Currency exchange has become an integral part of our globalized world, whether for personal or business transactions. Forex, short for foreign exchange, plays a pivotal role in facilitating these exchanges but sometimes, unexpected deductions can leave account holders perplexed. In this article, we delve into the intricacies of forex deductions and the reasons behind automatic refunds.

Image: quickbooks.intuit.com

Forex Deductions: A Closer Look

At the heart of forex transactions lies the concept of currency conversion. When exchanging one currency for another, individuals or businesses incur a small fee known as the forex spread. This spread, essentially the difference between the buy and sell prices, compensates exchange providers for their services. However, in addition to the spread, account holders may also encounter various other types of deductions.

- Commission: Some forex brokers charge a flat commission for each transaction.

- Margin interest: When trading on margin, which involves borrowing money from the broker, interest charges may apply.

- Other fees: Depending on the broker or platform, additional charges such as account maintenance fees, withdrawal fees, or inactivity fees may be present.

Understanding the nature and purpose of these deductions is essential for managing financial expectations while engaging in forex transactions.

Automatic Refunds: A Source of Relief

Automatic refunds, on the other hand, can provide a sense of relief when unexpected deductions occur. These refunds typically stem from several underlying reasons.

- Errors in calculation: In certain cases, errors during transaction processing or currency conversion can lead to incorrect deductions. When detected, brokers may automatically refund the excess amount.

- Overcharges: Sometimes, brokers may overestimate the spread or other charges due to system errors or human mistakes. In such instances, automatic refunds are initiated to correct the overcharge.

- Canceled or reversed transactions: When a transaction is canceled or reversed, such as due to a duplicate order or technical issue, the associated deductions may be automatically refunded.

- Regulatory compliance: Forex brokers are required to adhere to strict regulations, including measures to protect clients from unauthorized or fraudulent transactions. If unauthorized deductions are detected, brokers may issue refunds for compliance reasons.

Benefits of Automatic Refunds

The automatic refund mechanism provides several benefits to account holders:

- Dispute resolution: Refunds resolve potential disputes arising from incorrect deductions, eliminating the need for lengthy or complex communication.

- Account reconciliation: Refunds ensure that account balances are accurately reconciled, preventing confusion or financial loss.

- Client satisfaction: Automatic refunds demonstrate a commitment to customer satisfaction, reassuring clients that errors or discrepancies are addressed promptly and fairly.

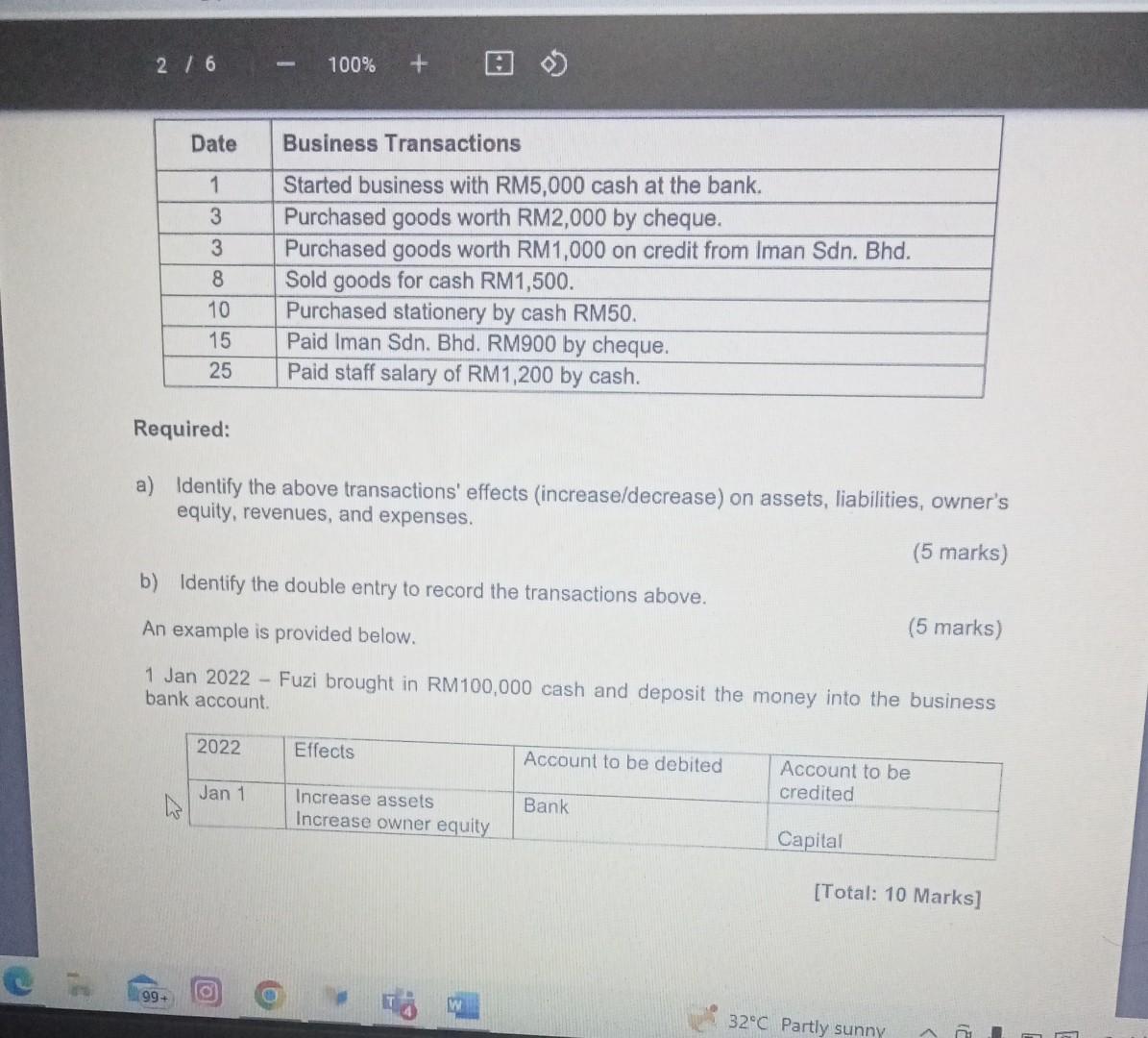

Image: www.chegg.com

Amount Deducted For Forex From Account And Automatically Refunded Reason

Conclusion

Understanding the causes and implications of forex deductions, as well as the reasons behind automatic refunds, is crucial for informed financial decision-making. By familiarizing themselves with these aspects, individuals and businesses can navigate forex transactions with greater confidence. If you encounter any questionable deductions from your forex account, do not hesitate to contact the broker directly to clarify the situation and seek a refund if warranted.