An effective internal audit process is essential for forex companies to maintain operational integrity, mitigate risks, and enhance stakeholder confidence. By adhering to this comprehensive checklist, internal auditors can thoroughly assess internal controls, identify areas for improvement, and contribute to the overall financial health and sustainability of their organizations. Regular internal audits serve as a valuable tool for continuous monitoring and improvement, enabling forex companies to navigate the dynamic regulatory and market landscape with confidence and success.