In the volatile and fast-paced world of foreign exchange (forex) trading, understanding your contractual obligations is crucial for safeguarding your investments. The ability to cancel a contract, if necessary, can protect you from financial losses and legal complications. This comprehensive guide will delve into the intricate details of contract cancellation in forex, equipping you with the knowledge to make informed decisions and navigate the legal complexities effectively.

Image: www.sampleforms.com

What is Contract Cancellation in Forex?

Contract cancellation in forex refers to the legal process of terminating a binding agreement between a trader and a broker or dealing desk. This agreement outlines the terms and conditions of the trade, including the agreed-upon price, currency pair, trade size, and any applicable costs or fees. Once a contract is executed, both parties are bound to fulfill their respective obligations. However, under certain circumstances, cancellation may be necessary or advantageous.

Reasons for Cancellation

There can be several reasons why traders may consider canceling a forex contract. These include:

- Market volatility: Extreme market conditions, such as sudden price swings or unpredictable events, may make it prudent to cancel a contract to minimize potential losses.

- Brokerage issues: If the trader encounters problems with the broker, such as unexpected trading restrictions, lack of communication, or delays in execution, cancellation may be necessary to safeguard their interests.

- Personal reasons: Unforeseen personal circumstances, such as illness, financial difficulties, or changes in risk tolerance, may necessitate the cancellation of a contract.

- Cooling-off period: In some jurisdictions, regulations provide traders with a cooling-off period during which they can cancel a contract without penalty.

Cancellation Process

The process of canceling a forex contract typically involves the following steps:

- Notification: The trader must inform the broker of their intention to cancel the contract, in writing or through the broker’s designated cancellation channel.

- Reasons for cancellation: The trader should clearly state the reasons for cancellation to ensure they comply with the terms of the contract or applicable regulations.

- Timing: The timing of cancellation is critical. Traders should adhere to any specified time frames or deadlines outlined in the contract or by the broker.

- Documentation: Traders should maintain clear and accurate documentation of the cancellation request, including the date, time, and method of communication used.

Image: www.youtube.com

Consequences of Cancellation

The consequences of canceling a forex contract can vary depending on the specific terms of the agreement and applicable regulations. In most cases, traders may incur certain penalties or charges, such as cancellation fees or loss of any accrued profits. However, if the cancellation is due to a material breach of contract by the broker, the trader may be entitled to compensation or damages.

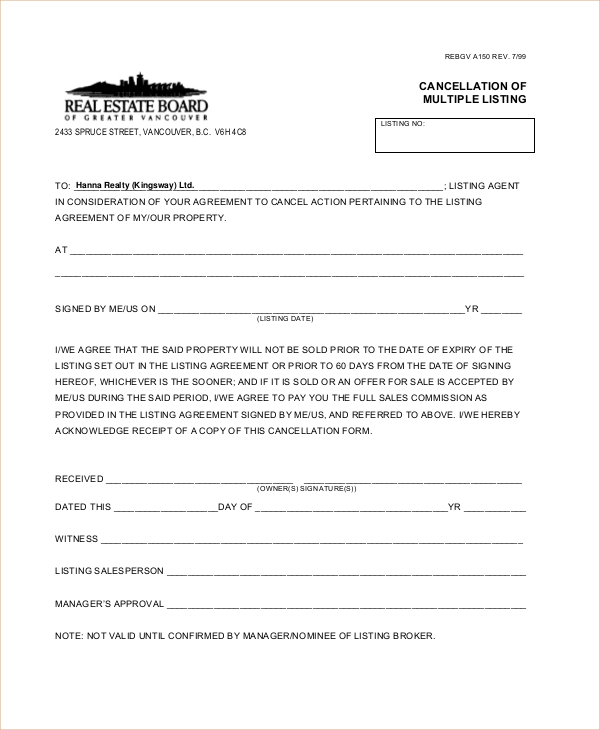

Cancellation Of Contract In Forex

Conclusion

Contract cancellation in forex provides traders with a legal mechanism to safeguard their rights and protect their finances. By understanding the reasons for cancellation, the process involved, and the potential consequences, traders can make informed decisions and navigate the complexities of forex trading with confidence. Always consult with reliable sources, including legal professionals or experienced brokers, to ensure a clear understanding of your contractual obligations and minimize potential risks.