In the ever-evolving world of financial markets, discerning traders seek strategies to gain a competitive edge. Understanding market volume, a crucial indicator of market sentiment, holds immense value. Forex, the global decentralized market for currency exchange, is no exception. Embark on a journey to unravel the intricacies of calculating volume in forex, a skill that empowers traders to make informed decisions.

Image: es.fxssi.com

Defining Volume: The Lifeblood of Market Action

Volume, in the forex context, represents the number of currency units traded over a specified period. Envision a bustling marketplace where buyers and sellers converge, each transaction contributing to the overall activity. Just as foot traffic indicates the popularity of a retail store, volume signifies the level of interest and participation in a particular currency pair.

The Significance of Volume: A Guiding Light

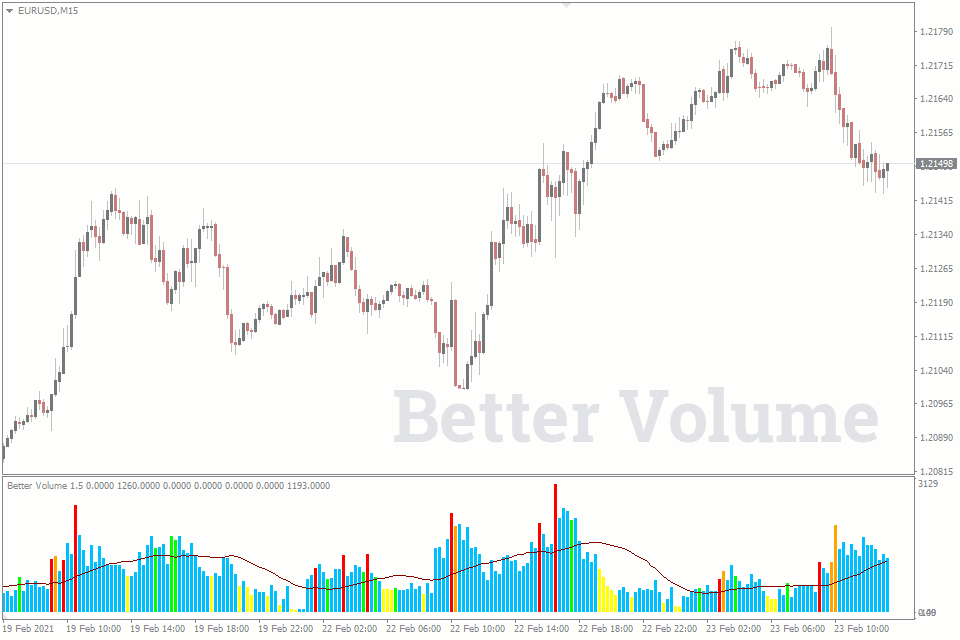

Market volume plays a pivotal role in identifying trends, assessing volatility, and spotting potential opportunities. High volume typically accompanies strong market moves, confirming the presence of substantial buying or selling pressure. Conversely, low volume can indicate periods of consolidation or indecision, signaling possible trend reversals. Armed with this knowledge, traders can gauge market sentiment and adjust their strategies accordingly.

Methods of Calculating Volume: Dissecting the Options

Calculating volume in forex involves several established methods, each with its advantages and nuances. Embrace the most suitable technique for your trading style and risk tolerance.

Image: www.forex.academy

Tick Volume: Precision in Simplicity

Tick volume, the most straightforward approach, counts the number of price ticks occurring within a specified time frame. A tick represents the smallest price movement, typically measured in pips. Simplicity and accessibility make tick volume a popular choice among retail traders.

Lot Volume: Uncovering the True Extent

Lot volume takes the concept further by considering the size of each transaction. A standard lot represents 100,000 units of the base currency. Lot volume provides a clearer picture of actual market activity, factoring in the scale of orders executed.

Notional Volume: Embracing Market Breadth

Notional volume calculates the total value of all trades conducted over a given period. By multiplying the price of the currency pair by the lot size, traders gain insights into the total dollar value exchanged. This method offers a comprehensive view of market activity, encompassing both retail and institutional trades.

Volume Profiling: Unlocking Market Sentiment

Beyond calculating volume, volume profiling delves deeper into the distribution of trades at different price levels. By visualizing this data, traders identify areas of support and resistance, where buying or selling interest tends to cluster. This advanced technique empowers traders to pinpoint potential trading opportunities and refine their risk management strategies.

How To Calculate Volume In Forex

Empowering Traders: Harnessing Volume for Success

Mastering the art of calculating volume in forex unlocks a wealth of possibilities for discerning traders. Implement these strategies to elevate your trading prowess:

- Confirm Trends: High volume supporting a price trend indicates strong momentum and enhances its reliability.

- Identify Reversals: Declining volume preceding a trend change signals potential exhaustion and an increased likelihood of a reversal.

- Assess Volatility: High volume often accompanies increased price volatility, enabling traders to adjust their risk appetite accordingly.

- Gauge Market Sentiment: Volume provides insights into the collective behavior of market participants, offering valuable clues about their buying and selling intentions.

By incorporating volume analysis into your trading toolkit, you empower yourself with an invaluable tool to navigate the ever-changing forex landscape. Embrace the journey of discovery, and let volume guide you towards informed decisions and enhanced trading success.