Introduction:

In the realm of financial markets, traders often grapple with a fundamental question: is forex harder than stocks? The answer lies not in a simple yes or no, but rather in a nuanced exploration of the complexities inherent in both markets. This comprehensive guide delves into the intricacies of forex and stocks, examining their distinct characteristics, challenges, and potential rewards.

Forex vs. Stocks: Unveiling the Fundamentals

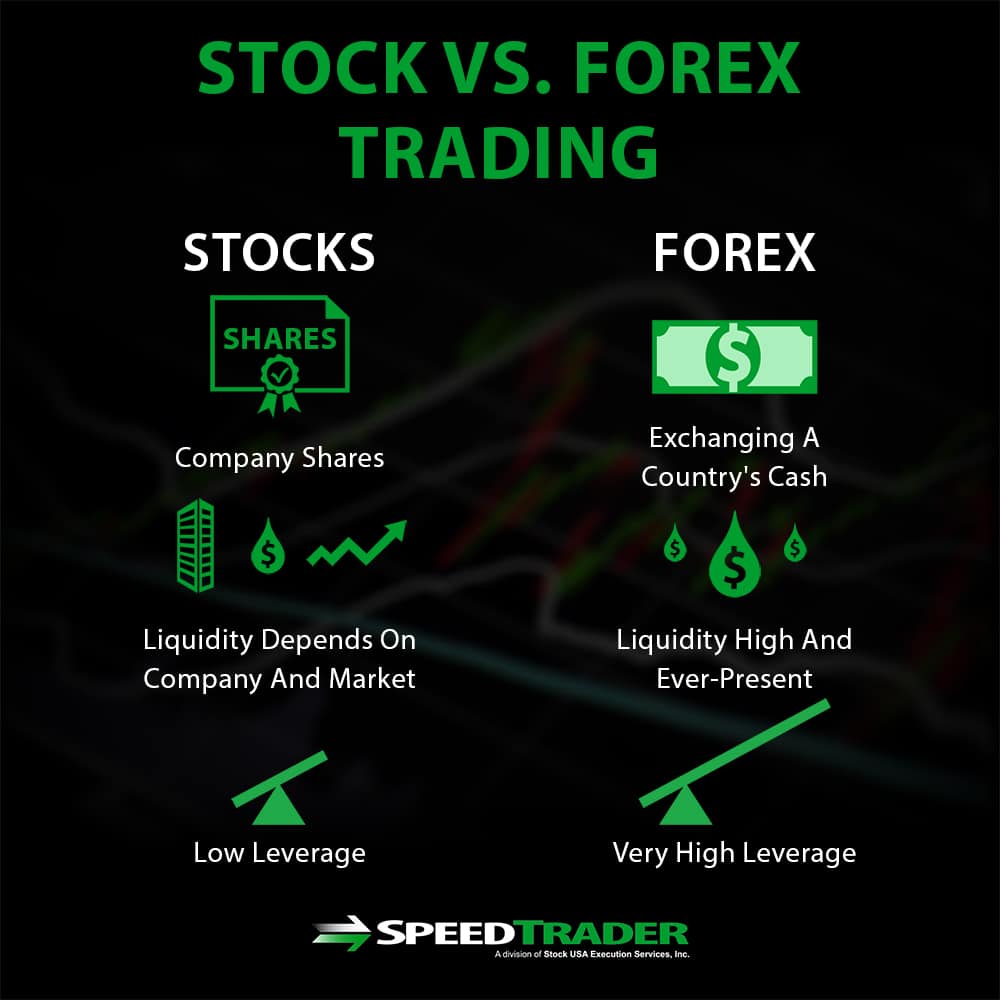

Forex (foreign exchange) involves the trading of currency pairs, representing the exchange rate between two different national currencies. Unlike stocks, which represent ownership in a company, forex trading focuses solely on the value fluctuations between currencies. The global nature of forex markets offers traders the opportunity to capitalize on international economic events and geopolitical shifts.

