Are you eager to explore the dynamic world of Forex trading but feel overwhelmed by its complexities? Look no further than Olymp Trade, a reputable online broker that empowers traders of all levels with accessible and rewarding Forex trading opportunities. This comprehensive guide will unravel the intricacies of Forex trading with Olymp Trade, equipping you with the knowledge and strategies to navigate the markets confidently.

Image: howtotradeblog.com

Introducing Forex Trading with Olymp Trade

Forex, short for foreign exchange, encompasses the trading of currency pairs on a global scale. With Olymp Trade, you can tap into the world’s largest and most liquid financial market directly from your desktop or mobile device. The broker’s user-friendly platform offers a wide range of currency pairs, from major currencies like EUR/USD to exotic pairs like USD/TRY, catering to traders’ diverse preferences.

Understanding Key Concepts of Forex Trading

● Currency Pair: In Forex trading, you speculate on the relative value of two different currencies. For instance, EUR/USD denotes the exchange rate between the Euro (EUR) and the US dollar (USD).

● Spread: This is the difference between the bid price (the price you sell at) and the ask price (the price you buy at). Spreads represent the broker’s commission for executing your trades.

● Leverage: Leverage allows you to trade with borrowed funds, amplifying your potential profits. However, it also magnifies potential losses, emphasizing the importance of responsible trading.

● Orders: Olymp Trade offers various order types, including Market orders for immediate execution, Pending orders for future execution at a specified price, and Stop-loss orders to limit potential losses.

Navigating the Olymp Trade Forex Platform

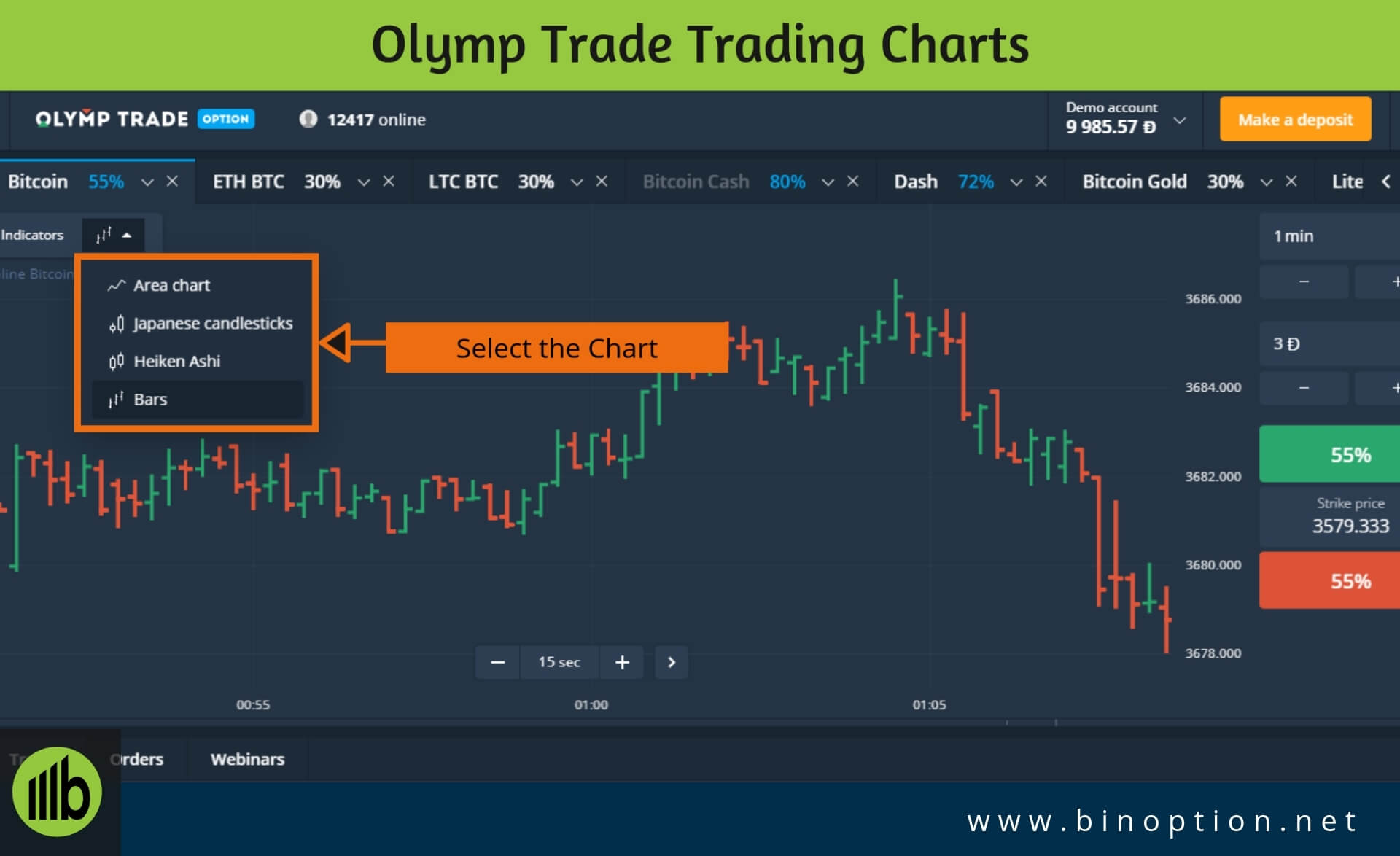

Olymp Trade’s intuitive trading platform is designed to facilitate seamless trading experiences. The platform’s clean interface allows you to monitor market movements, analyze charts, and execute trades swiftly. The advanced charting tools and technical indicators empower you with the insights you need to make informed decisions.

Image: morestmat.blogspot.com

Exploring Olymp Trade’s Trading Tools

● Technical Indicators: Olymp Trade offers an assortment of technical indicators, such as Moving Averages, Bollinger Bands, and Relative Strength Index, to analyze market trends and identify potential trading opportunities.

● Fundamental Analysis: Stay informed about economic and geopolitical events that influence currency values by accessing the platform’s economic calendar and news feed.

● Risk Management Tools: Protect your capital with Olymp Trade’s risk management tools, including stop-loss orders and trailing stops, which help you control potential losses and maximize profits.

Strategies for Successful Forex Trading

● Trend Following:

Identify market trends and trade in the direction of prevailing momentum for potential gains.

● Scalping:

Enter and exit trades frequently to capture small profits from short-term price fluctuations.

● News Trading:

Monitor major economic announcements and trade based on the expected impact on currency values.

● Carry Trading:

Borrow currencies with low-interest rates and invest in currencies with higher interest rates to exploit interest rate differentials.

Olymp Trade Forex Trading Explained

Conclusion

Embarking on the journey of Forex trading with Olymp Trade empowers you with access to the world’s most active financial market. By embracing the knowledge and strategies outlined in this comprehensive guide, you can navigate the complexities of Forex trading with confidence and explore exceptional trading opportunities. Remember, success in Forex trading requires dedication, continuous learning, and adherence to sound risk management principles. As you venture further into the world of Forex trading, embrace the support and resources offered by Olymp Trade and unlock the potential for rewarding returns.