Introduction

Image: geresida.blogspot.com

Have you ever marveled at the fluctuating dance of forex prices, wondering how to harness their volatility for profit? The key lies in understanding how prices change and how to quantify these changes effectively. By mastering the art of calculating 50-day returns, you unlock an invaluable tool for navigating the turbulent waters of the forex market.

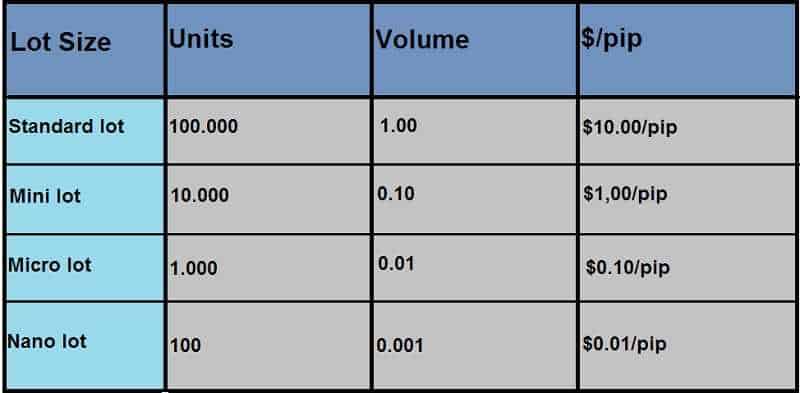

Forex (foreign exchange) trading involves the exchange of currencies from different countries. It’s a vast market that accounts for trillions of dollars traded daily. With such a high volume, it’s imperative to have a reliable way to measure price fluctuations. The 50-day return is one such measure that can help you make informed trading decisions.

Diving into the 50-Day Return

Simply put, the 50-day return is a measure of how much a currency pair has risen or fallen over a period of 50 days. It’s expressed as a percentage and tells you the percentage change in value over that period. To calculate the 50-day return, you simply divide the closing price of a currency pair on day 50 by its closing price on day 1 and multiply the result by 100.

For example, if the EUR/USD pair closed at 1.1000 on day 1 and 1.1200 on day 50, the 50-day return would be:

50-Day Return = ((1.1200 / 1.1000) - 1) * 100 = 1.82%This tells you that the EUR/USD pair has gained 1.82% in value over the past 50 days.

Significance in Forex Trading

Calculating 50-day returns is crucial for forex traders for several reasons:

- Trend Identification: The 50-day return can help you identify trends in currency pairs. If the return is positive, it indicates a bullish trend, while a negative return suggests a bearish trend.

- Trade Timing: Knowing the 50-day return can help you time your trades. A strong uptrend (high return) could be a good time to enter a buy position, while a strong downtrend (low return) could signal an opportunity for a sell position.

- Risk Management: Calculating 50-day returns allows you to assess the risk involved in trading a particular currency pair. A currency pair with a high 50-day return may be more volatile and carry more risk.

Expert Insights and Practical Tips

According to Forex expert, John Carter: “The 50-day return is a valuable tool for identifying trading opportunities. I use it to confirm trends and to find possible entry and exit points.”

Here are some practical tips for using the 50-day return in your forex trading:

- Combine with Other Indicators: Don’t rely solely on the 50-day return. Combine it with other technical indicators like moving averages or Bollinger Bands to get a more comprehensive view of the market.

- Look for Divergence: When the 50-day return starts to diverge from the price action (e.g., a positive return but a downtrend), it could be a signal of a potential trend reversal.

- Trade with the Trend: Trade in line with the 50-day return. If the return is positive, look for buy opportunities, and if it’s negative, look for sell opportunities.

Conclusion

Calculating 50-day returns is an essential skill for any forex trader. It empowers you to measure price fluctuations, identify trends, time your trades, and manage risk effectively. By integrating this simple yet powerful technique into your trading strategy, you can navigate the unpredictable world of forex with greater confidence and profitability.

Image: forexdkmoneyexchange.blogspot.com

Calculate 50 Day Returns Of Forex Price Change