Stocks, on the other hand, represent equity ownership in a company. When investors buy stocks, they are essentially acquiring a portion of that company’s assets, earnings, and future prospects. Stock markets provide access to a wide range of companies across industries and sectors, offering investors the potential for growth and dividends.

Image: admiralmarkets.com

Complexity and Challenges: Navigating the Forex and Stock Markets

The complexity of forex and stocks lies in their underlying dynamics and the strategies employed by traders. Forex markets are known for their high volatility and leverage, which can amplify both profits and losses. Traders must navigate fluctuating currency exchange rates influenced by economic indicators, political events, and global news.

Stock markets, while less volatile than forex, pose their own set of challenges. Investors must evaluate company fundamentals, industry trends, and market sentiment to make informed decisions. Stock markets are also susceptible to economic downturns, company-specific risks, and geopolitical events.

Leverage and Volatility: Exploring the Impact on Risk

Leverage, the ability to borrow funds to amplify trading positions, plays a significant role in both forex and stocks. Forex markets typically offer higher leverage than stock markets, which can magnify both potential profits and losses. Traders must carefully manage leverage to avoid excessive risk and potential financial ruin.

Volatility, the extent of price fluctuations, is another key factor to consider. Forex markets are generally more volatile than stock markets due to the vast amount of currency trading that occurs daily. Traders must be prepared for sudden price swings and develop strategies to mitigate volatility risk.

Trading Strategies: Deciphering the Art of Success

Successful trading in forex and stocks requires a well-defined strategy based on sound technical and fundamental analysis. Forex traders often rely on technical indicators, chart patterns, and economic data to make trading decisions.

Stock traders may employ fundamental analysis, examining company financials, industry trends, and macroeconomic factors to assess a stock’s value and potential. Both forex and stock trading strategies should align with individual risk tolerance, investment objectives, and market knowledge.

Image: speedtrader.com

Time Commitment and Learning Curve: Embarking on the Path to Mastery

Becoming proficient in forex or stock trading demands a significant time investment and a continuous learning curve. Forex markets operate 24 hours a day, requiring traders to be available and adaptable to changing conditions.

Stock markets have defined trading hours, but traders still need to devote time to research, analysis, and monitoring their investments. Both forex and stock trading require ongoing education and market knowledge to stay ahead of the curve.

Income Potential and Risk Tolerance: Aligning Expectations with Reality

The income potential in forex and stocks varies widely depending on factors such as market conditions, trading strategy, and risk tolerance. Forex markets offer the potential for high returns but also come with significant risks.

Stock markets may provide steadier growth potential over time but are subject to market fluctuations and economic downturns. Traders must align their income expectations with their risk tolerance and financial goals to make informed trading decisions.

Choosing Between Forex and Stocks: A Journey of Self-Discovery

Determining whether forex is harder than stocks is ultimately a personal choice that hinges on an individual’s risk appetite, time commitment, and trading style. Forex trading demands a higher level of expertise, risk tolerance, and constant vigilance due to its fast-paced, volatile nature.

Stock trading may suit investors seeking a more stable investment horizon and lower volatility. However, it still requires market knowledge, fundamental analysis skills, and ongoing monitoring.

Is Forex Harder Than Stocks

Conclusion: Empowering Traders with Knowledge and Confidence

Understanding the intricacies of forex and stocks is crucial for traders seeking success in the financial markets. Forex, with its high volatility and leverage, presents challenges and opportunities that require a deep understanding and disciplined approach. Stocks offer a wider range of investment options and potential for growth but come with their own set of risks.

By thoroughly exploring the complexities of both forex and stocks, traders can make informed decisions that align with their individual circumstances and financial goals. The journey to trading mastery entails continuous learning, prudent risk management, and a deep understanding of the markets. Embracing the complexities of forex and stocks with an open mind and a thirst for knowledge empowers traders to navigate the financial landscape with confidence and potential for success.