Step into the dynamic realm of corporate finance, where the intricate interlacing of foreign exchange (forex) plays a crucial role in shaping global financial landscapes. Join us on a captivating journey as we explore the world of corporate forex finance receivable and payable jobs descriptions, illuminating the vital function they serve in the seamless flow of international commerce.

Image: www.businessstudynotes.com

Corporate forex finance encompasses the management of foreign currency transactions for businesses operating across borders. It involves the strategic handling of accounts receivable and payable, ensuring that organizations can optimize their cash flow, manage exchange rate risks, and maintain financial stability in the face of global economic fluctuations.

Unveiling the Corporate Forex Finance Receivable and Payable Roles

The corporate forex finance receivable and payable departments are the financial guardians of cross-border transactions. They work hand-in-hand to facilitate the smooth flow of funds between companies and ensure the timely settlement of accounts.

Receivable professionals are the custodians of the funds owed to the organization from its international customers. They manage the collection process, including invoicing, payment reminders, and diligent follow-up. By maintaining accurate records and staying abreast of regulatory requirements, they ensure that the organization receives its payments promptly and efficiently.

On the other side of the equation, payable professionals take center stage in the management of funds owed to vendors and suppliers overseas. They review invoices, verify vendor information, and oversee the timely disbursement of payments. By adhering to strict payment schedules and negotiating favorable terms, they cultivate strong relationships with suppliers while safeguarding the organization’s financial resources.

The Importance of Corporate Forex Finance: A Global Perspective

In today’s interconnected global economy, the ability to manage forex effectively has become paramount for businesses of all sizes. The forex market, with its trillions of dollars in daily transactions, serves as the financial circulatory system of cross-border trade. Organizations that embrace the complexities of forex finance can gain a competitive edge, expanding their global reach and optimizing their financial performance.

Managing forex fluctuations is like navigating a turbulent sea. Receivable and payable professionals must closely monitor exchange rates and employ hedging strategies to minimize the impact of currency volatility on the organization’s bottom line. The ability to forecast future currency movements, coupled with a deep understanding of global economic trends, sets apart the most successful finance professionals in this arena.

Empowering the Corporate Forex Finance Team: Essential Skills and Training

Thriving in the world of corporate forex finance requires a confluence of skills and knowledge. Professionals must master the intricacies of forex markets, including currency rate analysis, hedging techniques, and cross-border payment regulations. A strong foundation in accounting principles and financial management forms the cornerstone of their expertise.

In addition to technical proficiency, effective forex finance professionals possess exceptional communication and interpersonal skills. The ability to build and maintain strong relationships with clients, vendors, and financial institutions is crucial for ensuring smooth transactions and navigating the complexities of global commerce.

Continuous professional development is the hallmark of successful forex finance professionals. Industry certifications and specialized training programs provide opportunities to enhance their knowledge and stay abreast of emerging trends in this dynamic field.

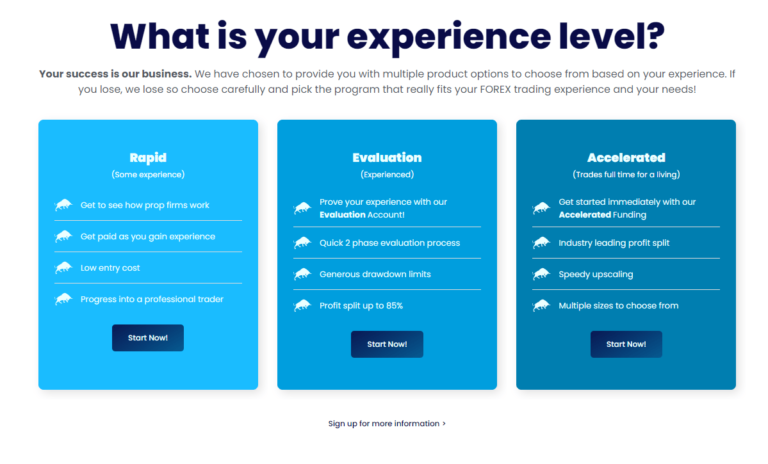

Image: traderevenuepro.com

Corporate Forex Finance Receivable And Payable Jobs Description

Conclusion: The Pillars of Global Financial Stability

Corporate forex finance is not merely a financial function; it is an indispensable pillar of global economic stability. Receivable and payable professionals play a pivotal role in ensuring the smooth flow of funds across borders, facilitating international trade, and supporting the growth of global economies.

As the world becomes increasingly interconnected, the demand for skilled and knowledgeable forex finance professionals will continue to rise. Embrace the opportunity to play a vital role in shaping the financial landscape of the future. Join the ranks of those who harness the power of forex to drive global commerce and create a more prosperous world for all.