In the ever-evolving landscape of global financial transactions, forex cards have emerged as a convenient and cost-effective way to manage multicurrency transactions. Whether you’re a frequent traveler, an international businessperson, or simply someone who needs to transfer funds across borders, forex cards offer a wide range of benefits, including favorable exchange rates, reduced transaction fees, and real-time access to your funds. However, knowing how to transfer money from forex cards can be a daunting task, especially if you’re unfamiliar with the process. This guide will provide a step-by-step breakdown on how to transfer money from forex card to DBS Singapore account, equipping you with the necessary knowledge to navigate the process seamlessly.

Image: www.dbs.com.sg

Understanding Forex Cards

Forex cards, also known as travel cards or multicurrency cards, are prepaid cards that allow you to store multiple currencies in a single card. They operate similar to debit cards, but offer more flexibility and convenience when making transactions in different currencies. Forex cards can be purchased from banks, financial institutions, or online currency exchange platforms, and they often come with various features such as online banking access, mobile apps, and 24/7 customer support. By using forex cards, you can avoid the hefty fees associated with traditional bank transfers and exchange rate markups, saving you money on your international transactions.

Transferring Funds from Forex Card to DBS Singapore Account

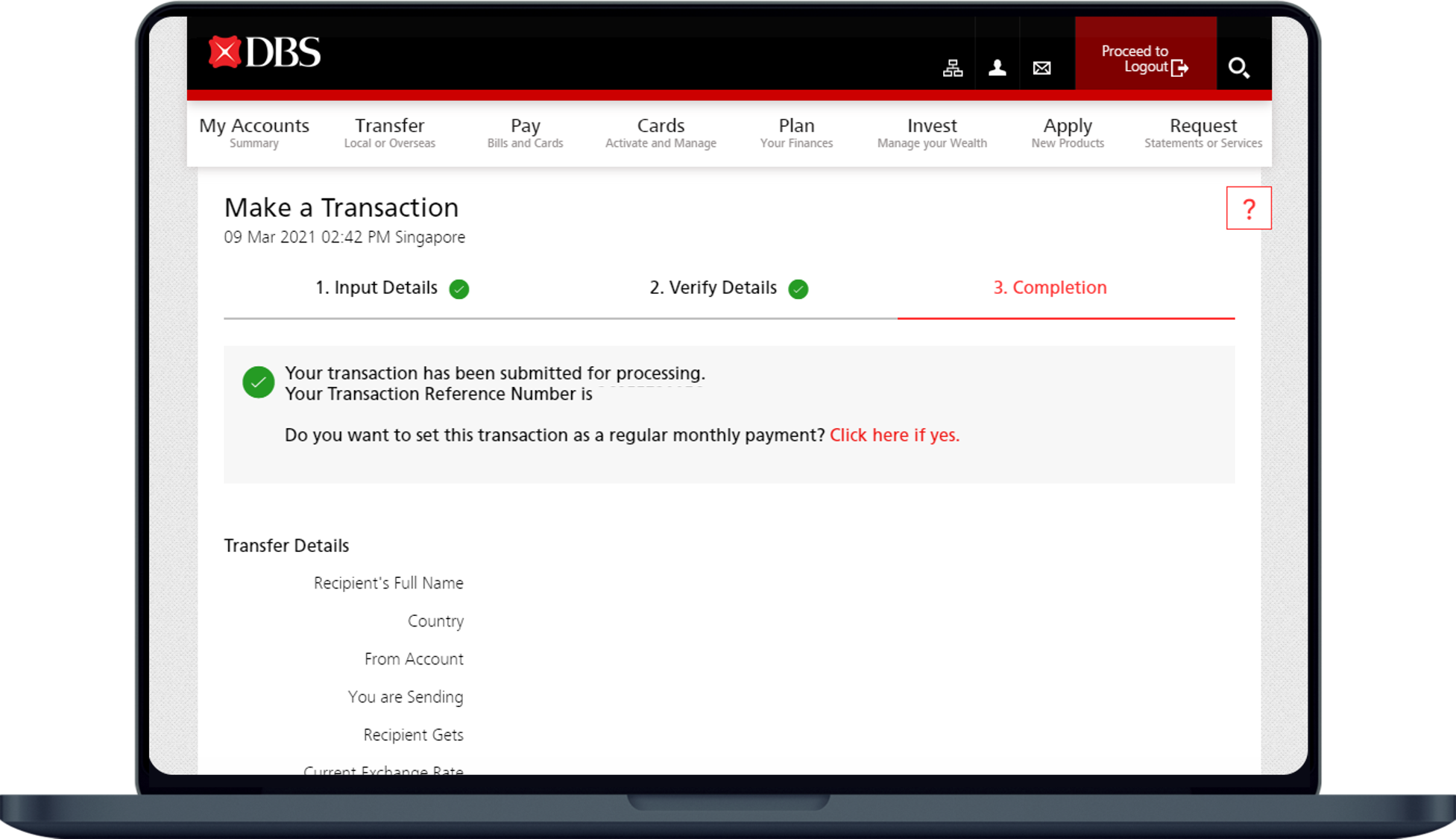

Transferring money from your forex card to your DBS Singapore account is a straightforward process that can be completed in a few simple steps:

-

Log In to Your DBS Internet Banking Account. Access your DBS Internet Banking account through the DBS website or mobile app. You’ll need your DBS account number, login ID, and password to log in.

-

Navigate to the ‘Transfer Funds’ Section. Once you’re logged in, locate the ‘Transfer Funds’ section on the DBS Internet Banking platform. This section allows you to initiate fund transfers to other DBS accounts or to accounts in other banks.

-

Select ‘Telegraphic Transfer (TT). ‘ For international transfers to your forex card, you’ll need to select the ‘Telegraphic Transfer (TT)’ option. This method enables you to send funds directly to your forex card account.

-

Enter the Details of Your Forex Card Account. In the transfer form, you’ll need to provide the following information about your forex card account:

- Account Number: The 16-digit account number printed on your forex card.

- Bank Name: The name of the bank that issued your forex card.

- SWIFT Code: The SWIFT code of the bank that issued your forex card.

- Currency: The currency of the account on your forex card.

