In the dynamic realm of forex trading, conquering market volatility is paramount for achieving lasting success. Pullbacks, momentary reversals in price action, present traders with unique opportunities to capitalize on market trends and enhance their profit potential. However, navigating these fluctuations requires a robust and reliable pullback forex system, one that empowers traders with the knowledge and tools to execute calculated trades with precision.

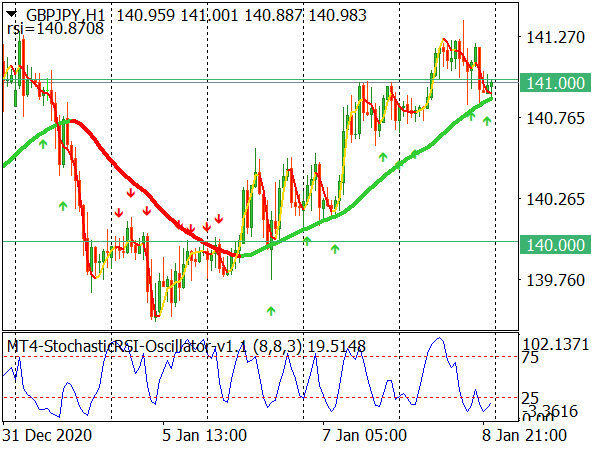

Image: www.best-metatrader-indicators.com

This comprehensive guide delves into the intricacies of pullback trading, unveiling the best pull back forex system ever devised. We’ll explore the fundamental principles, practical techniques, and proven strategies that will equip you to master this lucrative trading approach. So, buckle up, traders, as we embark on this enriching journey towards unlocking the secrets of successful pullback trading.

Deciphering Pullbacks: The Key to Market Mastery

A pullback, in the context of forex trading, refers to a temporary price reversal that occurs within an established trend. This momentary dip or surge offers traders a chance to enter or exit positions strategically, potentially maximizing their profit potential. Understanding the nature of pullbacks is crucial for exploiting their trading opportunities effectively.

Types of Pullbacks: Identifying the Market’s Intentions

Pullbacks can be categorized into two primary types, each exhibiting distinct characteristics that demand tailored trading strategies:

-

Retracement: A retracement represents a partial reversal in price movement, typically occurring within a larger trend. It retraces a certain percentage of the preceding move before resuming the prevailing trend.

-

Reversal: A reversal denotes a significant change in the underlying trend. It indicates a potential shift in market sentiment, often leading to a sustained price reversal. Reversals are typically more substantial and prolonged than retracements.

Trading Pullbacks: A Balancing Act of Risk and Reward

Trading pullbacks effectively hinges on a delicate balance between risk and reward. While pullbacks offer lucrative entry points, it’s crucial to recognize the potential risks involved:

-

False Breakouts: The market may pierce through a support or resistance level, only to revert to its original trend, leaving traders vulnerable to losses.

-

Extended Pullbacks: Occasionally, pullbacks may extend beyond anticipated levels, jeopardizing open positions and increasing the risk of significant losses.

To mitigate these risks while maximizing profit potential, traders must adhere to sound risk management principles, including:

-

Proper Position Sizing: Calculate position size cautiously, ensuring that potential losses are within acceptable limits.

-

Stop-Loss Placement: Implement stop-loss orders to safeguard against excessive losses, placing them at strategic levels to minimize potential damage.

-

Risk-Reward Ratio: Always evaluate the potential reward in relation to the potential risk before initiating a trade. Favorable risk-reward ratios are generally regarded as those exceeding 1:2.

Image: www.forex.academy

The Zenith of Pullback Trading: Unveiling the Ultimate System

After meticulously examining numerous pullback forex systems, one stands tall as the unrivaled champion: the Fibonacci Retracement Pullback Trading System. This time-tested system harnesses the power of Fibonacci ratios to pinpoint optimal entry and exit points, maximizing profit potential while minimizing risk exposure.

Fibonacci Retracements: Unraveling the Harmonic Patterns

The Fibonacci sequence, a series of numbers in which each subsequent number is the sum of the two preceding ones (e.g., 0, 1, 1, 2, 3, 5, 8, 13, …), holds immense significance in technical analysis. Traders utilize Fibonacci retracement levels, such as 23.6%, 38.2%, 50%, 61.8%, and 78.6%, to identify potential support and resistance zones within a trend.

Integrating Fibonacci Retracements into Pullback Trading

The Fibonacci Retracement Pullback Trading System leverages Fibonacci retracement levels to identify pullback entry and exit points with remarkable precision:

-

Trend Identification: Determine the prevailing trend using technical analysis tools such as moving averages, trendlines, or oscillators.

-

Fibonacci Retracement Levels: Plot Fibonacci retracement levels on the price chart to identify potential support and resistance zones within the trend.

-

Pullback Confirmation: Wait for a pullback to reach a Fibonacci retracement level. Look for signs of support or resistance at these levels, such as candlestick patterns, price action, or volume indicators.

-

Trade Entry and Exit: Enter a trade in line with the prevailing trend when the price rebounds from a Fibonacci retracement level. Place stop-loss orders appropriately and target profit levels based on Fibonacci extension levels or other technical indicators.

-

Risk Management: Implement sound risk management principles, including proper position sizing, stop-loss placement, and risk-reward ratio calculation.

Case Study: Profiting from GBP/USD Pullback

To illustrate the practical application of the Fibonacci Retracement Pullback Trading System, let’s analyze a real-world example:

-

Trend Identification: In February 2023, the GBP/USD currency pair exhibited a clear uptrend, supported by moving averages and trendline analysis.

-

Fibonacci Retracement Levels: Fibonacci retracement levels were plotted on the price chart, revealing potential support zones at 1.2160 (38.2% retracement) and 1.2100 (50% retracement).

-

Pullback Confirmation: On March 8th, 2023, the GBP/USD pair pulled back and found support at the 50% Fibonacci retracement level (1.2100).

-

Trade Entry: Based on the pullback confirmation, a long trade was executed at 1.2105.

-

Trade Management: A protective stop-loss order was placed below the 61.8% Fibonacci retracement level (1.2060), while a profit target was set at the 1.2280 price level (based on a Fibonacci extension level).

-

Trade Outcome: The GBP/USD pair continued its uptrend, reaching the target profit level and generating a substantial profit.

This case study demonstrates how the Fibonacci Retracement Pullback Trading System can assist traders in identifying profitable trading opportunities within a pullback.

Best Pull Back Forex System Ever

Conclusion: Empowering Traders to Conquer Pullback Profits

The allure of pullback trading lies in its ability to enhance trading outcomes by capitalizing on temporary price reversals. However, to