In the ever-evolving world of finance, grasping the intricacies of currency pairs is paramount for navigating global markets.

Image: taihasegin.blogspot.com

Currency Pairs: The Basics

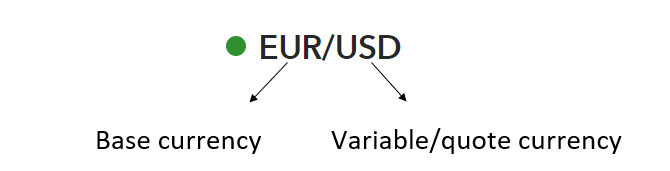

A currency pair represents a quoted exchange rate between two currencies. The first currency is the base currency, against which the second currency, the quote currency, is traded. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

Common Currency Pairs

- EUR/USD (Euro vs. US Dollar)

- USD/JPY (US Dollar vs. Japanese Yen)

- GBP/USD (British Pound vs. US Dollar)

- AUD/USD (Australian Dollar vs. US Dollar)

- CHF/JPY (Swiss Franc vs. Japanese Yen)

Understanding Currency Pair Movements

The exchange rate of a currency pair constantly fluctuates due to various factors such as economic data, interest rate changes, and geopolitical events. When the base currency strengthens against the quote currency, its value increases. Conversely, when the base currency weakens, its value decreases.

Traders analyze currency pair movements to speculate on potential exchange rate changes. A successful trader must comprehend the underlying factors influencing currency valuations and interpret market trends accurately.

Image: www.fxcryptonews.com

Tips and Expert Advice

Tips for Reading Currency Pairs

- Pay attention to the pip: The pip (point in percentage) is the smallest increment of price change for a currency pair.

- Monitor economic indicators: Assess key economic data like GDP, inflation, and interest rates to gauge currency strength.

- Study news and events: Stay informed about geopolitical events, political announcements, and natural disasters as they can impact currency valuations.

- Technical analysis: Utilize technical indicators like moving averages, support and resistance levels, and chart patterns to identify trading opportunities.

Expert Advice

“Traders should incorporate fundamental analysis with technical analysis to make informed trading decisions. A comprehensive understanding of the underlying factors driving currency movements is crucial to successful trading.” – George Soros, renowned financier

Frequently Asked Questions (FAQs)

What is the base currency versus the quote currency?

The base currency is the first currency in a pair, against which the quote currency is traded.

How do I interpret a currency pair exchange rate?

The exchange rate indicates how much of the quote currency is needed to buy one unit of the base currency.

What factors influence currency pair movements?

Economic data, interest rate changes, geopolitical events, and market sentiment are among the factors impacting currency valuations.

Is technical analysis effective for currency trading?

Technical analysis can be useful to identify trading opportunities, but it should be used in conjunction with fundamental analysis and a strong understanding of market dynamics.

How To Read Currency Pairs

Conclusion

Mastering the art of reading currency pairs is an essential skill for traders, investors, and anyone involved in international markets. By understanding the basics, following the tips, and consulting expert advice, individuals can navigate currency fluctuations and make informed decisions. Whether you are a seasoned trader or a beginner, delving into the world of currency pairs can unlock a wealth of opportunities.

Interested in learning more about the intricacies of currency pairs? Explore our blog and become a currency exchange wizard today!