Imagine you’re at a bustling market, navigating the maze of stalls, each brimming with wares. Some stalls are teeming with customers, their voices a cacophony of chatter, while others stand quietly, their vendors patiently waiting for patrons. This lively scene is a microcosm of the foreign exchange (forex) market, where the hustle and bustle of trading are captured by two key terms: volume and volatility.

Image: www.researchgate.net

Understanding the difference between volume and volatility in forex is crucial for traders seeking success. It provides a lens through which they can assess market sentiment, anticipate trends, and make informed trading decisions. In this comprehensive guide, we’ll delve into the intricacies of volume and volatility, empowering you to navigate the forex market with confidence.

Volume: A Measure of Market Activity

Volume measures the number of transactions executed within a given time frame. It reflects the level of engagement in the market, indicating the number of traders buying and selling currencies. High volume suggests a liquid market with ample participation, while low volume may indicate a market that is slow or illiquid.

Traders often use volume to gauge market sentiment. Rising volume during an uptrend signals that buyers are in control, while increasing volume during a downtrend implies that sellers are dominating. Volume can also help identify potential breakouts and reversals, as a sudden surge in volume can indicate a shift in market momentum.

Image: www.blogforex.org

What Is The Difference Between Volume And Volatility In Forex

Volatility: A Measure of Price Fluctuation

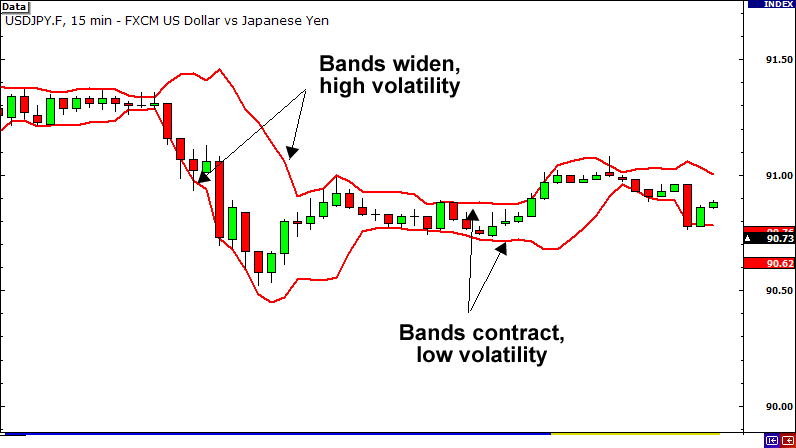

Volatility measures the degree to which a currency pair’s value changes over time. It indicates the extent of price fluctuations and is typically expressed as a percentage. Higher volatility means that the value of the currency pair is experiencing rapid and significant changes, while lower volatility suggests a more stable and predictable market.

Traders pay close attention to volatility as it affects risk and reward potential. A high-volatility market offers greater opportunities for profits but also exposes traders to larger losses. Conversely, a low-volatility market minimizes potential losses but also limits profit margins. Volatility can be influenced by a range of factors, including economic data releases, geopolitical events, and market sentiment.

The Relationship Between Volume and Volatility

Volume and volatility are intertwined in the forex market. Generally, higher volume leads to increased volatility, as increased trading activity tends to coincide with more significant price fluctuations. However, this relationship can vary depending on market sentiment and other factors.

During periods of strong market sentiment, such as during major news events or central bank announcements, high volume can result in extreme volatility. Conversely, in slow and illiquid markets, low volume may not translate into substantial volatility, as there are fewer participants driving price action.

Tips for Utilizing Volume and Volatility

Harnessing the power of volume and volatility can enhance your trading strategies. Here are some expert tips:

-

Identify potential breakouts: Look for a combination of high volume and rising prices to anticipate potential upward breakouts. Conversely, high volume and falling prices may indicate a potential downward breakout.

-

Manage risk: Remember that high volatility can magnify risk. Adjust your trading strategies and position sizes accordingly to minimize potential losses.

-

Exploit market trends: Use volume and volatility to identify the direction of the trend. Buy into strong uptrends with high volume and rising prices, and sell into downtrends with high volume and falling prices.

Frequently Asked Questions

Q: What is the difference between volume and volatility?

A: Volume measures the number of transactions while volatility measures the degree to which prices fluctuate.

Q: How do I use volume and volatility in my trading?

A: Use volume to assess market sentiment, identify potential breakouts, and manage risk. Volatility can help you gauge potential risk and reward potential and adjust your trading strategies accordingly.

Q: Which is more important, volume or volatility?

A: Both volume and volatility are important in the forex market, but their significance depends on your trading style and risk tolerance.

Conclusion

Volume and volatility are essential concepts in the forex market that provide valuable insights into market activity and price behavior. By understanding the difference between these two metrics and utilizing them effectively, traders can gain a significant advantage. Remember, the forex market is a dynamic and ever-changing environment. Embrace the power of volume and volatility, adapt your strategies accordingly, and unlock the potential for trading success.

Are you ready to elevate your forex trading game? Dive deeper into the intricacies of volume and volatility today and transform your trading journey!