Embark on an extraordinary journey into the realm of forex trading, where timing is everything. As a trader, understanding the ebb and flow of the markets is crucial for maximizing your potential profits. In this comprehensive guide, we delve into the intricacies of forex trading sessions in Indian Standard Time (IST), empowering you with the knowledge to trade with confidence and precision.

Image: changelly.com

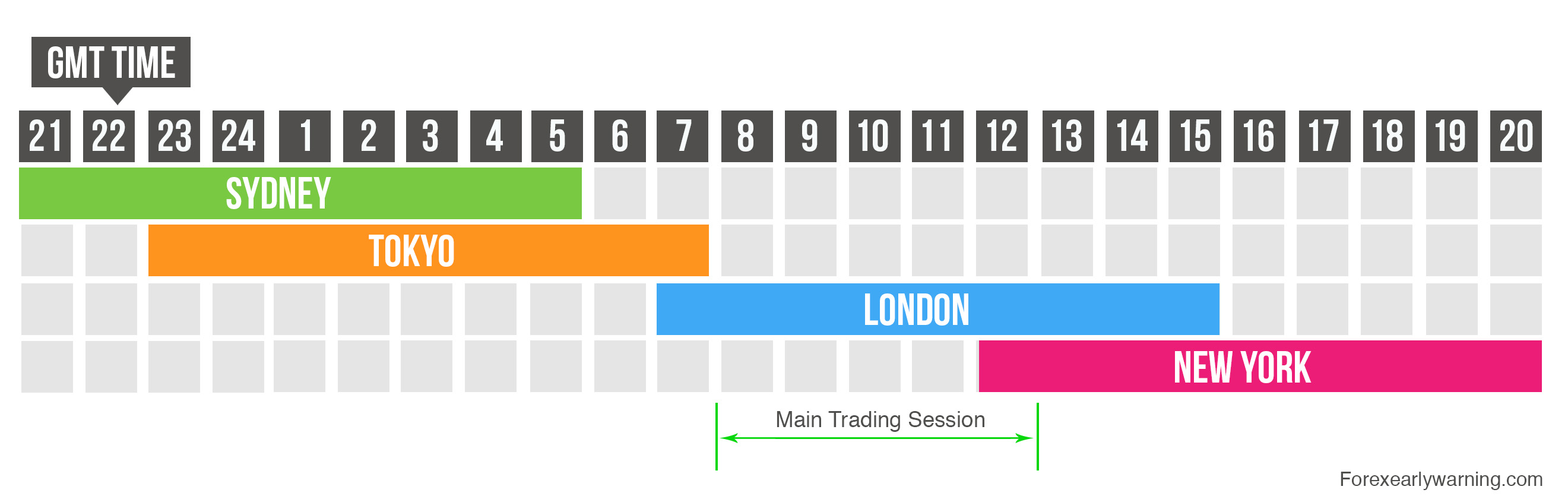

Forex trading, the dynamic world of currency exchange, operates 24 hours a day, five days a week. However, depending on the time zone, market activity and liquidity fluctuate, creating distinct trading sessions with unique characteristics. For traders in India, grasping the intricacies of IST forex trading sessions is paramount to timing your trades strategically.

Just as the sun rises and sets, each trading session brings its own set of opportunities and challenges. Recognizing these patterns and aligning your trading strategy accordingly can make all the difference between success and disappointment. So, let’s dive into the captivating world of forex trading sessions in IST and uncover the secrets to trading at the optimal times.

Understanding Forex Trading Sessions in IST

Indian Standard Time (IST) is 5 hours and 30 minutes ahead of Coordinated Universal Time (UTC), the global standard time zone. This means that forex trading sessions in India begin at 5:30 AM IST and end at 12:00 AM IST the following day. Within this time frame, three primary trading sessions occur:

Sydney Session (5:30 AM – 12:00 PM IST)

The Sydney session, also known as the Asia-Pacific session, marks the start of the trading day for IST traders. As the first major financial center to open, Sydney sets the tone for the day’s market activity. This session is characterized by relatively low volatility and liquidity, making it suitable for cautious traders.

Tokyo Session (6:30 AM – 2:00 PM IST)

The Tokyo session, or the Asian session, takes over as Sydney winds down. This session is a powerhouse of market activity, with Tokyo being one of the world’s largest financial hubs. Increased liquidity and volatility make this session ideal for aggressive traders seeking higher returns.

Image: tradenation.com

London Session (12:00 PM – 8:00 PM IST)

The London session, also known as the European session, is the most significant for IST traders. It overlaps with both the Tokyo and New York sessions, creating a period of high market volatility and liquidity. This session offers abundant opportunities for profitable trades, but traders must be prepared for rapid price fluctuations.

New York Session (7:00 PM – 12:00 AM IST)

The New York session, or the American session, completes the trading day for IST traders. As the day winds down, liquidity and volatility typically decrease, making this session more suitable for conservative traders. However, major news events or economic data releases can spark significant market movements, creating short-lived trading opportunities.

Optimizing Your Trading Strategy for IST Sessions

The key to success in forex trading lies in aligning your trading strategy with the characteristics of each session. Here are some valuable tips to help you optimize your approach:

-

Sydney Session: This session is ideal for breakout trades or range-bound strategies due to its lower volatility. Focus on identifying support and resistance levels and trading within defined channels.

-

Tokyo Session: The increased liquidity and volatility of the Tokyo session provide ample opportunities for trend-following strategies. Look for strong price trends and enter trades in the direction of the trend.

-

London Session: The London session is a battleground for scalpers and day traders due to its rapid price movements. Short-term trades based on technical analysis and quick decision-making can be highly profitable during this session.

-

New York Session: The New York session’s declining liquidity often results in consolidation or retracements. Traders can capitalize on these movements by employing counter-trend strategies or waiting for strong breakouts before entering trades.

Trading Psychology and Risk Management

Trading forex in IST sessions requires not only technical proficiency but also a sound understanding of trading psychology and risk management. Here are a few crucial considerations:

-

Emotional Control: The fast-paced nature of forex trading can trigger emotional responses. Traders must maintain composure and avoid making impulsive decisions. Learn to detach yourself from emotional influences and rely on logical analysis.

-

Risk Management: Every trade carries an element of risk. Implement a robust risk management strategy that defines your maximum loss per trade and adheres to strict stop-loss orders. Never risk more than you can afford to lose.

-

Discipline and Patience: Successful forex trading requires discipline and patience. Stick to your trading plan, avoid overtrading, and wait for the right opportunities to present themselves. Remember, patience is a virtue that can yield significant rewards.

Forex Trading Sessions In Ist

https://youtube.com/watch?v=PezbXWtgBg8

Conclusion

Mastering the nuances of forex trading sessions in IST equips Indian traders with a competitive edge. By understanding the characteristics of each session and adapting your trading strategy accordingly, you can increase your chances of profitability and minimize potential losses. Embrace the dynamic nature of these sessions, navigate the market’s ebb and flow, and embark on a rewarding journey in the thrilling world of forex trading.