In the ever-evolving world of forex trading, identifying profitable trade setups is paramount for success. Among the array of technical analysis tools, the bullish engulfing pattern stands out as a highly reliable indicator of impending bullish momentum. By understanding the intricacies of its confirmation and implementation, traders can harness its power to elevate their trading strategies.

Image: www.pinterest.com

Understanding the Bullish Engulfing Pattern: A Signal of Bullish Reversal

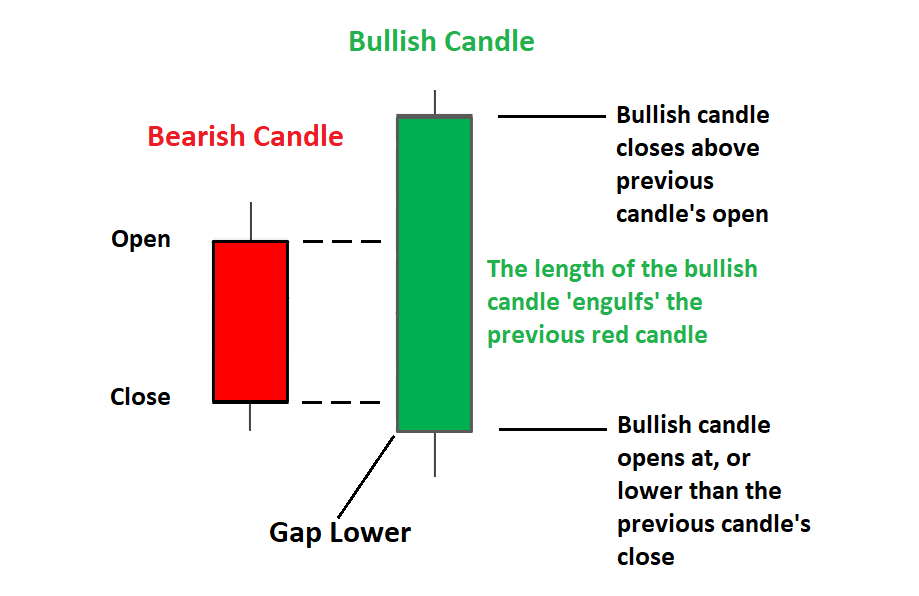

Imagine a scenario where a bearish trend has dominated the market, driving prices lower. Suddenly, a single candlestick emerges, completely enveloping the range of the previous bearish candle. This candlestick, representing a bullish engulfing pattern, signifies a pivotal shift in market sentiment.

The engulfing nature of the bullish pattern implies that bulls (traders anticipating price increases) have gained dominance over bears (those expecting prices to fall). This sudden surge in bullish momentum suggests a reversal of the prevailing downtrend, creating a potential buying opportunity for traders.

Confirming the Bullish Engulfing Pattern: Strengthening the Signal

While the emergence of a bullish engulfing pattern is a strong indication of a trend reversal, it’s essential to confirm its validity before placing a trade. This confirmation process involves analyzing subsequent price action and observing whether it aligns with the bullish engulfing pattern’s implications.

Firstly, traders should monitor the following candlestick after the bullish engulfing pattern. A continuation of the bullish momentum, such as another bullish candlestick with a higher high and higher low, reinforces the reversal signal and increases the probability of a successful trade.

Furthermore, traders can evaluate the volume associated with the bullish engulfing pattern and subsequent candlesticks. High trading volume during and after the pattern formation indicates strong participation from market participants, lending further credence to the reversal.

Trading the Bullish Engulfing Pattern: Harnessing Profitable Opportunities

Once the bullish engulfing pattern has been confirmed, traders can capitalize on the potential reversal by placing a buy order. The entry point should be set slightly above the high of the bullish engulfing candle, providing a margin of safety.

Traders should also determine their stop-loss order, which acts as a protective measure to limit potential losses. In this case, the stop-loss can be placed below the low of the bearish candle that preceded the bullish engulfing pattern.

To maximize profitability, traders can establish a take-profit target based on technical analysis or predefined risk-to-reward ratios. These targets typically involve identifying potential resistance levels or specific profit goals.

Image: tradewithmarketmoves.com

Bullish Englufing Pattern Confirmation In Forex

Additional Considerations: Enhancing Trading Strategies

While the bullish engulfing pattern provides a strong indication of a trend reversal, it’s essential to approach it with a comprehensive trading strategy. Incorporating other technical analysis tools, such as trendlines, support and resistance levels, and moving averages, can enhance the accuracy and reliability of trade decisions.

It’s also crucial to consider market context and broader economic conditions. News and events that impact market sentiment can influence the validity and timeliness of the bullish engulfing pattern. Staying informed about current events and their potential impact on forex markets can provide traders with a more informed perspective.

In summary, the bullish engulfing pattern is a powerful technical indicator that signals potential trend reversals in forex markets. By confirming the pattern and trading it with a comprehensive strategy, traders can harness its potential to identify profitable opportunities and elevate their trading performance in the dynamic world of forex.