Foreign exchange rates are a key consideration when making international transfers or payments. Understanding the factors that influence exchange rates is essential for businesses and individuals alike. In this article, we’ll delve into the world of Axis Bank’s forex TT rates and explore the key factors that determine their value.

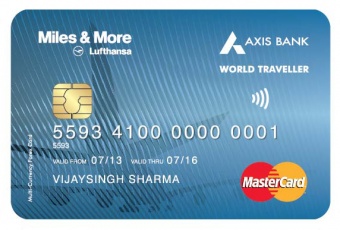

Image: www.kenznow.com

Factors Influencing Axis Bank TT Rates

TT rates, or telegraphic transfer rates, play a significant role in forex transactions. Axis Bank, as one of the leading financial institutions in India, offers competitive TT rates for various currencies. However, these rates are not static and can fluctuate based on several factors, including:

- Demand and supply: The availability of a particular currency in the market directly impacts its exchange rate. High demand for a currency can lead to an appreciation in its value, while low demand can cause it to depreciate.

- Economic conditions: The overall health of a country’s economy, including its inflation rate, interest rates, and GDP growth, can influence its currency’s value.

- Political stability: Political uncertainty or instability in a country can reduce confidence in its currency, leading to a decline in its value.

- Interest rate differentials: Differences in interest rates between countries can affect currency exchange rates. A country with higher interest rates may attract foreign investment, leading to an appreciation of its currency.

TT Rates in Practice

When making a forex TT transfer through Axis Bank, you can expect to pay a TT fee in addition to the exchange rate. This fee covers the bank’s costs associated with processing the transaction, including international wire transfer charges and currency conversion fees. The TT fee varies depending on the amount transferred, the currency, and the destination country.

For example, if you wish to transfer 10,000 USD to a Japanese Yen (JPY) account, you would need to consider the following:

- Current TT rate: 1 USD = 130.56 JPY

- Amount to be transferred: 10,000 USD

- TT fee: 1% of the amount transferred (100 USD)

Therefore, the total amount debited from your account would be 10,100 USD, which would be equivalent to 1,305,600 JPY at the prevailing TT rate.

Expert Advice for Navigating Forex TT Rates

Mastering the intricacies of forex TT rates can help you optimize your international payments and transactions. Here are some expert tips to keep in mind:

- Monitor market trends: Stay informed about global economic news and geopolitical events that may impact exchange rates.

- Compare rates from multiple providers: Don’t hesitate to compare TT rates offered by different banks or money transfer services to get the best deal.

- Consider locking in rates: If you anticipate significant currency fluctuations, consider using forward contracts or options to lock in a favorable exchange rate.

- Negotiate with your bank: As a long-term customer or for large-volume transactions, you may be able to negotiate a better TT rate with your bank.

Image: forexretro.blogspot.com

Frequently Asked Questions

- Q: What documents are required for a forex TT transfer?

- A: Typically, you will need to provide proof of identity and residence, as well as details of the recipient.

- Q: How long does a forex TT transfer take?

- A: TT transfers usually take 1-3 business days to process, depending on the destination country and currency.

- Q: Are there any restrictions on forex TT transfers?

- A: Yes, there may be limits on the amount of money that can be transferred through a TT based on regulations set by the sending and receiving countries.

- Q: Can I cancel a forex TT transfer?

- A: Yes, but it may incur charges and the funds may not be immediately available after cancellation.

Axis Bank Forex Tt Rates

Conclusion

Understanding Axis Bank’s forex TT rates is crucial for making informed decisions regarding international payments and transfers. By staying updated on the factors that influence exchange rates and following expert advice, you can optimize your transactions and maximize your savings. If you have any further questions or require personalized guidance, don’t hesitate to consult with an Axis Bank representative or an experienced financial advisor.

Are you interested in learning more about forex TT rates? Let us know in the comments below!