How to Effortlessly Transfer Funds from Forex to Your DBS Singapore Account

Image: www.dbs.com.sg

Introduction

Managing your finances across borders can be a daunting task. With the rise of forex trading and increased globalization, the need for seamless money transfers between different currencies and accounts has become crucial. In this comprehensive guide, we will navigate the intricacies of transferring funds from your forex account to your DBS Singapore account, empowering you to execute these transactions with confidence and ease.

Understanding Forex and DBS Singapore

Forex, short for foreign exchange, is the global marketplace where currencies are traded. When you participate in forex trading, you speculate on the rise or fall of currency values. On the other hand, DBS Singapore, a leading financial institution in Southeast Asia, provides a wide range of banking services, including the ability to hold multiple currency accounts. Linking your forex account with your DBS Singapore account allows you to conveniently manage your forex gains and utilize them as needed.

Step-by-Step Guide to Fund Transfer

-

Choose a Reputable Forex Broker: The first step is to select a trusted forex broker that supports withdrawals to DBS Singapore accounts. Look for brokers with a proven track record, favorable exchange rates, and low transfer fees.

-

Set Up Your DBS Singapore Account: Ensure you have a valid DBS Singapore account linked to your NRIC or FIN. Your account must have a compatible currency for receiving funds from your forex account.

-

Initiate the Withdrawal: Log in to your forex broker’s platform and navigate to the withdrawal section. Select DBS Singapore as your withdrawal method and enter the necessary account details.

-

Input the Transfer Amount: Specify the amount you wish to transfer. Consider both the exchange rate and any applicable transfer fees.

-

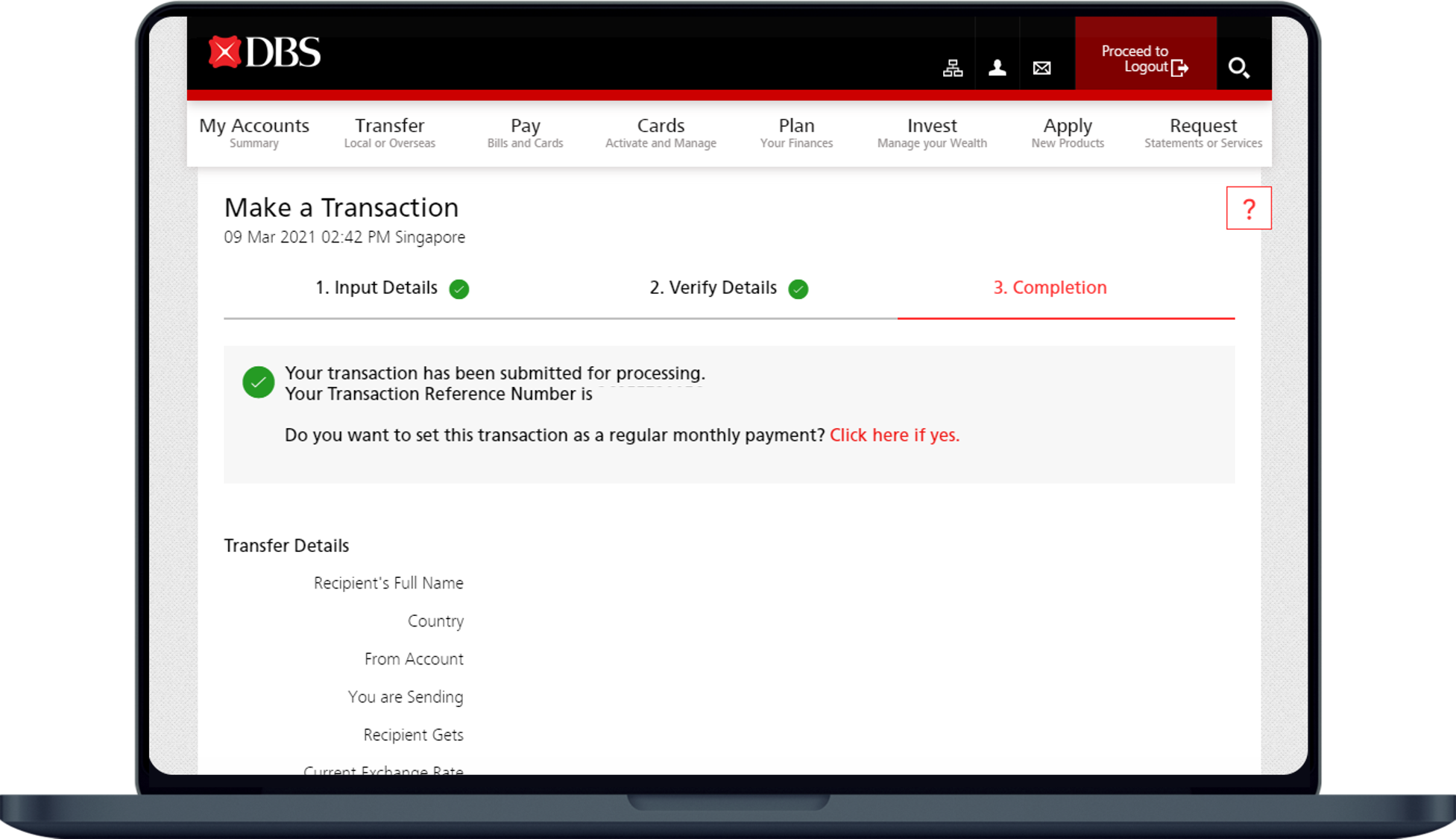

Confirm the Transaction: Carefully review the transfer details and confirm the transaction by entering your password or security code.

-

Track the Status: Monitor the progress of your transfer through your forex broker’s platform or DBS Singapore account.

Tips for a Smooth Transfer

- Verify Account Ownership: Ensure that the name on the forex account matches the name on the DBS Singapore account to prevent any delays in processing.

- Avoid Peak Hours: Avoid initiating transfers during peak trading hours when the market is highly volatile to minimize potential fluctuations in the exchange rate.

- Be Aware of Transfer Fees: Forex brokers may charge a fee for withdrawals. Choose a broker with competitive fees or consider the volume of your transfer to optimize your gains.

- Confirm Account Details: Double-check that the DBS Singapore account number, account name, and currency match your forex account to avoid any transfer errors.

- Maximize Exchange Rates: Monitor the currency market and transfer funds when the exchange rate is favorable to maximize the value of your funds.

Conclusion

Transferring funds from forex to your DBS Singapore account can be a straightforward process with the right guidance. By following the steps outlined in this article, you can seamlessly move your trading profits and manage your finances with peace of mind. Remember to choose a reputable forex broker, set up your DBS Singapore account correctly, and carefully verify the transfer details to ensure a smooth and successful transaction.

Image: www.tpsearchtool.com

How To Transfer Money From Forex To Dbs Singapore Account