The ebb and flow of the forex market can be a daunting landscape to navigate, but for traders seeking consistent returns, understanding trend following strategies is paramount. By identifying and aligning with the prevailing market direction, traders can seize lucrative opportunities and minimize risks. In this comprehensive guide, we will delve into the realm of trend following forex pairs, exploring their characteristics, key strategies, and indispensable tips to empower you in your trading endeavors.

Image: www.litefinance.org

What Defines a Trend Following Forex Pair?

Within the forex market, a trend following pair is a currency pair that exhibits a discernible directional bias, demonstrating either a consistent rise or fall over an extended period. These trends can range from short-term fluctuations to major market shifts spanning several years. Identifying these pairs empowers traders to capitalize on the market’s momentum, resulting in potentially substantial profits.

Spotting Trend Following Forex Pairs: A Trader’s Checklist

Recognizing trend following forex pairs requires a keen eye for market dynamics. Several fundamental indicators can assist you in this endeavor:

-

Historical Price Action: Examine the currency pair’s price history to discern prevailing trends. Look for consistent higher highs and lows for uptrends or lower highs and lows for downtrends.

-

Moving Averages: Moving averages smooth out price fluctuations, revealing the underlying market direction. If a pair’s price consistently trades above its moving average, it suggests an uptrend, while trading below signals a downtrend.

-

Trendlines: Drawing trendlines connecting key highs or lows can visually depict the trend’s trajectory. Respected trendlines provide dynamic support or resistance levels, enabling traders to identify favorable entry and exit points.

-

Momentum Indicators: Measures like the Relative Strength Index (RSI) and Stochastic Oscillator assess the magnitude and sustainability of price movements. Overbought or oversold conditions can indicate potential trend reversals.

Profiting from Trend Following Forex Strategies

Once trend following forex pairs have been identified, savvy traders can employ various strategies to capitalize on their momentum:

-

Breakout Trading: Execute trades when prices breach key support or resistance levels, signaling the continuation of an existing trend.

-

Pullback Trading: Enter trades during temporary market retracements against the trend’s direction, aiming to benefit from the resumption of the primary trend.

-

Trendline Trading: Trade near respected trendlines, anticipating bounces or breakouts for profit opportunities.

Image: lorafincham.blogspot.com

Mastering Trend Following Forex Trading: Expert Insights

To enhance your trend following prowess, heed the wisdom of seasoned forex traders:

-

“Identify a trend and ride it until it reverses. Don’t try to time every wiggle.” – George Soros

-

“The trend is your friend until the end, when it bends.” – Alexander Elder

-

“Don’t fight the trend. Adapt to the market’s direction, and your profits will follow.” – Kathy Lien

Leverage these Tips for Your Forex Trading Success

Complement your trading knowledge with these valuable tips:

-

Manage Risk Prudently: Implement stop-loss orders to minimize losses and protect your capital.

-

Trade with a Plan: Establish a clear trading plan outlining your entry and exit points, profit targets, and risk appetite.

-

Control Your Emotions: Maintain a disciplined trading approach, avoiding impulsive decisions fueled by fear or greed.

-

Continuous Learning: Stay abreast of market trends and refine your trading strategies through ongoing education and analysis.

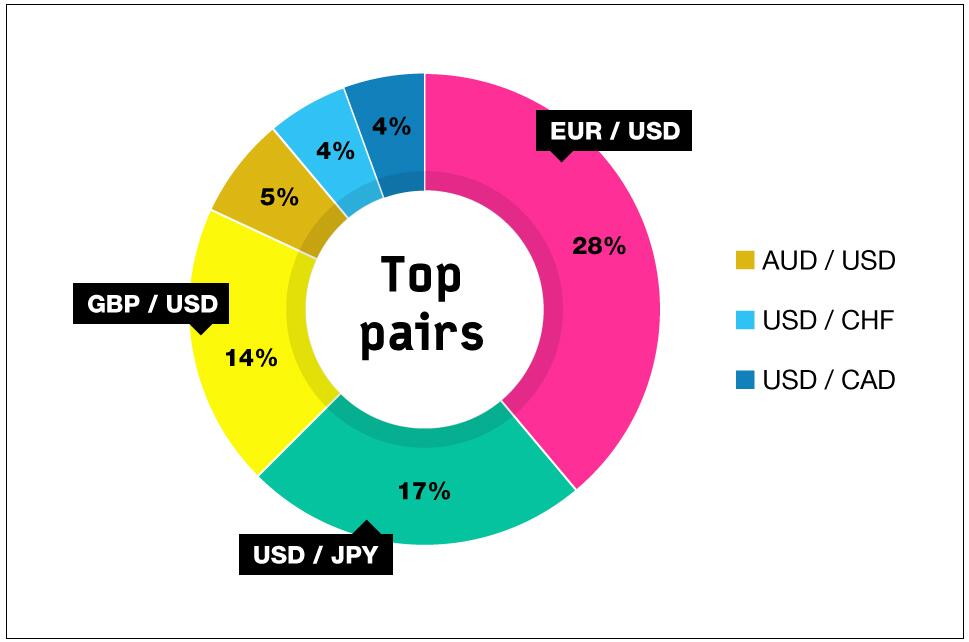

Best Trend Following Forex Pairs

Conclusion

Navigating the forex market as a trend follower requires a keen understanding of pair selection and trading strategies. By embracing the principles outlined in this guide, traders can harness the power of momentum to maximize their profit potential. Remember, mastering trend following is an ongoing journey, but with dedication and a thirst for knowledge, you can unlock the secrets to forex trading success. Embrace the market’s rhythm and let the trends guide your path to financial empowerment.