As an experienced forex trader, I’ve witnessed firsthand the frustrating yet lucrative nature of pullbacks. Mastering a comprehensive pullback strategy is key to unlocking consistent profits amidst market fluctuations. Let’s dive into a deep analysis of pullback trading, exploring its nuances, benefits, and proven techniques.

Image: www.youtube.com

Pullbacks: Understanding the Reversal Sanctuaries

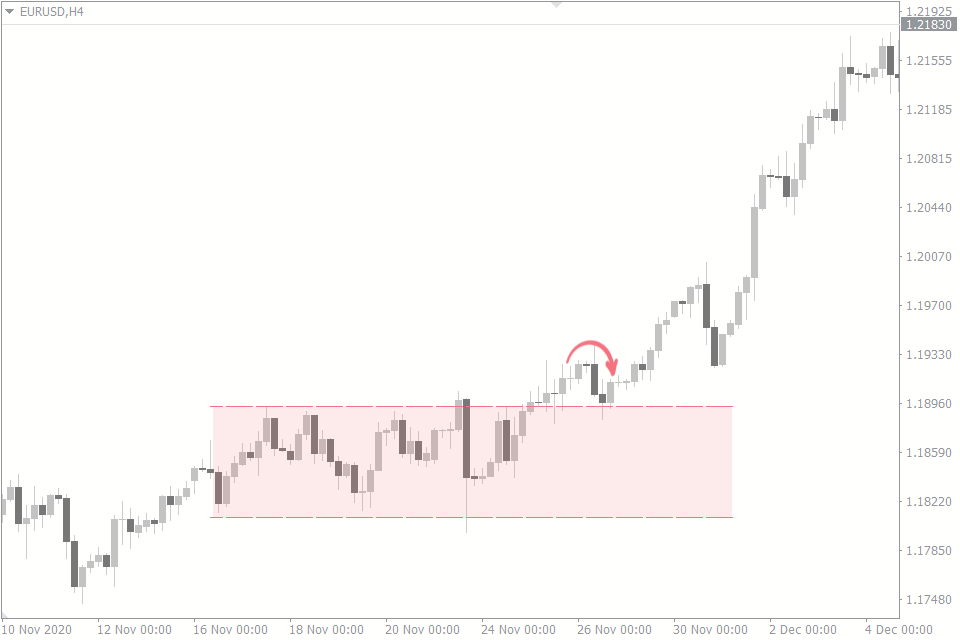

In forex trading, pullbacks refer to temporary reversals in the price trend. They occur when the price retraces a portion of its previous move, offering traders a potential entry point in line with the prevailing trend. Pullbacks can be mere ripples in the market’s upward or downward trajectory or signify a more substantial shift in market sentiment.

By identifying and capitalizing on pullbacks, traders can take advantage of temporary market corrections to enter or adjust positions at favorable prices. This strategy helps mitigate the risk of chasing a rapidly moving market and provides opportunities to accumulate more favorable entries in line with the overall trend.

Multiple Pullback Strategies: Tailoring to Diverse Market Conditions

The forex market’s dynamic nature demands a multifaceted approach to pullback trading. Seasoned traders employ a range of pullback strategies to adapt to varying market conditions and personal trading styles. Let’s delve into some widely implemented techniques:

-

Fibonacci Retracement Levels: Fibonacci retracement levels are a popular tool for identifying potential support and resistance zones during pullbacks. By overlaying Fibonacci ratios on a price chart, traders can anticipate areas where the market might pause or reverse, providing entry and exit points.

-

Moving Average Convergence Divergence (MACD) Histogram: The MACD histogram measures the difference between two exponential moving averages. When the MACD histogram turns positive, it can signal a bullish pullback, while a negative value may indicate a bearish pullback. This indicator helps traders assess the strength and momentum of a pullback.

-

Relative Strength Index (RSI): The RSI gauges the market’s momentum and can indicate overbought or oversold conditions. A reading above 70 suggests a potentially overbought market, signaling a possible retracement to lower levels. Conversely, an RSI below 30 indicates an oversold market, potentially prompting a pullback to higher levels.

Advanced Tips and Expert Insights for Pullback Mastery

Beyond the fundamental pullback strategies, experienced traders leverage advanced techniques to enhance their accuracy and profitability:

-

Volume and Volatility Analysis: Incorporating volume and volatility analysis provides a comprehensive understanding of market dynamics during pullbacks. High volume during a pullback implies market conviction behind the price reversal, while low volume may indicate a weak trend that may not sustain.

-

Trendline and Support/Resistance Levels: Identifying trendlines and critical support and resistance levels helps traders gauge the strength of a pullback. A pullback that respects a previous trendline or a significant support or resistance level may offer an exceptional trading opportunity.

-

Price Action Confirmation: Relying solely on indicators can sometimes lead to false signals. Pairing technical analysis with price action confirmation, such as engulfing candlesticks, pin bars, or breakouts, validates trading decisions and improves risk management.

Image: fxssi.com

Frequently Asked Questions (FAQs) on Pullback Trading

Q: What is the ideal risk-to-reward ratio for pullback trades?

A: A desirable risk-to-reward ratio for pullback trades is generally considered to be 1:2 or higher. This means that the potential profit target should be at least twice the amount of risk taken on the trade.

Q: How can I determine the direction of a pullback?

A: The direction of a pullback can be determined by analyzing the overall trend and identifying potential support and resistance levels. Using technical indicators such as Fibonacci retracement levels or moving averages can also provide insights into the likely direction of the price movement.

Complete Forex Pull Pullback Strategy

Conclusion

Mastering pullback trading empowers forex traders to navigate market fluctuations and capitalize on emerging opportunities. By understanding the mechanics of pullbacks and incorporating advanced strategies and expert advice, traders can enhance their profitability and achieve long-term success in the dynamic forex market. Are you ready to delve into the exciting world of pullback trading and unlock your hidden potential?