**A Tale of Two Forex Worlds**

I’ve often found myself marveling at the vastness of the foreign exchange market (forex). With its countless currencies and ever-fluctuating rates, it’s a labyrinthine world that can both fascinate and intimidate. Two key terms that are often encountered in this arena are “regalia forex” and “multi-currency forex.” At first glance, these terms may seem interchangeable, but upon closer examination, their nuances become evident.

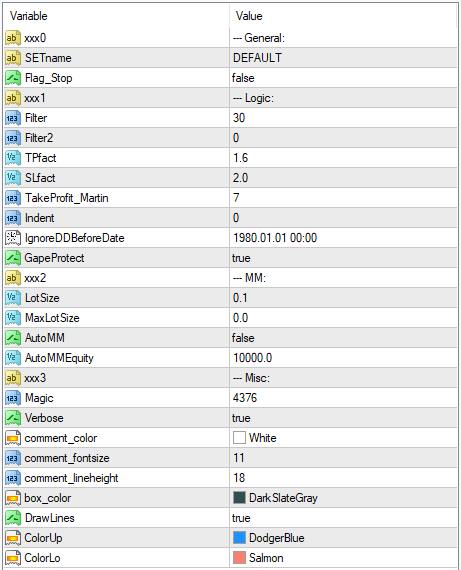

Image: www.fxcracked.com

In this blog post, we embark on a journey to unravel the differences between regalia forex and multi-currency forex. Through thorough exploration and expert insights, we will shed light on their distinct characteristics, advantages, and potential drawbacks. Whether you’re an experienced trader or a Forex newbie, this guide will provide valuable insights to enhance your understanding and empower your trading decisions.

**The Essence of Regalia Forex**

Regalia forex, also known as retail forex, is a market segment that caters specifically to individual traders. It is characterized by smaller order sizes, user-friendly platforms, and accessibility to a wider range of currencies. Regalia forex accounts are typically offered by brokers who act as intermediaries between traders and the interbank market, where large financial institutions trade in bulk.

One of the key advantages of regalia forex is its accessibility. It offers traders a simplified and convenient entry point into the forex market. With low minimum deposit requirements and user-friendly platforms, it appeals to both novice and experienced traders alike. Moreover, regalia forex accounts often provide leverage, allowing traders to control larger positions with a relatively small amount of capital.

**Exploring Multi-Currency Forex**

Multi-currency forex, on the other hand, is a market segment tailored to institutional investors and high-net-worth individuals. It involves trading a wider range of currencies, including exotic and emerging market currencies, and typically requires larger order sizes.

Multi-currency forex brokers specialize in providing sophisticated trading solutions for institutional clients. These brokers offer access to deeper liquidity, enabling traders to execute large orders with minimal slippage. Additionally, multi-currency forex accounts may offer advanced trading tools, such as direct market access (DMA) platforms, which provide traders with real-time market data and the ability to place orders directly into the interbank market.

**Key Differences at a Glance**

To summarize the key differences between regalia forex and multi-currency forex:

- **Target Audience:** Regalia forex is aimed at individual retail traders, while multi-currency forex caters to institutional investors and high-net-worth individuals.

- **Order Sizes:** Regalia forex typically involves smaller order sizes, while multi-currency forex handles larger orders.

- **Currency Pairs:** Regalia forex offers a narrower range of currencies, while multi-currency forex provides access to a wider variety, including exotic and emerging market currencies.

- **Platform Sophistication:** Regalia forex platforms are generally more user-friendly, while multi-currency forex platforms offer advanced trading tools and capabilities.

- **Liquidity:** Multi-currency forex brokers offer deeper liquidity, enabling traders to execute larger orders with reduced slippage.

Image: onlineforexcard.wordpress.com

**Making the Right Choice**

When choosing between regalia forex and multi-currency forex, the decision ultimately depends on your individual trading needs and preferences. If you’re just starting out in forex trading, regalia forex may be a more suitable option due to its accessibility, low minimum requirements, and user-friendly platforms.

As you become more experienced and your trading volume increases, you may consider transitioning to a multi-currency forex account to take advantage of the wider currency range, deeper liquidity, and advanced trading tools offered by these brokers.

**Frequently Asked Questions (FAQs)**

- **Q: Is it better to choose regalia forex or multi-currency forex?**

A: The choice depends on your trading needs and preferences. Regalia forex is suitable for beginners, while multi-currency forex is preferred by institutional investors and experienced traders.

- **Q: Do all regalia forex brokers offer leverage?**

A: Most regalia forex brokers offer leverage, but the amount of leverage may vary depending on the broker and your trading experience.

- **Q: Is it possible to trade exotic currencies on regalia forex platforms?**

A: Not all regalia forex platforms offer exotic currencies. Check with your broker to confirm if they support trading in such currencies.

- **Q: Do multi-currency forex brokers charge higher fees?**

A: Yes, multi-currency forex brokers may charge higher fees due to the specialized services and sophisticated infrastructure they offer.

Regalia Forex Vs Multi Currency Forex

**Conclusion**

The world of forex trading is vast and multifaceted, with regalia forex and multi-currency forex serving distinct segments of the market. By understanding the differences between these two realms, you can make informed decisions and optimize your trading strategies accordingly.

Whether you’re a budding trader seeking your first foray into forex or an experienced investor looking to diversify your portfolio, we encourage you to explore the world of regalia forex and multi-currency forex. With a clear understanding of their unique strengths and limitations, you can harness the power of the forex market to achieve your financial goals.

So, dear reader, are you ready to delve deeper into the intricacies of regalia forex and multi-currency forex? Let us know your thoughts and questions in the comments below.