Introduction: Unraveling the intricacies of Forex

Foreign exchange, commonly known as Forex, plays a pivotal role in global trade and investment. Whether you’re an experienced trader or just starting out, understanding how to manage forex gain and loss is crucial to navigate the complexities of the market. Tally, a robust accounting software, offers comprehensive features that make adjusting forex gain loss a breeze. In this article, we’ll delve into a step-by-step guide to help you master this essential task in Tally.

Image: bestforexeaintheworld1.blogspot.com

Before we dive into the details, let’s clarify some essential terminologies. Forex gain occurs when the value of the currency you hold increases relative to another currency. Conversely, forex loss happens when the value of the currency you hold decreases. Understanding these concepts is key to effectively managing your forex transactions.

Navigating the Accounting of Forex Gain and Loss

Recording Forex Transactions in Tally

To begin, it’s crucial to record your Forex transactions accurately in Tally. Create separate ledger accounts for each currency you deal in, such as ‘USD Receivable’ and ‘USD Payable.’ When receiving payments in foreign currency, debit the relevant receivable account and credit the bank account. Similarly, for payments made in foreign currency, credit the payable account and debit the bank account.

Exchange Rate Fluctuations and Their Impact

Exchange rates, the value of one currency relative to another, constantly fluctuate. These fluctuations can lead to forex gain or loss. Tally allows you to record the exchange rate prevailing on the transaction date, ensuring accurate tracking of your forex positions.

Image: howtotradeonforex.github.io

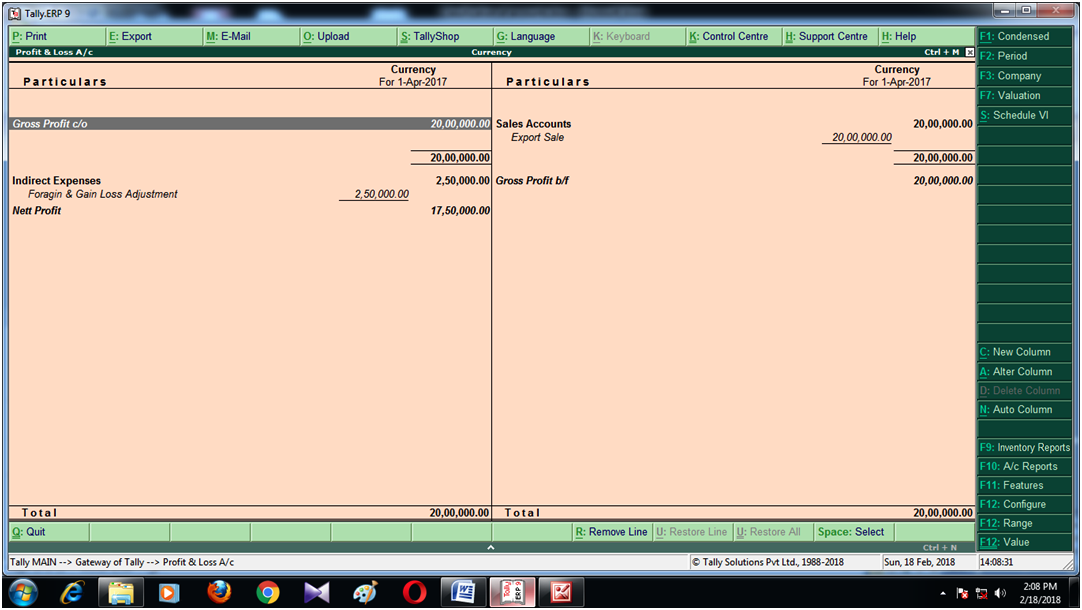

Adjusting Forex Gain and Loss in Tally: A Step-by-Step Guide

Step 1: Create a Forex Gain/Loss Account

Begin by creating a separate ledger account named ‘Forex Gain/Loss.’ This account will be used to record unrealized gains or losses arising from exchange rate fluctuations.

Step 2: Record Unrealized Gain/Loss

To recognize unrealized forex gain or loss, pass a journal entry debiting or crediting the ‘Forex Gain/Loss’ account, depending on the situation. For example, if the value of the USD increases against the INR, you’ll record a forex gain by debiting ‘Forex Gain/Loss’ and crediting the relevant USD receivable or payable account.

Step 3: Realizing Forex Gain/Loss

When the foreign currency is eventually converted back to the base currency, the unrealized forex gain or loss is realized. Pass a journal entry to transfer the amount from the ‘Forex Gain/Loss’ account to the respective income or expense account. For example, if you sell your USD receivables, you’ll record a realized forex gain by debiting the relevant receivable account and crediting ‘Forex Gain/Loss.’

Tips and Expert Advice for Effective Forex Management

- Monitor exchange rate fluctuations regularly and adjust your positions accordingly.

- Use hedging instruments like forward contracts or options to mitigate the risks associated with exchange rate fluctuations.

- Stay updated with economic and political news that may impact exchange rates.

- Seek professional advice from a qualified accountant or financial advisor to optimize your forex management strategies.

- Regularly review your forex positions and make necessary adjustments to ensure profitability.

Frequently Asked Questions (FAQs)

- Q: Why is it important to adjust forex gain and loss in Tally?

A: Adjusting forex gain and loss in Tally ensures accurate financial reporting and reflects the real-time value of your foreign currency positions.

- Q: When should forex gain and loss be adjusted?

A: Forex gain and loss should be adjusted periodically, typically at the end of each accounting period or when there are significant exchange rate fluctuations.

- Q: What are the consequences of not adjusting forex gain and loss?

A: Failing to adjust forex gain and loss can lead to inaccurate financial statements and incorrect tax reporting.

How To Adjust Forex Gain Loss In Tally

Conclusion: Embracing Forex Management in Tally

Managing forex gain and loss in Tally is essential for businesses and individuals dealing in foreign currencies. By following the steps outlined in this article and incorporating the tips provided, you can effectively adjust forex gain and loss, ensuring accurate financial reporting and maximizing profitability. Remember, staying informed about exchange rate fluctuations and seeking expert guidance when needed are key to successful forex management.

We trust this comprehensive guide has provided you with a deep understanding of how to adjust forex gain loss in Tally. If you found this article informative, please let us know in the comments section below.