Ever felt that exhilarating rush after making a winning trade, but then the sinking feeling when you realize the profit was too small to make a difference? Or perhaps you’ve been burned by a trade gone wrong, wondering if you could have limited the damage with a different position size? The answer might lie in a powerful tool often overlooked by even seasoned traders: the position size calculator.

Image: rt-forex.com

This deceptively simple tool can be a game-changer for traders of all levels. It’s more than just a numerical calculation; it’s a strategic weapon for maximizing profit potential while minimizing risk. In this comprehensive guide, we’ll delve deep into the world of position size calculators, exploring their core principles, practical applications, and how they can revolutionize your trading approach.

Understanding the Importance of Position Sizing

The Foundation of Risk Management

Think of a professional athlete meticulously planning their training regimen. They don’t just jump into a grueling workout without considering their physical limitations. Similarly, in trading, position sizing is your training regimen, ensuring that each trade aligns with your overall risk tolerance and financial health. It’s about finding the sweet spot where you can maximize potential gains without putting your entire portfolio at risk.

Beyond the Basics: More Than Just Entry and Exit Points

Many traders focus solely on choosing the right entry and exit points, neglecting the crucial factor of position size. Imagine finding the perfect stock to buy, but unknowingly over-investing and losing a significant chunk of your capital in a sudden market downturn. Position sizing is the antidote to this scenario; it helps you manage risk effectively by determining the appropriate amount of capital to allocate to each trade.

Image: baxiamarkets.com

Unmasking the Position Size Calculator

The Formula Decoded

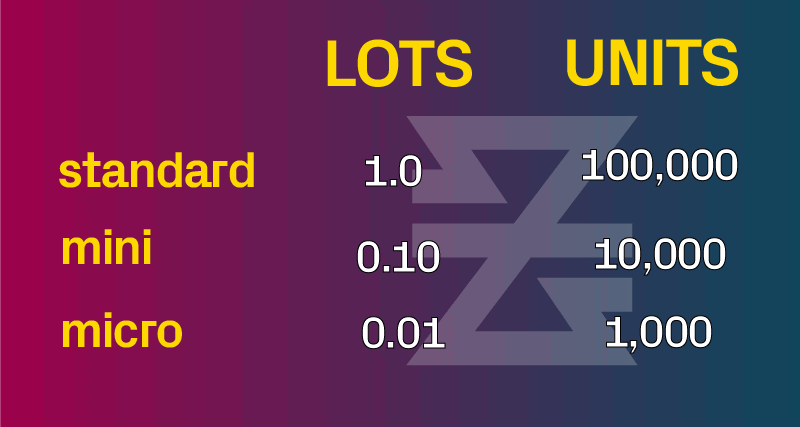

Position size calculators are driven by a formula that balances the desired risk per trade with the volatility of the asset being traded. A common formula involves dividing your risk per trade (typically expressed as a percentage of your account capital) by the stop-loss distance, multiplied by the entry price.

The good news is, you don’t need to be a math whiz to use these calculators. Numerous online tools and software applications are available, simplifying the calculation process and allowing you to quickly determine your optimal position size.

Key Components of the Position Size Calculator

Let’s break down the essential elements of a position size calculator:

- Account Capital: This represents the total funds available for trading.

- Risk Per Trade: The percentage of your account capital you’re willing to risk on a single trade. It’s crucial to set this value based on your individual risk tolerance and financial goals.

- Stop-Loss Distance: The predetermined price point at which you’ll exit a losing trade to limit potential losses. The stop-loss distance is the difference between your entry price and your stop-loss order.

- Entry Price: The price at which you intend to enter the trade.

Real-World Examples: Putting Theory into Practice

Imagine you have a $10,000 trading account, and you’re willing to risk 1% per trade, or $100. You identify a stock trading at $50 with a potential buy entry point and a stop-loss order set at $47.50. Your stop-loss distance is $2.50 ($50 – $47.50).

Using a position size calculator, you would input these values:

Risk per trade: $100

Stop-loss distance: $2.50

Entry Price: $50

The calculator would determine the optimal position size for this trade, allowing you to manage your risk effectively.

Beyond the Formula: Building a Comprehensive Strategy

The Role of Market Volatility

While the formula provides a foundation, it’s essential to consider the inherent volatility of the underlying asset. Highly volatile markets, like those in cryptocurrencies, require more cautious position sizing. On the other hand, less volatile markets, such as blue-chip stocks, might allow for larger position sizes.

Understanding Your Tolerance for Risk

The most important element of position sizing is your risk tolerance. Are you a risk-averse trader who prefers small, consistent gains, or are you willing to take on more substantial risks in pursuit of potentially larger returns? Your answer will shape your approach to position sizing.

Beyond Individual Trades: A Holistic Approach to Portfolio Management

Position sizing is not just about individual trades. It’s about the overall allocation of capital across your entire portfolio. You might decide to allocate a larger share to a trade that you believe offers higher potential returns, while taking a smaller position in a less volatile investment.

Leveraging Technology: Maximizing Efficiency

Position Size Calculators: A Boon for Traders

The rise of online tools and trading platforms has made it incredibly convenient to use position size calculators. Many tools allow you to input your individual settings and quickly calculate the appropriate size for any given trade.

Advanced Features for Streamlined Trading

Some platforms offer advanced features, such as allowing you to create customized presets for different market conditions, or even integrating the calculator directly into your trading interface. These features can help you save time and ensure consistency in your risk management practices.

The Evolution of Position Sizing: New Horizons in Trading

AI-Powered Tools: The Future of Risk Management

The world of trading is constantly evolving, and artificial intelligence is playing an increasingly important role. AI-powered position size calculators are emerging, leveraging complex algorithms to analyze market data and dynamically adjust position sizes based on real-time market conditions. This technology holds the potential to reshape our understanding of risk management, offering greater precision and adaptability.

Algorithmic Trading: Redefining Position Sizing

Algorithmic trading, which uses pre-programmed rules to automate trading decisions, is also impacting position sizing. Algorithms can be designed to factor in risk management principles, dynamically adjust positions based on market conditions, and optimize trading execution. This opens up new possibilities for both individual traders and institutional investors.

Position Size Calcultor

Conclusion: Mastering Position Sizing for Long-Term Success

The position size calculator is more than a tool; it’s a key to unlocking the full potential of your trading strategy. By understanding the principles of position sizing and utilizing the appropriate tools, you can navigate the markets with greater confidence, manage risk effectively, and ultimately achieve your financial goals. The journey of mastering position sizing might take time and effort, but the rewards of improved risk management and enhanced profit potential make it a worthy investment for any trader. So, embrace the power of this often overlooked tool, and set yourself on a path to greater trading success.