-

Enter the Amount to Be Transferred. Indicate the amount of money you wish to transfer from your forex card to your DBS Singapore account. Ensure that you enter the correct amount and that it doesn’t exceed the available balance on your forex card.

-

Review and Confirm the Transfer. Carefully review the transfer details, including the amount, account numbers, and currency, to ensure that everything is correct. Once you’re satisfied with the details, click the ‘Confirm’ or ‘Transfer’ button to proceed with the transaction.

-

Transaction Processing Time. Telegraphic transfers typically take 1-3 business days to be processed, although the actual time may vary depending on the bank and the destination country. You’ll receive an email or SMS notification from DBS once the transfer is complete.

By following these steps, you can easily and securely move funds from your forex card to your DBS Singapore account, enabling you to manage your international finances conveniently and cost-effectively.

Benefits of Transferring Funds from Forex Card to DBS Singapore Account

Transferring funds from forex card to DBS Singapore account offers a wide range of benefits, including:

- Cost-effectiveness: Forex cards typically offer more favorable exchange rates and lower transaction fees compared to traditional bank transfers.

- Convenience: You can transfer funds anytime, anywhere, without the need to visit a bank or deal with extended processing times.

- Security: Forex cards and DBS Singapore accounts are protected by robust security measures, ensuring the safety of your funds.

- Currency Flexibility: Forex cards allow you to store and transfer multiple currencies, providing greater flexibility in managing your international transactions.

- Real-time Tracking: You can track your transfer status online or via mobile app, allowing you to monitor the progress of your transaction in real time.

Additional Tips

- Check the exchange rate and transaction fees associated with your forex card before making a transfer.

- Consider the transfer limits and daily withdrawal limits set by your forex card provider.

- Keep a record of your transactions for future reference and to avoid any discrepancies.

- If you encounter any difficulties or have questions during the transfer process, don’t hesitate to contact your forex card provider or DBS customer support for assistance.

By leveraging forex cards and DBS Singapore accounts, you’ll have a powerful tool at your disposal for managing your international finances. Remember to compare exchange rates and fees from different forex card providers to find the best deal, and always prioritize security when making online transactions.

Image: singapore-bank.net

How To Transfer From Forex Card To Dbs Singapore Account