Navigating Forex Transfers: Understanding the Process

Forex transfers, the exchange of currencies across borders, often carry uncertainties and complexities. Making money transfers from India to the US can be particularly daunting, especially for those unfamiliar with the process. This comprehensive guide aims to demystify the intricacies of forex transfers, empowering you to make secure and efficient transactions.

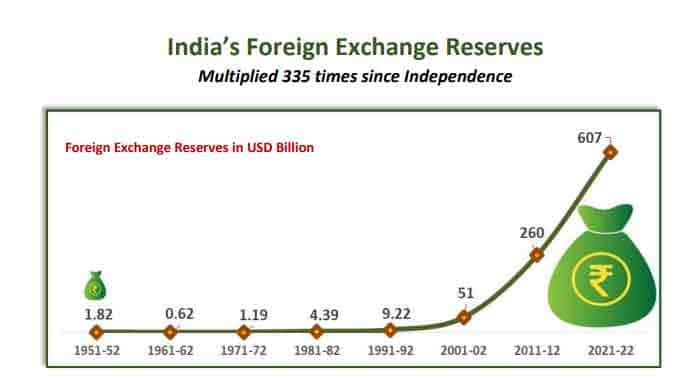

Image: www.zeebiz.com

Forex transfers may involve varying degrees of complexity depending on the amount, purpose, and chosen service providers. It’s crucial to select a reputable and reliable money transfer operator that offers competitive exchange rates and minimizes transfer fees to ensure optimal value for your funds.

Types of Forex Transfer Services

Choosing the right forex transfer service is key. Banks, known for their traditional money transfer services, offer stability but can have higher fees and longer processing times. Online money transfer services provide convenience and competitive rates but may have limits on transfer amounts. Foreign exchange brokers specialize in large-scale transfers and offer customized solutions for businesses and individuals with high-value transactions.

Peer-to-peer platforms allow for direct transfers between individuals, offering lower fees but limited payment options. Specialized money transfer companies focus on specific corridors, such as India to the US, providing tailored services with competitive rates and faster processing times.

Steps to Initiate a Forex Transfer

Step 1: Determine Transfer Amount and Currency

Accurately specify the amount you wish to transfer and the desired currency. Check live exchange rates to determine the best time to make the transfer.

Step 2: Choose a Transfer Service Provider

Compare different service providers based on fees, exchange rates, transfer speed, and customer reviews. Select the one that best meets your requirements.

Step 3: Provide Personal and Bank Details

Input your personal information, including your full name, address, and contact details. Provide the bank account information for both the sender and receiver.

Step 4: Verify Transfer Details

Carefully review all transfer details, including the amount, currency, exchange rate, and fees. Ensure the recipient’s information is accurate.

Step 5: Fund the Transfer

Choose the most convenient method to fund your transfer, such as bank transfer, credit card, or debit card. Confirm the transaction and await the transfer completion.

Expert Tips for Optimal Forex Transfers

Enhance your forex transfer experience with these valuable tips.

Shop Around for the Best Rates and Fees

Comparing exchange rates and transfer fees from multiple providers can lead to significant savings.

Choose the Right Transfer Method Based on Speed and Cost

Urgent transfers may come with higher fees, while slower methods offer more cost-effective options.

Consider Using a Currency Exchange Specialist

For large or frequent transfers, working with a currency exchange specialist can provide access to exclusive rates and customized solutions.

Plan Your Transfers Around Favorable Exchange Rates

Volatility in currency markets can impact exchange rates. Stay informed about market trends to make informed decisions.

Secure Your Transfer with Reliable Service Providers

Verify the credibility and security measures of the transfer service provider for peace of mind.

Image: medium.com

Frequently Asked Questions (FAQs)

- Q: How long does a forex transfer take?

A: Processing times vary depending on the transfer method and service provider, ranging from a few hours to several business days.

- Q: Are there limits on how much I can transfer?

A: Transfer limits vary based on regulations, service providers, and the receiving country. It’s advisable to check with the provider for specific limits.

- Q: How can I track my forex transfer?

A: Most service providers offer online or mobile app tracking features to monitor the progress of your transfer.

Forex Transfer From India To Us

https://youtube.com/watch?v=FRp43wzzZec

Conclusion

Understanding the intricacies of forex transfers is essential for efficient and secure transactions. By choosing the right service provider, utilizing expert tips, and being aware of common FAQs, you can navigate the process confidently. Answer the following question in Comments.

Let us know if you have any questions or need further assistance with your forex transfer journey. By deepening your understanding of forex transfers and implementing the knowledge and insights provided in this guide, you can make informed decisions, optimize your transfers, and ensure the successful movement of your funds across borders.